Testimony on the New York City November 2022 Financial Plan for Fiscal Years 2023 to 2026

Submitted to the New York City Council Committee on Finance

Good afternoon, Chair Brannan and members of the City Council Committee on Finance. I am Ana Champeny, Vice President for Research at the Citizens Budget Commission (CBC), a nonpartisan, nonprofit think tank and watchdog devoted to constructive change in the finances and services of New York State and City governments. Thank you for the opportunity to testify regarding the City’s November 2022 Financial Plan for Fiscal Years 2023 to 2026 (the November Plan).

This November Plan demonstrated that while New York City’s short-term budget challenges are manageable, its long-term fiscal outlook is precarious. While the City’s Program to Eliminate the Gap (PEG) provided some ongoing budget relief—which is needed and welcome—increased pension costs due to poor market returns last year swamped those savings and widened future budget gaps to $4.6 billion in fiscal year 2025 and $5.9 billion in fiscal year 2026. Given the significant risks of a recession and unbudgeted collectively bargained raises, among others, it is critical that the City start taking action immediately to restrain spending over the long run to reduce the future gaps. Absent such action, the City may well face the much worse choices of significant future service cuts or very risky tax increases.

PEG Relies on Re-Estimates and Includes Illusory Savings

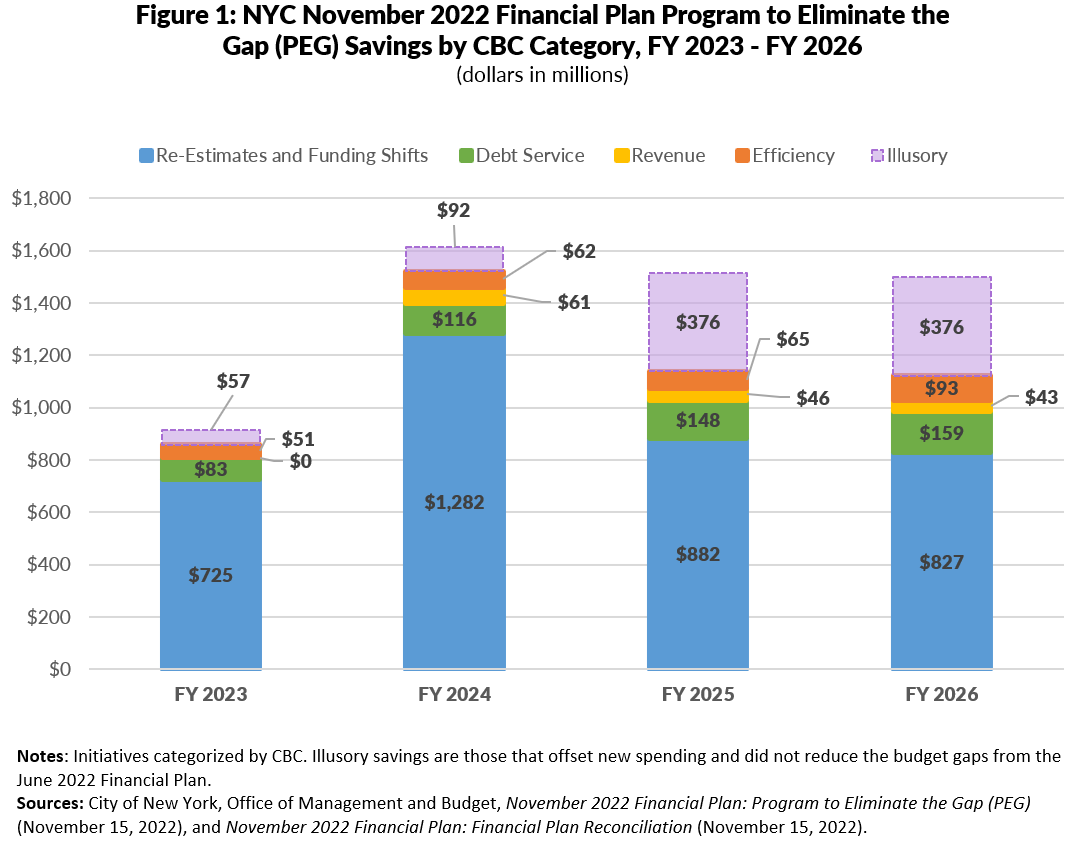

The PEG reduced spending by $916 million in fiscal year 2023, $1.6 billion in fiscal year 2024, and $1.5 billion in fiscal years 2025 and 2026. CBC found that the PEG relied predominantly on spending re-estimates, which comprised about 80 percent of fiscal year 2023 and 2024 savings and around 55 percent of fiscal year 2025 and 2026 savings. (See Figure 1.) There were few efforts to restructure government operations to be more productive; efficiency savings were less than $100 million in each year of the PEG.

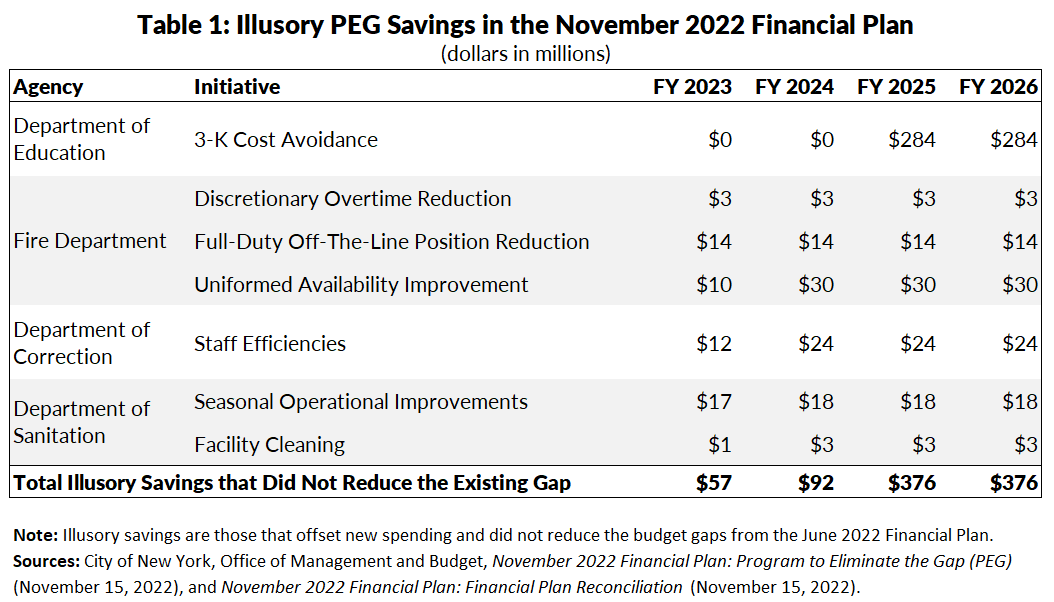

Furthermore, the true impact of the PEG on budget gaps was smaller due to illusory savings that had a net zero impact on the gap. (See Table 1.) On one hand, new spending that was not actually included in adopted budget was added in the November Plan, while, at the same time, the City claimed credit in the November 2022 PEG for eliminating that same spending. The Plan calls this “cost avoidance.”

The value of the illusory savings was $57 million in fiscal year 2023, $92 million in fiscal year 2024, and $376 million annually in fiscal years 2025 and 2026. For example, the City increased Fire Department expenditures by $14 million annually for additional costs due to full-duty off-the-line positions and then included a PEG for $14 million in annual savings from Full-Duty Off-The-Line Position Reduction. As the two actions cancel each other out, the PEG does not reduce the budget gap.

Substantial Vacant Positions Remain and Offer Opportunity for Further Savings

The November Plan reduces vacancies by roughly 2,000 annually in fiscal years 2024 and 2025, which is welcome progress. However, this still left more than 24,000 vacant full-time positions. The City can and should both hire for critical functions and eliminate many more, ultimately unneeded, positions.

The Adams Administration subsequently notified City agencies that half of their City-funded vacant civilian positions will be eliminated by the Office of Management and Budget (OMB) in the Fiscal Year 2023 Preliminary Budget. With exceptions to the elimination pool, this reduction will total around 5,000 positions and is expected to save around $350 million annually. OMB has indicated that agencies will be allowed to hire to their funded personal service levels, which should speed up recruitment. However, the City and agencies should have flexibility to shift vacant positions across and within agencies to units and titles that have critical staffing needs.

Fiscal Year 2024 Budget Gap Is Relatively Manageable, But Out-Year Gaps Are Wider

The Plan reduced the fiscal year 2024 budget gap to $2.9 billion, primarily due to PEG savings this and next year. Conversely, with additional pension costs swamping PEG savings in fiscal years 2025 and 2026, gaps increased by $866 million and $1.9 billion, respectively, compared to the June 2022 Financial Plan.

Fiscal Risks Abound and Budget Gaps Even Absent a Recession Could Reach $8 Billion and $10 Billion in Fiscal Years 2025 and 2026, Respectively

CBC has consistently warned of three risks: collective bargaining costs, the City- and federal-funded fiscal cliff, and the potential revenue shortfall from a recession. These risks remain. Employee raises of three percent annually would increase these gaps by around $800 million in the first year, increasing to $2.5 billion in the third year. The City-funded fiscal cliff is about $865 million in fiscal year 2024 growing to $1 billion by fiscal year 2026. Depletion of non-recurring COVID aid represents a fiscal cliff of at least $345 million in fiscal year 2025 and $760 million in fiscal year 2026. A recession with revenue impacts equivalent to the average of the two recessions prior to the pandemic could cause revenue shortfalls of $4.3 billion in the first year and between $10 billion and $16 billion over 3 years.

Furthermore, the November Plan includes $1 billion in new spending, to be funded by the federal government, for services provided to migrants. While CBC concurs that the federal and State governments should shoulder a significant portion of these costs, these funds have yet to be secured. If federal and State aid falls short of the $1 billion in the plan, there will be a commensurate increase in City spending, putting further pressure on the budget.

Looking Forward to the Fiscal Year 2024 Preliminary Budget

The City has a path to close the $2.9 billion fiscal year 2024 gap. The City may roll $1.5 billion from the fiscal year 2023 General and Capital Stabilization Reserves into fiscal year 2024 to reduce the gap. Based on typical Preliminary Budget actions, the City also may recognize around $400 million in prior year payables that reduce the gap. The City may recognize savings that help close the gap, including $350 million in vacant position savings in each fiscal years 2023 and 2024, as well as some further savings. Taken together, these actions alone would reduce the gap to around $300 million.

However, the gap could be higher than the $2.9 billion. First, while agencies have been directed to self-fund new needs, there will likely be some additional agency spending. Furthermore, the gap would increase by $865 million if the fiscal cliff were addressed by continuing the funded programs instead of terminating them, and potentially more once collective bargaining agreements are negotiated. Lastly, the City will update its economic and tax revenue forecasts in the Preliminary Budget, the first time since April 2022, which could either increase or decrease the gap.

Conclusion

While the City has a clear path to balancing fiscal year 2024, it would be a mistake to conclude that the City’s fiscal situation is brighter, and that it can therefore afford more recurring spending on programs. There are significant fiscal challenges ahead. The best way to preserve services for New Yorkers when they need them most is to improve the quality and efficiency of the City’s operations today. More transformative changes are needed to ensure future stability.

Thank you, and I look forward to answering any questions you may have.