An Insufficient Savings Plan

At his budget presentation in late January, Mayor Bill de Blasio rightly cautioned that there were troubling signs of an imminent economic slowdown and warned that the City should be prepared. Despite this recognition, the fiscal year 2017 budget proposal increased city-funded spending by $2.7 billion. Though the budget included a Citywide Savings Program, or CSP, it was small relative to the size of the budget and savings programs of past years and insufficient to meaningfully offset the cost of new initiatives or to boost reserves. In advance of the Executive Budget proposal, the Mayor should ask agencies to identify operational efficiencies that provide recurring savings to increase its budget cushion and guard against economic uncertainty.

Overview of the FY17 CSP

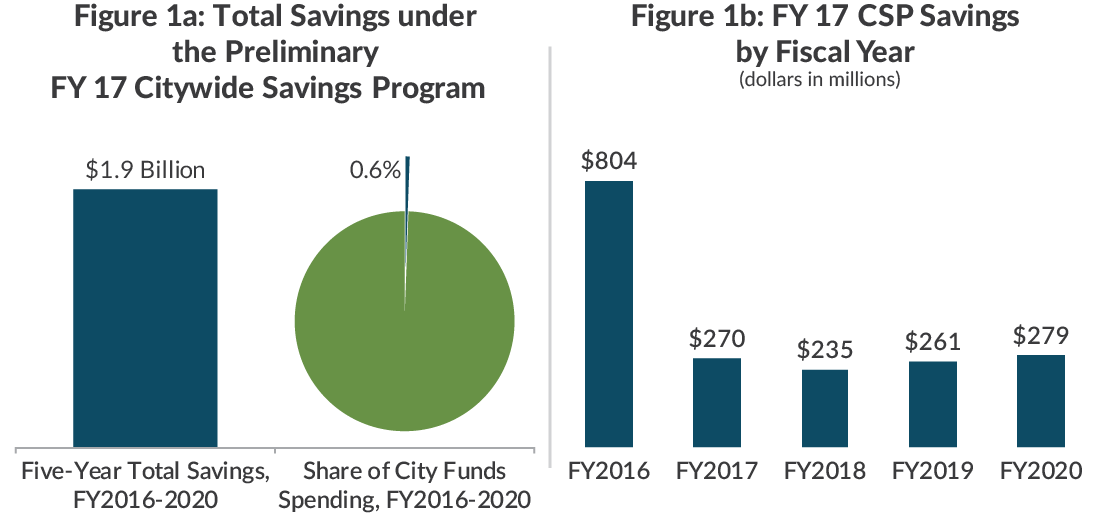

The fiscal year 2017 (FY17) CSP proposes new savings initiatives worth $1.9 billion over fiscal years 2016 to 2020. The savings amount to 0.6 percent of city-funded spending during this time period. The bulk of the savings, $804 million, are planned for the current year, fiscal year 2016. Savings in the remaining four years total $270 million, $235 million, $261 million, and $279 million, respectively.

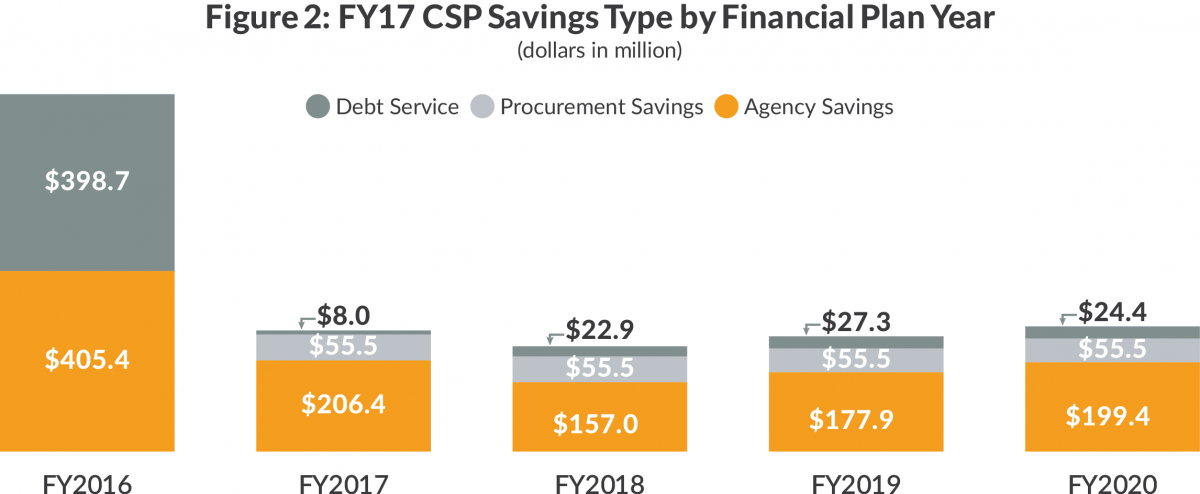

The sources of savings for the FY17 CSP are debt service, procurement, and agency initiatives. Notably, debt service (26 percent) and procurement (12 percent) total more than $700 million, or 38 percent of total FY17 CSP savings. Debt service savings, which are predominantly in fiscal year 2016 and consist of half the savings for that year, stem largely from lower than anticipated interest rates for variable rate debt. Procurement savings, $55 million annually in fiscal years 2017 to 2020, are a placeholder for a citywide innovation initiative that was also included, but not achieved, in last year’s CSP.

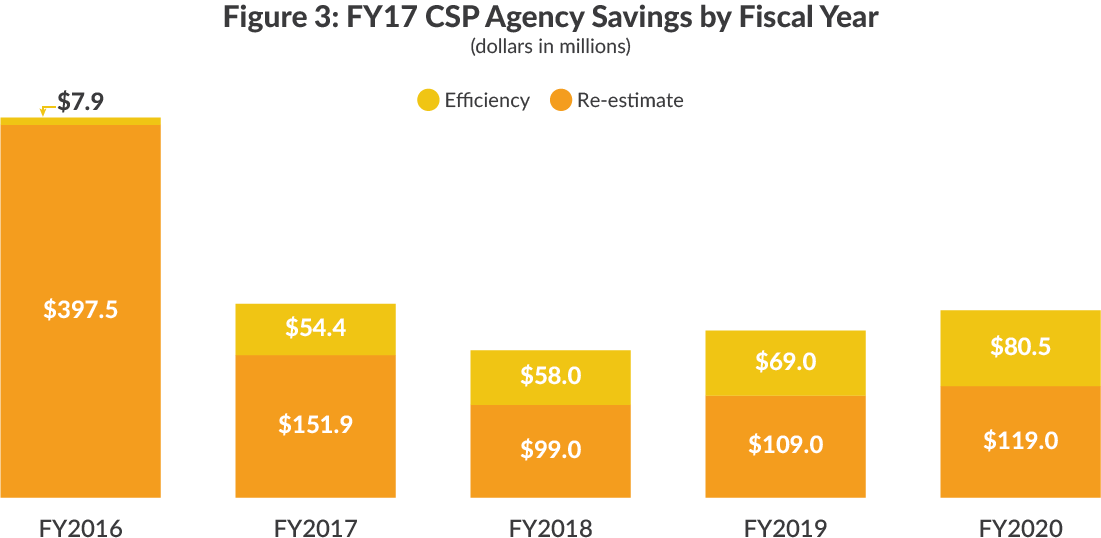

Agency initiatives account for $1.2 billion, or 62 percent, of the FY17 CSP; however, very little of this value is to be derived from improving the efficiency of agency operations for the long term. Most savings are planned for fiscal year 2016 and are primarily composed of spending re-estimates and funding shifts that substitute federal or state grants for local resources. Re-estimates and funding shifts comprise $398 million of the $405 million (98 percent) in agency savings identified in fiscal year 2016 and $809 million out of $1.2 billion (70 percent) in total agency savings for fiscal years 2016 to 2020.

Initiatives to make agencies more efficient total a mere $7.9 million in fiscal year 2016 and $270 million for the entire period—just 23 percent of all agency savings identified, 15 percent of the total FY17 CSP, and 0.1 percent of all city-funded agency expenditures.

One reason for the paltry savings is more than two-thirds of the items in the CSP provide savings in only one or two fiscal years and do not recur. For example, the Department of Sanitation identified $30 million in one-time savings from the Fresh Kills Landfill Closure because the project is running behind schedule.

The one-third of items with recurring savings include worthwhile ideas like energy saving projects at city facilities ($15 million), placing people in new supportive housing units instead of homeless shelters ($63 million), and using longer-lasting red asphalt instead of red paint on new Select Bus Service routes ($10 million).

How does the new CSP compare to past savings programs?

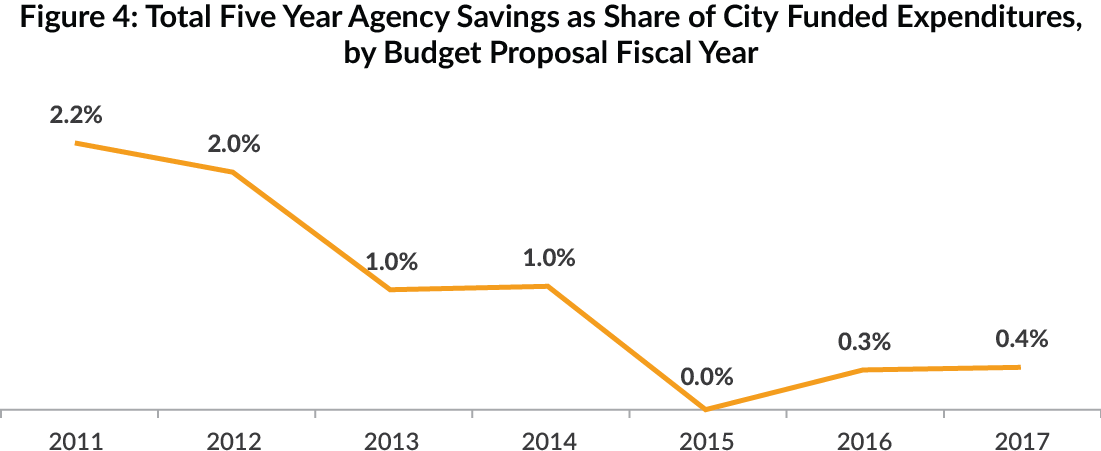

The FY17 CSP is smaller in dollar value and as a share of the city-funded budget than previous savings programs, which include Mayor de Blasio’s FY16 CSP and programs to eliminate the gap (PEGs) under Mayor Michael Bloomberg. Mayor de Blasio did not implement a savings program in fiscal year 2015, his first year in office.

Looking specifically at agency initiatives, the $1.2 billion in savings identified in the FY17 CSP represent a slightly higher share of the city-funded budget than the FY16 CSP, 0.4 percent compared to 0.3 percent, respectively; however, the size of these programs is dwarfed by the PEGs of prior years, which ranged from 1.0 percent to 2.2 percent of the city-funded budget.

Another difference between the CSP and PEGs is that fewer agencies are contributing to savings. Participation in PEGs was mandatory, while participation in the CSP has been voluntary and depends on agency heads to suggest potential savings. Several did not participate in the FY16 CSP, and even more are absent from the FY17 CSP, including the Fire Department and Department of Environmental Protection.

Why savings programs matter

The City’s economy continues to thrive, but there are some indicators that a slowdown may be coming. First, the economy is cyclical: periods of growth are followed by periods of decline. The United States is in its 79th consecutive month of economic expansion, making this the fourth-longest period of expansion since World War II.1 We have surpassed the average expansion period by 19 months, increasing the likelihood that a recession will occur within the financial plan period.

Some signs point to a possibly weakening economy. There is economic uncertainty overseas, particularly in China, where the stock market is down 45 percent since its peak in June.2 This has contributed to losses on Wall Street. There have been layoffs, slower pay growth, and smaller bonuses at several large investment banks, including Goldman Sachs, Morgan Stanley, Credit Suisse, Barclays, Deutsche Bank, Citigroup, and Jefferies Group. Oil prices are also historically low, with the price of a barrel having dropped by 70 percent since June 2014.3 This decreases demand for American exports in countries that rely on oil revenues and presents challenges in states that produce oil. The stronger dollar is hitting the profits of domestic manufacturers.

Because of the difficulty inherent in predicting when a recession will occur and how much impact it will have locally, it is wise to exercise spending restraint and build reserves regularly and well in advance of a potential downturn. Such planning provides flexibility to avoid drastic actions, such as big tax hikes, cuts to important programs, and wide-scale layoffs, when a recession does arrive.

The Mayor has signaled that there will be an expanded CSP in the Executive Budget. That program should include much more in the way of agency savings from initiatives that improve operations and provide recurring savings. A robust savings plan is good financial management and essential for preparing for the inevitable downturn.

Footnotes

- National Bureau of Economic Research, “U.S. Business Cycle Expansions and Contraction” (accessed February 18, 2016), www.nber.org/cycles.html.

- Bloomberg, Market Data for Shanghai Stock Exchange Composite Index (accessed February 18, 2016).

- Clifford Krauss, “Oil Prices: What’s Behind the Drop? Simple Economics,” The New York Times (February 16, 2016), www.nytimes.com/interactive/2016/business/energy-environment/oil-prices.html.