Memo on the State Budget: Some Ups and Downs

A couple of positive steps were taken in the Capitol yesterday. The first was passage of the Deficit Reduction Program (DRP). Although the package totals only $2.8 billion, is mostly comprised of non-recurring items and falls short of the Governor’s proposed target by $400 million, it does represent an acknowledgment by the Legislature that there is a substantial shortfall and that action needed to be taken.

The second was the overdue creation of a new, less costly tier of pension benefits for new employees of State government and localities outside New York City. This measure--a compromise plan developed in hard negotiations through the determination of the Governor--will "bend the cost curve" of rapidly rising pension costs. The structural changes in the pension system made yesterday will be helpful to state and local governments. It remains to be seen whether the Legislature will in future years stick to the terms of the new tier and refrain from the past practice of passing various "sweetener" bills that raise costs. Nonetheless, this marks the first time in nearly 30 years that pension benefits have been adjusted to meet fiscal realities, and it is a big step.

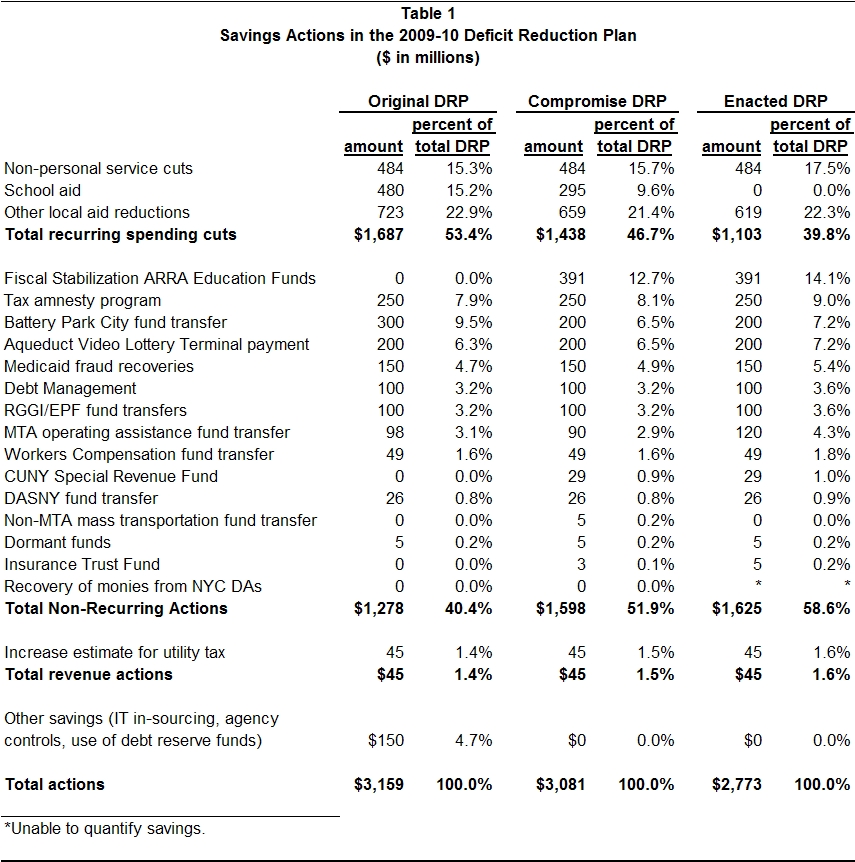

On to the downers. The contents of the final DRP package are disappointing. The earlier proposal by the Governor covered 40 percent of the $3.2 billion current-year deficit with items that are non-recurring, and the package that passed yesterday increased that share to 59 percent. (See Table 1.) Especially egregious is the acceleration of the use of federal stimulus relief, a measure that will make the day of reckoning when this money runs out even worse than it would have been.

(Click to enlarge)

In addition, what was given away in concessions to the teachers' unions to aid the passage of the new pension tier included a big ticket item -- a provision that prohibits the diminution of health insurance benefits for retired teachers without first bargaining the changes with the local teachers' union. This ties the hands of local school district management in containing the costs associated with retiree health insurance. Although it is true that this measure has been renewed every year since 1994, making it permanent means that to end the practice now requires repeal rather than a veto by the Governor. It was a lot to give away and will open the gates for other employee groups to demand the same benefits. This Governor and all future Governors will need to stand firm against that.

By Elizabeth Lynam and Tammy Pels