Learning from Past Mistakes

Examining Changes to the Excelsior Jobs Program

In 2008, CBC called for the elimination of the Empire Zones jobs program amid concerns it wasted public resources.1 In 2010, New York State replaced Empire Zones with the streamlined Excelsior Jobs Program. Excelsior was designed to avoid the errors of Empire Zones but until recently it has been difficult to assess to what degree it achieves its objectives.

New data released on the State’s Open Data website suggest efforts to contain costs are working: average cost per job under Excelsior is less than half of that for Empire Zones. Additionally, a comparison of the initial three years admitting new entrants shows Excelsior allocated $470 million in tax credits over the lifetime of the benefit period, compared to $2 billion by Empire Zones.2 In order for Excelsior to continue to control costs, the state should avoid the temptation to loosen restrictions and performance requirements to entice more entrants.

Excelsior as Improvement Over Empire Zones Program

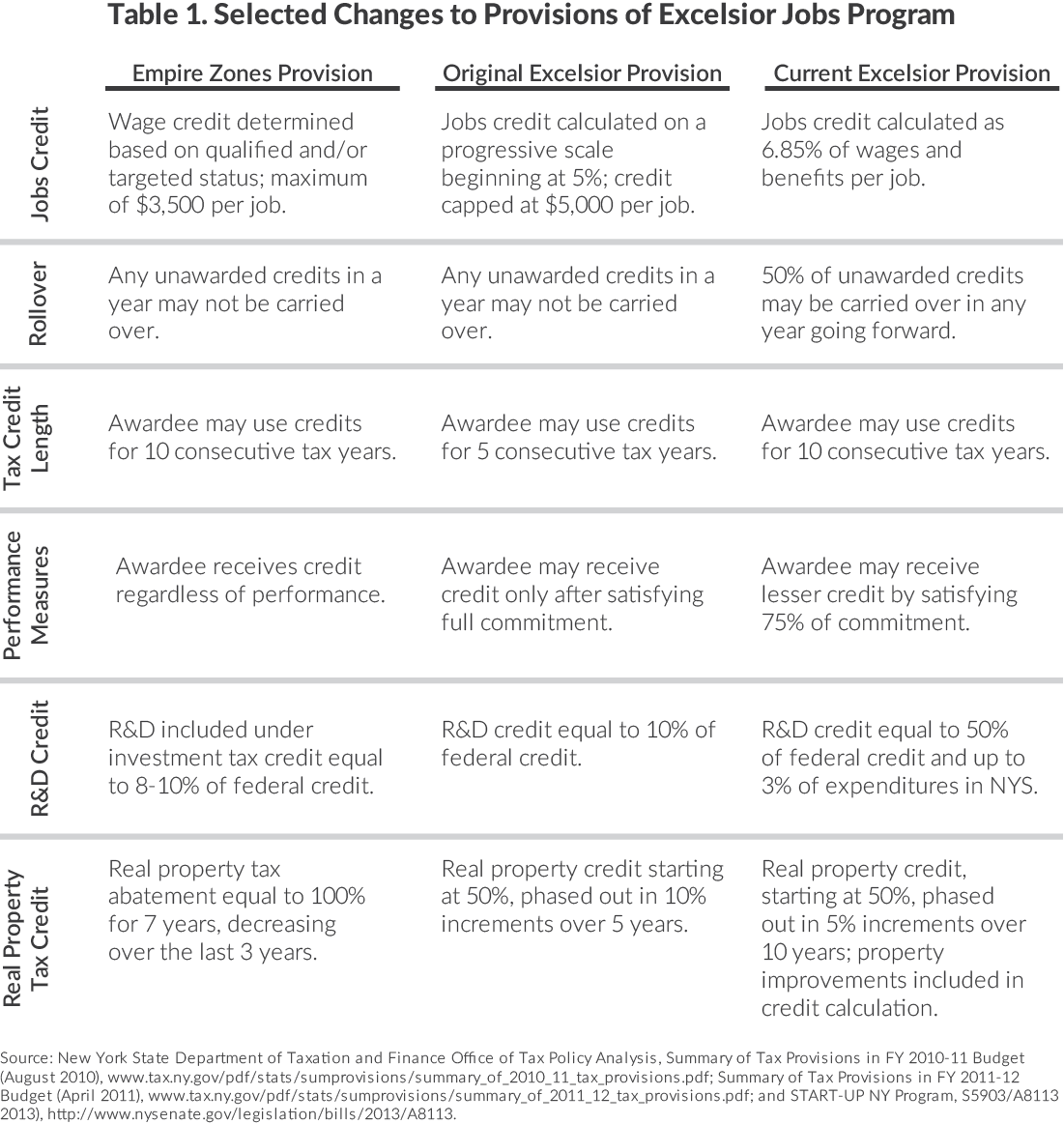

Prior to Excelsior’s enactment, CBC commended the proposed legislation for adhering to four criteria: (1) targeting industries; (2) short-term benefits acting as a “bridge to profitability”; (3) pre-determined criteria for eligibility; and (4) performance-based allocation of credits.3 The reformed program identified specific traditional and growth industries for eligibility, limited the benefit period to five years, set minimum job creation requirements by industry, and provided benefits retroactively based on performance.4 In contrast to Empire Zones, which granted benefits to applicants "as of right" if they met all program criteria, Excelsior benefits must be approved on a case by case basis by Empire State Development (ESD). In addition, Excelsior had an annual program cap peaking at $250 million in 2015.

Excelsior initially provided four fully refundable tax credits on State business income taxes: (1) An income-based jobs credit for companies with certain employment thresholds; (2) an investment tax credit equal to 2 percent of investment; (3) a new research and development (R&D) tax credit based on R&D expenditures pegged to the federal R&D tax credit; and (4) a credit for 50 percent of property taxes phased out over five years.5

Program Expansion

There have been three rounds of modifications to the Excelsior program since its inception, enacted as part of the 2011-2012 state budget, in 2013 legislation establishing the START-UP New York Program, and the 2015-2016 budget.

In the 2011-2012 budget, the total length of the program was extended five years, sunsetting in 2024, and the benefit period for participating businesses was extended to ten years from the original five. The original cap on total tax credits changed as well. In 2017, the cap will remain flat at $200 million until 2021, after which it decreases by $50 million each year until 2024.6

There were also changes to three of the four tax credits. To incentivize the creation of higher paying jobs, the jobs program credit was expanded to 6.85 percent of total wages, a more generous credit than was allowed by Empire Zones. The R&D tax credit increased from 10 percent to 50 percent of the participant’s federal R&D tax credit for expenditure in New York State.7 The real property tax credit was extended to ten years with a 5 percent phase out after year one. Property improvements were included in the real property credit calculation.8 ESD maintains these changes were made because initial Excelsior legislation did not fully reward higher paying jobs or investment in property.

In 2013, employment and investment thresholds for businesses to qualify for the program were reduced and ESD was allowed to roll over half of all unused credits, retroactively, in any given year to be used in any other year of the program. ESD accumulated nearly $478 million in unused credits during the first four years of the program; rolling over half amounts to an additional $239 million.9

In the 2015-2016 budget, changes were made expanding eligibility to music production and video game development companies.10

These modifications have expanded the credits for Excelsior and brought them closer to those of Empire Zones.

|

|

Comparative Analysis

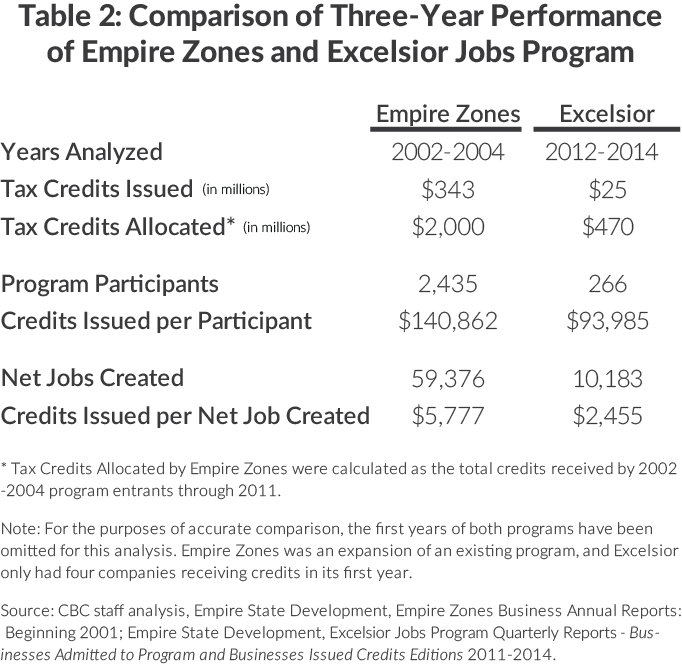

The total cost and unit costs of the Excelsior program are significantly smaller than those of Empire Zones at the same point in its lifetime. Four years into its existence, Excelsior has issued $25 million (5 percent) of $470 million in allocated credits, a fraction of the $343 million issued to new entrants in the first three years of Empire Zones.11 (See Table 2.) Credits issued per job under Excelsior are less than half those costs under Empire Zones.

Stricter reporting and performance requirements for receiving benefits have reined in costs and kept the Excelsior program small and targeted. Nonetheless, as benefit length, size, and program eligibility are expanded while performance requirements are tempered, it is possible participation and costs will grow for Excelsior as they did for Empire Zones.12 Over the program's lifetime, costs grew by an average of 20 percent per year.13

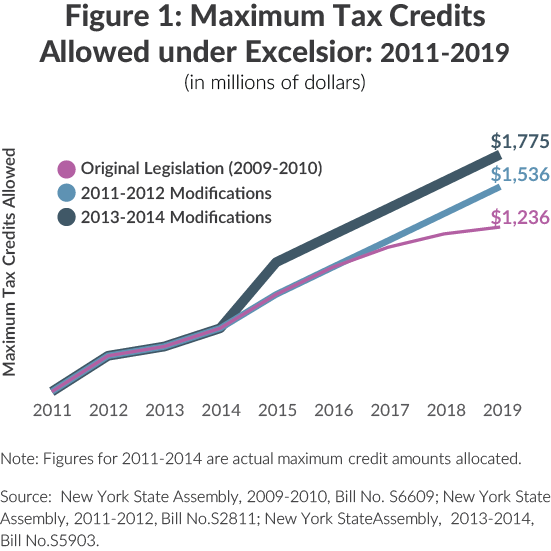

Figure 1 shows the potential fiscal effect of expanding the program’s length and allowing rollover credits. Values for 2011 through 2014 represent actual tax credits allocated. Given program participation through 2014, the maximum credit provided by the original legislation would be $1.2 billion. Expanding the program’s length increased the potential cost of the program to $1.5 billion by 2019. The allowance for rollover credits from the program’s first four years brings the potential cost of the program to nearly $1.8 billion by 2019.14

Restrictive eligibility limits program cost growth; but due to the modifications, Excelsior job credits now require creation of fewer jobs while providing larger per job benefits. Property tax credits, the largest cost component of Empire Zones program, have been expanded and extended to 10 years, the same length available under Empire Zones.

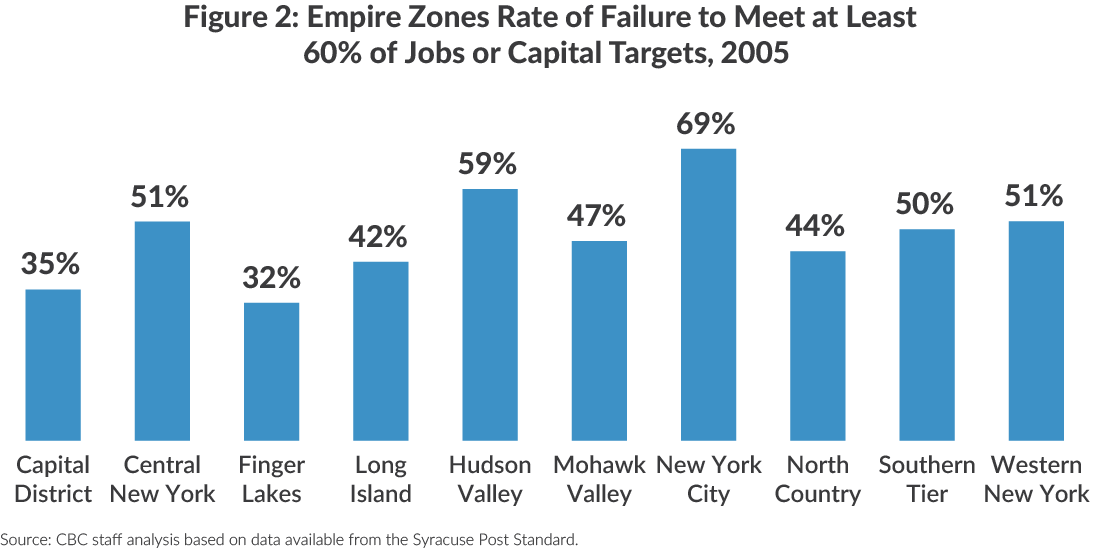

Easing requirements is concerning because it sets the stage for rewarding businesses falling short of performance goals. A significant number of Empire Zone participants failed to meet their targets for job creation and investment, as shown in Figure 2. Halfway through the Empire Zones program, no ESD region had more than 69 percent of participants successfully meeting 60 percent of their jobs and capital targets.15

Conclusion

Excelsior is a slimmer and more efficient program than its predecessor, a result of adhering to criteria for quality economic development programs and more robust reporting requirements for participants. Despite changes to the program, Excelsior’s targeting, annual cost caps, reporting, and use of performance-based credits are still stronger than its predecessor. But the modifications are worrisome for taxpayers. ESD should remain cautious and vigilant in administering and monitoring the program, and legislators should avoid additional modification to expand it; without careful guidance, Excelsior could slip back into the costly patterns of Empire Zones.

Footnotes

- Citizens Budget Commission, It’s Time to End New York State’s Empire Zone Program, (December 2008).

- The calculation of “allocated” credits for the Empire Zones program is actual tax credits received as reported by businesses during the period from 2002 to 2011. The first year of each program, 2001 for Empire Zones and 2011 for Excelsior, was omitted because Empire Zones was an expansion of an existing program and Excelsior only admitted four companies receiving credits in the first year. Comparing years two through four allows the comparison to consider new entrants only. Source: CBC Staff Analysis: State of New York, Empire State Development, Empire Zones Business Annual Reports: Beginning 2001, https://data.ny.gov/Economic-Development/Empire-Zones-Business-Annual-Reports-Beginning-200/edtu-bdbi; and Excelsior Jobs Program Quarterly Report - Businesses Admitted to Program, (2015), www.esd.ny.gov/Reports/2015_2016/ChartA_BusinessesAdmittedToProgram_6302015.pdf.

- Citizens Budget Commission, “End the Empire Zones Program and Adopt Excelsior”, Citizens Budget Commission Blog, (March 25, 2010).

- New York State Assembly, 2009-2010 Budget, Bill No. S6609, Part MM, http://assembly.state.ny.us/leg/?bn=S06609&term=2009.

- Property tax benefits are limited to distressed areas and “significant projects.” Source: New York State Assembly, 2009-2010 Budget, Bill No. S6609, Part MM, http://assembly.state.ny.us/leg/?bn=S06609&term=2009.

- New York State Assembly, 2011-2012 Budget, Bill No. S02811, Part G, http://assembly.state.ny.us/leg/?bn=S02811&term=2011.

- For example, if a firm received a 6 percent federal R&D tax credit on total R&D expenditures, the modified legislation would provide a state R&D tax credit of 3 percent, up from 0.6 percent under the original Excelsior legislation.

- New York State Assembly, 2011-2012 Budget, Bill No. S02811, Part G, http://assembly.state.ny.us/leg/?bn=S02811&term=2011. .

- New York State Assembly, 2013, Bill No. S05903, Part C, http://assembly.state.ny.us/leg/?bn=S05903&term=2013.

- New York State Assembly, 2015-2016 Budget, Bill No. S06009, Part K, http://assembly.state.ny.us/leg/?bn=A06009&term=2015.

- Credits allocated refer to credit amounts to be issued over the entire benefit period while credits issued refer to actual credits paid out in a given year. The calculation of “allocated” credits for the Empire Zones program is actual tax credits received as reported by businesses during the period from 2002 to 2011. The first year of each program, 2001 for Empire Zones and 2011 for Excelsior, was omitted because Empire Zones was an expansion of an existing program and Excelsior only admitted four companies receiving credits in the first year. Comparing years two through four allows the comparison to consider new entrants only.

- CBC staff analysis of data from Empire State Development, Empire Zones Business Annual Reports: Beginning 2001, https://data.ny.gov/Economic-Development/Empire-Zones-Business-Annual-Reports-Beginning-200/edtu-bdbi; Empire State Development, Excelsior Jobs Program Quarterly Report - Businesses Admitted to Program, (June 2015), www.esd.ny.gov/Reports/2015_2016/ChartA_BusinessesAdmittedToProgram_6302015.pdf.

- CBC staff analysis of data from Empire State Development, Empire Zones Business Annual Reports: Beginning 2001, (June 2015), https://data.ny.gov/Economic-Development/Empire-Zones-Business-Annual-Reports-Beginning-200/edtu-bdbi.

- The maximum credits allowed under Excelsior now exceed $2.0 billion by its expiration in 2024. Source: New York State Assembly, 2011-2012 Budget, Bill No. S02811, Part G, http://assembly.state.ny.us/leg/?bn=S02811&term=2011; New York State Assembly, 2013-2014 Budget, Bill No. S05903, Part C, http://assembly.state.ny.us/leg/?bn=S05903&term=2013.

- The 60 percent figure is based on Empire State Development’s decision to step up oversight of the program in 2007. Letters were sent to these companies in an effort to cut down on program abuses. Source: Citizens Budget Commission, It’s Time to End New York State’s Empire Zone Program, (December 2008).