Breaking Down the Amazon HQ2 Deal:

Facts and Takeaways

The announcement that Amazon has chosen Long Island City, Queens, as one of two locations for its planned HQ2 project has generated much attention. Amazon has committed to creating 25,000 full-time high-paying jobs over ten years; investing approximately $2.5 billion; and building 4 million square feet of office space, with the possibility of expanding to 8 million square feet and 40,000 jobs. The location will serve as one of three headquarters of the company, along with Seattle, Washington, and Arlington, Virginia.

To facilitate this investment, Amazon will receive benefits of up to $1.7 billion from New York State and $1.8 billion from New York City. This blog explains the incentive package provided by the State and City and offers five takeaways about the deal and its lessons for future economic development policy.

Elements of New York State’s Incentive Proposal

Excelsior Jobs Program Tax Credits

The state has indicated Amazon can receive up to $1.2 billion in Excelsior tax credits over a ten-year period. This consists of two fully refundable tax credits. The first credit, the Excelsior Job Growth Tax Credit, is equal to 6.85 percent of gross wages for each net new full-time job.1 The second credit, the Excelsior Investment Tax Credit, is equal to 2 percent of qualified investments that meet a 10:1 benefit-cost threshold and generate new wages.2

The Excelsior program is targeted to particular industries, including software development, life sciences, back office services, and manufacturing. Firms must meet a minimum job creation threshold in each industry to be eligible for the program, and ESD reviews each application, considering criteria including how the project fits with regional economic development strategies and the likelihood of project completion.3

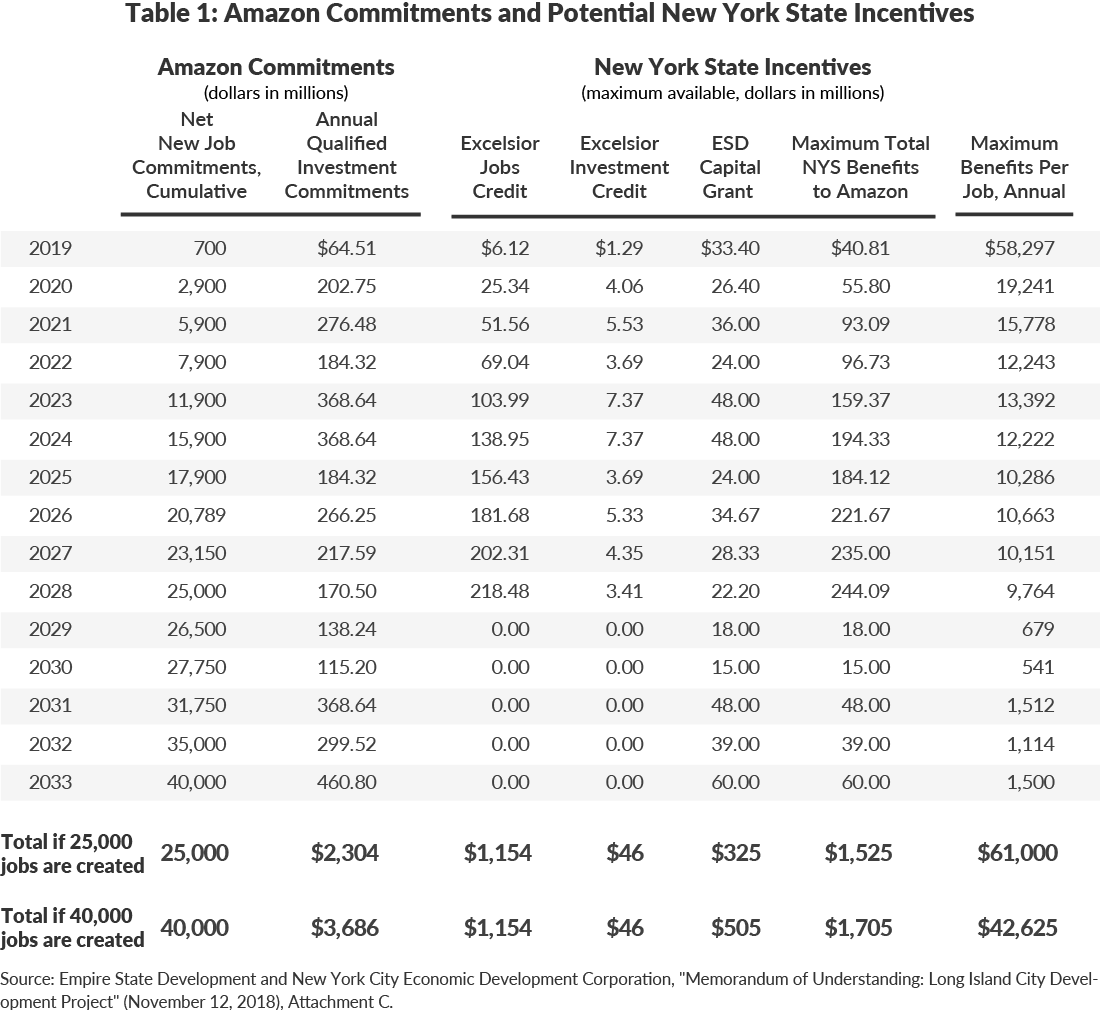

ESD’s incentive proposal to Amazon states that to earn the maximum credits, Amazon must employ 25,000 net new full-time employees at the project site by June 30, 2028, with this employment maintained through January 1, 2029, and make qualifying capital investments of $2.3 billion through 2028.4 The preliminary schedule of benefits indicates that Amazon could receive a maximum of $1,153,920,000 in job growth credits and $46,080,000 in investment credits over the 2019-2028 period, totaling $1.2 billion. (See Table 1.)

To claim either of its Excelsior credits, Amazon will have to submit an annual performance report showing the number of jobs that it has created and the investment it has made that year. The tax credits awarded will be proportional to the actual performance achieved. If in any year Amazon creates less than 75 percent of the net new jobs projected in the preliminary schedule of benefits, it will not receive any job growth credits that year.5 If Amazon exceeds the commitments in the preliminary schedule of benefits, it will not receive additional credits. The performance-based design of the Excelsior program ensures that the state does not pay benefits up front for job growth that never happens; benefits are awarded only based on actual results.

State law currently caps Excelsior benefits for 2019 at $183 million, decreasing to $133 million in 2022, $83 million in 2023, and $36 million in 2024. Assuming Amazon meets its job targets, the State Legislature would need to approve an extension of Excelsior that increases the caps.

Empire State Development Capital Grant

Unlike the Excelsior tax credits, the capital grant to be provided by Empire State Development (ESD) is fully discretionary. The grant will reimburse Amazon for capital costs of office build out at $75 per square foot, up to a maximum of $480 million, and costs of site preparation and infrastructure improvements up to a maximum of $25 million, for a total of $505 million.6 It will be paid over a period of up to 15 years.

The incentive proposal includes a schedule of grant disbursement that ties it to the same cumulative job creation and annual investment commitments as the Excelsior credits. If Amazon creates 25,000 jobs the capital grant can reach a maximum of $325 million. If job creation reaches 40,000 by 2033, an additional $180 million will be available, bringing the total to $505 million. (See Table 1.)

ESD will disburse the capital grant as long as Amazon meets its full annual investment commitment and 85 percent of its cumulative net new jobs commitment for that year. If Amazon falls short of the scheduled job commitment targets, ESD will withhold the grant funds until Amazon meets the thresholds. If total net new jobs at the project in any year fall below the amount required for either of the previous two years, ESD can recapture the grant funds disbursed for those two previous years.7

Funds for this grant are likely to come from one of a number of flexible sources of capital funds that do not require legislative approval. For example, the State and Municipal Facilities Program (SAM), which grew by $475 million in the Fiscal Year 2019 budget, can be used for a wide range of projects, including economic development, at the discretion of the governor and legislative leaders, through the Public Authorities Control Board.

General Project Plan

The final major element of the state’s incentive proposal is that it will be subject to a general project plan rather than the city’s usual land use process, the Uniform Land Use Review Procedure (ULURP). This gives the state the authority to approve a land use plan without needing to secure City Council approval for a rezoning. In recent years, this process was used for development of Atlantic Yards, Brooklyn Bridge Park, and redevelopment in Times Square.8

Potential Benefits from New York City

In addition to the state incentives spelled out in the incentive proposal, Amazon is eligible for two pre-existing as-of-right city tax expenditures. Firms receive these benefits by meeting the criteria specified in state statutes.

Industrial and Commercial Abatement Program (ICAP)

ICAP provides property-tax abatements lasting up to 25 years for industrial and commercial buildings that are built, expanded, or modernized. New commercial construction is eligible anywhere except in Manhattan between 96th Street to the north and Murray Street, Frankfort Street, and Dover Street to the south.9 Selected areas of the city are eligible for additional benefits, but the Amazon development site is not in one of these areas.

The abatement covers the amount by which the property tax post-construction exceeds 115 percent of the tax before construction. Recipients of ICAP must spend at least 30 percent of the Taxable Assessed Value of the property within four years of issuance of the first building permit, with construction completed no more than five years from the date of issuance of the first building permit.10

The abatement schedule varies depending on whether a project is industrial or commercial, the portion of the building used for retail purposes, and whether the project is in a designated special ICAP area. The Amazon project, a commercial project not located in a special area, would be eligible for a 100 percent abatement for 11 years, which then phases out over the following four years.11 The City estimates that the abatement will total $386 million.12

Relocation and Employment Assistance Program

The REAP credit is available to businesses that relocate from outside New York City to Lower or Upper Manhattan or the other boroughs and make property improvements worth more than 50 percent of the property’s assessed value. The credit is worth $1,000 for 12 years per eligible full-time employee. Firms that relocate to “revitalization areas,” which includes Amazon’s site in Long Island City, qualify for a more generous credit of $3,000 for 12 years per eligible full-time employee.13 Revitalization areas are those parts of the city zoned for manufacturing or specific commercial uses. Recipients must be certified annually to determine the amount of credit they can claim. The credit is refundable for the first five years, including the year of relocation. In subsequent years, unused credits may be carried forward for up to five years.14

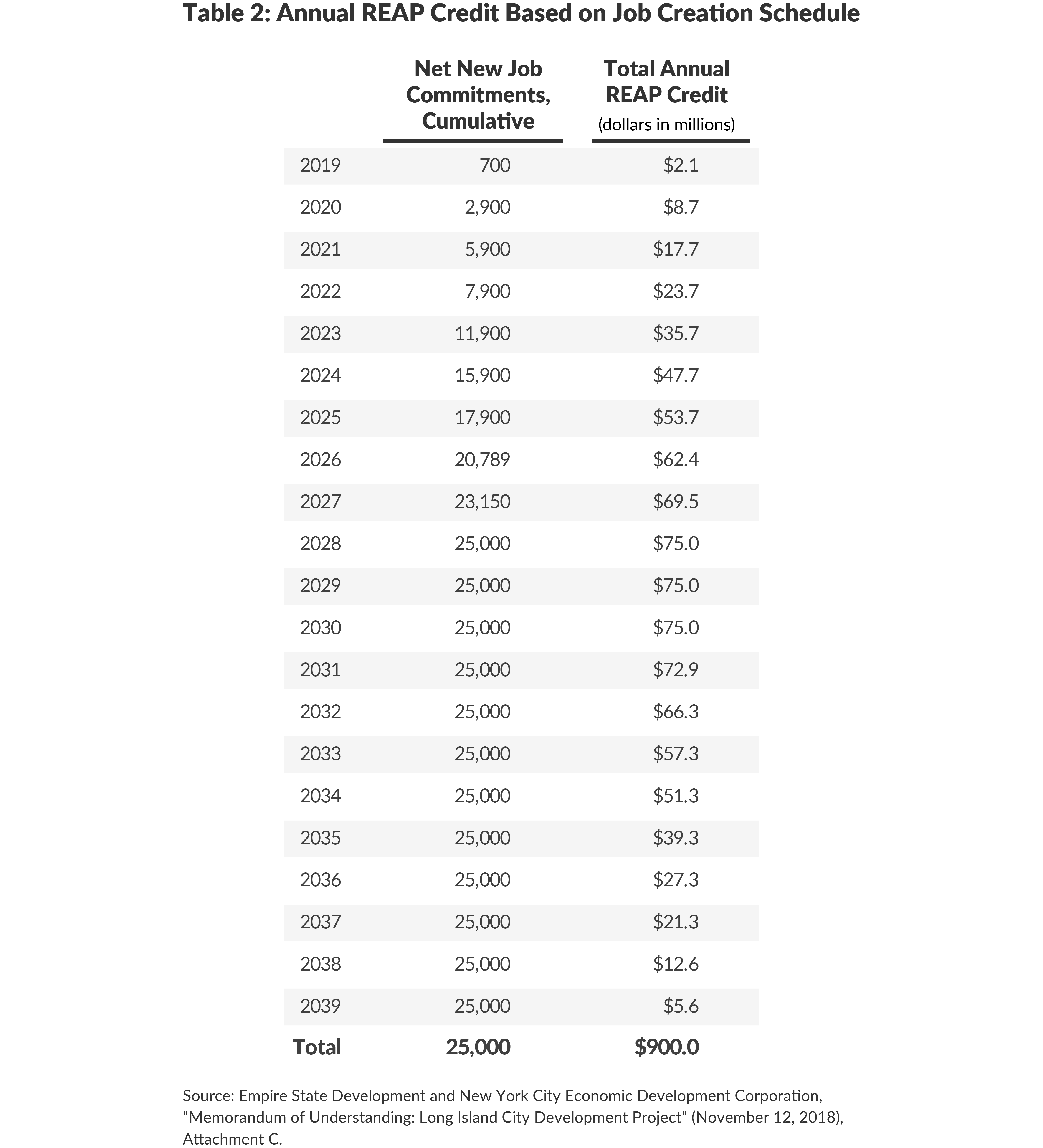

Using the schedule of job creation commitments associated with the Excelsior Job Program credits, the potential total REAP credit by 2039 is $900 million, assuming the creation of 25,000 jobs. (See Table 2.) If Amazon creates 40,000 jobs, the total REAP credit could reach $1.44 billion.

Infrastructure Investment in Long Island City

For all of the sites that are part of the development, Amazon must make payments in lieu of property taxes (PILOTs). The PILOTs will be equal to the amount of taxes that would be due if the land were not tax exempt, minus the amount of any applicable as-of-right property tax abatements, such as those under ICAP.15 As a result, for the first 11 years the PILOT will be equivalent to the property tax due only on 115 percent of the initial assessed value of the property, excluding the assessed value of improvements Amazon makes.16 As ICAP phases out, the PILOT will increase to apply to the assessed value of the improvements made by Amazon.

The PILOT funds will go to ESD, which will place at least half of the funds related to the previously city-owned sites into an Infrastructure Fund to be held by the New York City Economic Development Corporation (NYCEDC). The remainder of the funds will be transferred to the city’s general fund, as they would if they were regular property tax payments. NYCEDC will use the Infrastructure Fund for improvements outside of the development site itself but within a yet to be determined area within Long Island City.17

In addition, City officials also had previously announced $180 million in capital funding for improvements to sewer and water systems, construction of a new school, street reconstruction, and open space improvements in the neighborhood.18

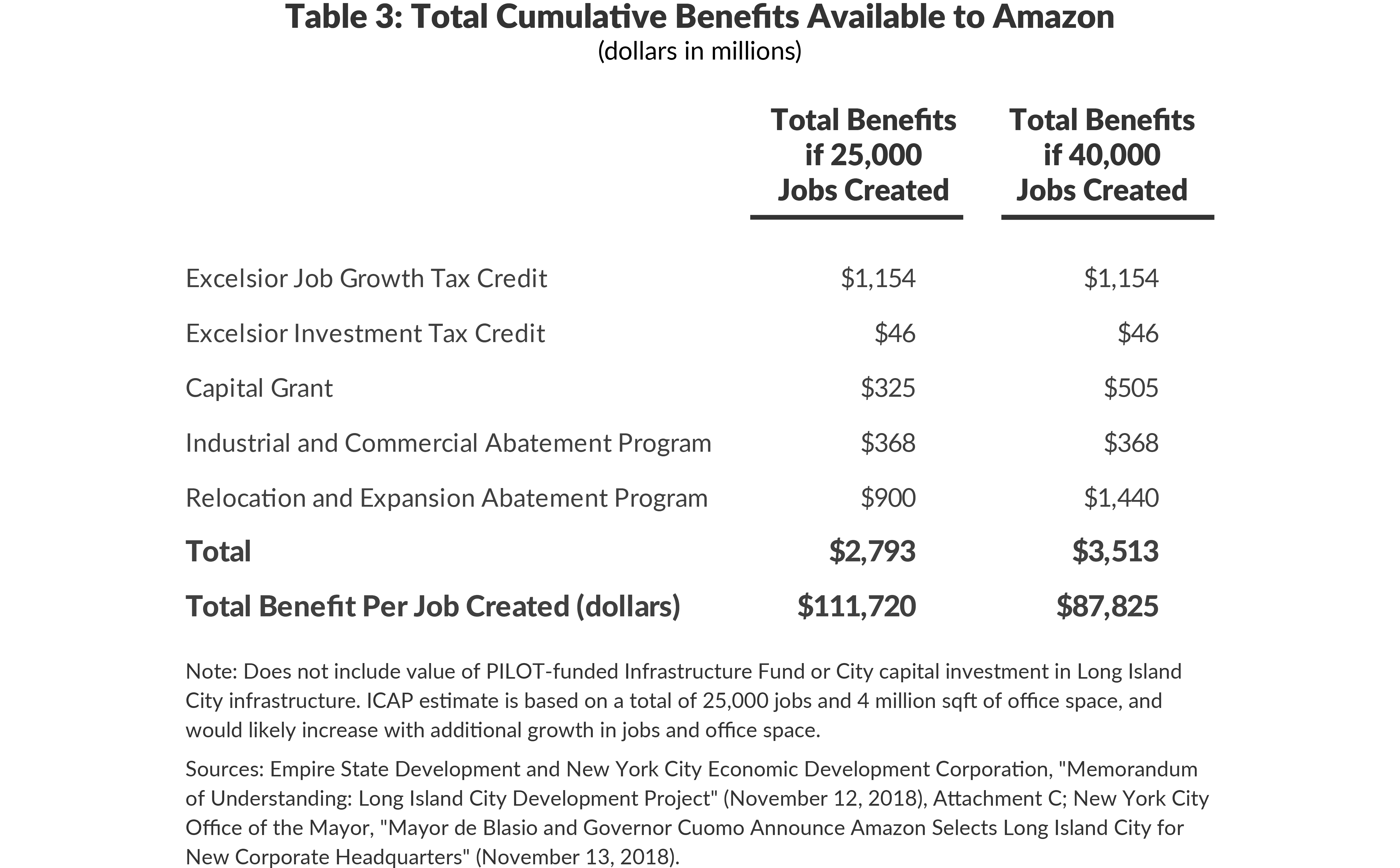

The benefits available to Amazon from New York State and City total $2.8 billion if 25,000 jobs are created and $3.5 billion if 40,000 jobs are created. (See Table 3.)

Key Takeaways from the Amazon HQ2 Deal

The presence of Amazon’s HQ2 will support New York City’s economic development goal of growing the technology sector to create well-paying jobs and diversify away from financial services. It will provide tax revenue to the city and state and power growth for the regional economy. Nevertheless, this deal highlights a number of weaknesses in the City and State’s approach to economic development.

- The Excelsior Job Program is generally well designed, with performance-based incentives targeted at strategic industries. However, offering Amazon benefits that go well above the current cap and expiration date of the program sets a concerning precedent that programs will be expanded to accommodate the needs of a single company. Other state programs, including the Film Tax Credit and the now-ended Empire Zones program, were significantly broadened through revisions, making them too generous, insufficiently targeted, and costly to taxpayers. Excelsior should not follow this example. The need to go through the State Legislature to increase the cap provides an important opportunity for oversight and review.

- The Excelsior jobs program provides a wage credit equal to 6.85 percent of gross wages, regardless of how much employees are paid. Caps to the level of wages eligible for reimbursement would minimize the State’s financial exposure. For example, the Start-Up NY program caps eligible wages between $200,000 and $300,000 annually depending on the employee’s filing status.

- The reimbursement-based structure of the ESD capital grant is an improvement over many projects in which state capital has been invested upfront at great risk to taxpayers; however, funding streams used to make these grants, like the State and Municipal Facilities Fund, circumvent oversight. Moreover, state capital funding is best invested in general infrastructure, not for the direct benefit of an individual company.

- Amazon should pay the full value of the PILOT directly to the City rather than diverting some funds to the surrounding neighborhood. It is worthwhile to make capital investment in growing areas of the city, but such investment should go through the regular budgetary process.

- New York City’s as-of-right tax incentives should be reconsidered. While programs like REAP and ICAP may have been necessary when they were first established, the economic landscape of the city has changed in the last three decades. These programs should be evaluated and potentially narrowed or eliminated to ensure benefits are only spent to induce job creation that would not otherwise occur.

Footnotes

- Must be 35 hours per week and fully new to the state. See Regulations of the Commissioner of Economic Development, Chapter XIX, Parts 190 and 193, https://esd.ny.gov/sites/default/files/Excelsior-Regs-2818.pdf.

- Regulations of the Commissioner of Economic Development, Chapter XIX, Parts 191 and 193,https://esd.ny.gov/sites/default/files/Excelsior-Regs-2818.pdf.

- Regulations of the Commissioner of Economic Development, Chapter XIX, Part 191,https://esd.ny.gov/sites/default/files/Excelsior-Regs-2818.pdf.

- Empire State Development and New York City Economic Development Corporation, “Memorandum of Understanding: Long Island City Development Project” (November 12, 2018), Attachment C, p. 7, https://d39w7f4ix9f5s9.cloudfront.net/4d/db/a54a9d6c4312bb171598d0b2134c/new-york-agreement.pdf.

- Regulations of the Commissioner of Economic Development, Chapter XIX, Part 192,https://esd.ny.gov/sites/default/files/Excelsior-Regs-2818.pdf.

- Empire State Development and New York City Economic Development Corporation, “Memorandum of Understanding: Long Island City Development Project” (November 12, 2018), Attachment C, p. 3, https://d39w7f4ix9f5s9.cloudfront.net/4d/db/a54a9d6c4312bb171598d0b2134c/new-york-agreement.pdf.

- However, if Amazon’s job creation catches up to its goals by the five-, ten-, or fifteen-year mark, ESD will make all disbursements for that year plus any grant funds that ESD has withheld or recaptured in the previous four years. See Empire State Development and New York City Economic Development Corporation, “Memorandum of Understanding: Long Island City Development Project” (November 12, 2018), Attachment C, p. 4, https://d39w7f4ix9f5s9.cloudfront.net/4d/db/a54a9d6c4312bb171598d0b2134c/new-york-agreement.pdf.

- Daniel Geiger, “Cuomo likely to steer Amazon project around City Council” (November 9, 2018), Crain’s New York Business, www.crainsnewyork.com/real-estate/cuomo-likely-steer-amazon-project-around-city-council.

- New York City Department of Finance, “Industrial & Commercial Abatement Program (ICAP)” (accessed November 16, 2018), https://www1.nyc.gov/site/finance/benefits/benefits-industrial-and-commercial-abatement-program-icap.page.

- New York City Department of Finance, “Industrial & Commercial Abatement Program (ICAP)” (accessed November 16, 2018), https://www1.nyc.gov/site/finance/benefits/benefits-industrial-and-commercial-abatement-program-icap.page.

- New York City Department of Finance, “ICAP Benefit Schedules Pursuant to s. 489-bbbbbb” (April 23, 2008), https://www1.nyc.gov/assets/finance/downloads/pdf/icap/icap_benefit_schedule.pdf.

- New York City Office of the Mayor, “Mayor de Blasio and Governor Cuomo Announce Amazon Selects Long Island City for New Corporate Headquarters” (November 13, 2018), https://www1.nyc.gov/office-of-the-mayor/news/552-18/mayor-de-blasio-governor-cuomo-amazon-selects-long-island-city-new-corporate#/0.

- New York City Department of Finance, “Annual Report on Tax Expenditures: Fiscal Year 2018” (April 2018), p. 84, https://www1.nyc.gov/assets/finance/downloads/pdf/reports/reports-tax-expenditure/ter_2018_final.pdf; “Relocation and Employment Assistance Program (REAP)” (accessed November 19, 2018), https://www1.nyc.gov/site/finance/benefits/business-reap.page.

- New York City Department of Finance, “Relocation and Employment Assistance Program (REAP)” (accessed November 19, 2018), https://www1.nyc.gov/site/finance/benefits/business-reap.page.

- All of the parcels will be acquired by ESD, making them tax exempt. Empire State Development and New York City Economic Development Corporation, “Memorandum of Understanding: Long Island City Development Project” (November 12, 2018), p. 5, https://d39w7f4ix9f5s9.cloudfront.net/4d/db/a54a9d6c4312bb171598d0b2134c/new-york-agreement.pdf.

- Under ICAP, Amazon would receive an abatement equivalent to the difference between the post-renovation assessed value of the property, and 115 percent of the initial assessed value of the property. The value of the abatement is fixed for the duration of the benefit period. The ICAP recipient will pay property taxes on any additional assessed value growth. See New York City Department of Finance, “Industrial & Commercial Abatement Program (ICAP)” (accessed November 16, 2018), https://www1.nyc.gov/site/finance/benefits/benefits-industrial-and-commercial-abatement-program-icap.page; “ICAP Benefit Schedules Pursuant to s. 489-bbbbbb” (April 23, 2008), https://www1.nyc.gov/assets/finance/downloads/pdf/icap/icap_benefit_schedule.pdf.

- Empire State Development and New York City Economic Development Corporation, “Memorandum of Understanding: Long Island City Development Project” (November 12, 2018), p. 5,https://d39w7f4ix9f5s9.cloudfront.net/4d/db/a54a9d6c4312bb171598d0b2134c/new-york-agreement.pdf.

- New York City Office of the Mayor, “De Blasio Administration Unveils Long Island City Investment Strategy and $180M in New Funding” (October 30, 2018),https://www1.nyc.gov/office-of-the-mayor/news/535-18/de-blasio-administration-long-island-city-investment-strategy-180m-new-funding.