Budget Proposals with a Big Long-Term Payoff

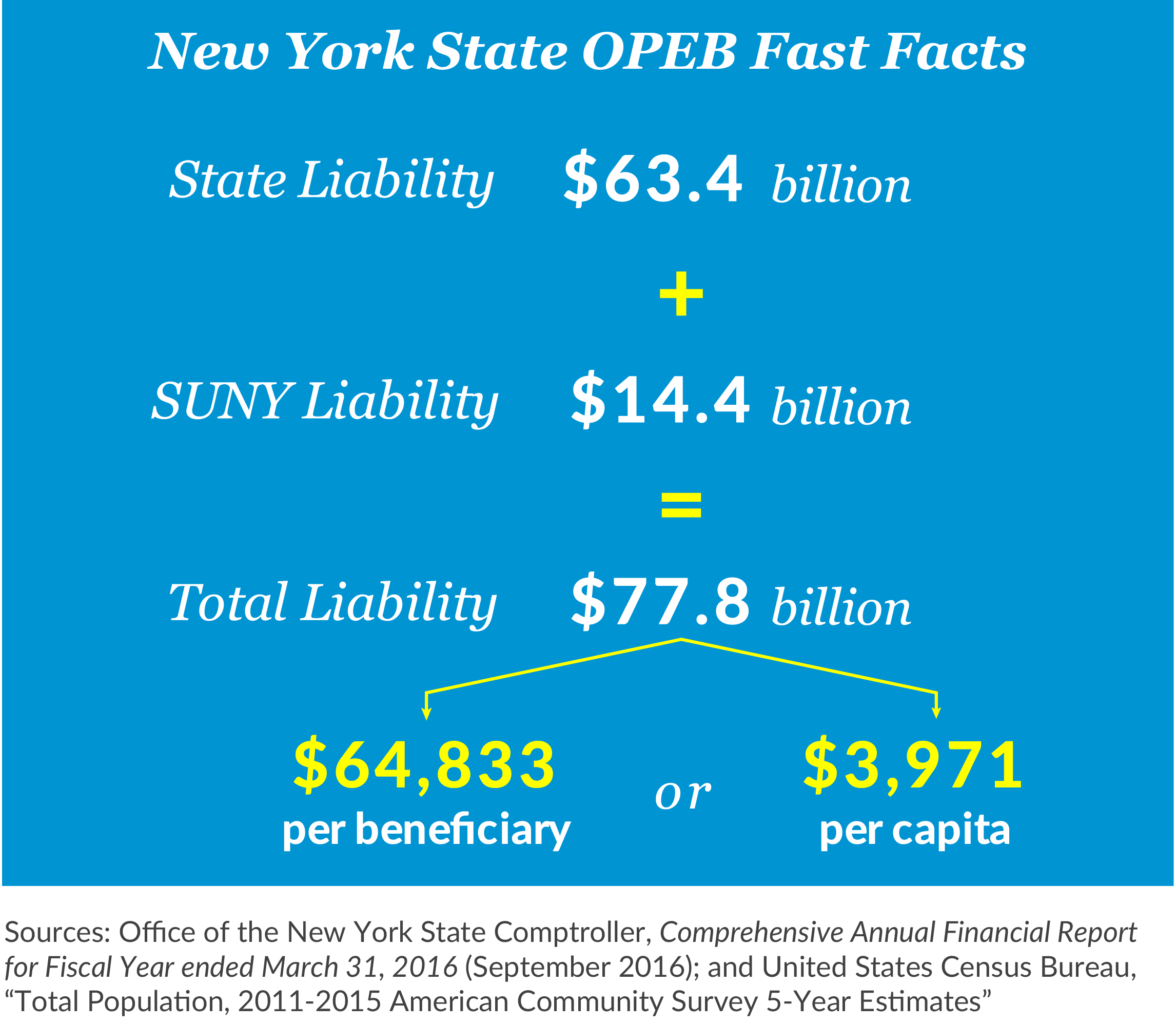

The New York State Fiscal Year 2018 Executive Budget includes three proposals to reduce the State’s cost of providing retiree health insurance. These proposals would save $18.8 million in fiscal year 2018, but this modest short-term saving understates the importance to the State’s long-term fiscal stability: the proposals would reduce the State’s $78 billion liability for other post-employment benefits (OPEB) more than one-third. In addition, the Budget proposes to create a trust fund to accumulate resources to address this liability. The Legislature should adopt these sensible proposals and develop a plan to require regular deposits to the fund.

New York’s OPEB Liability

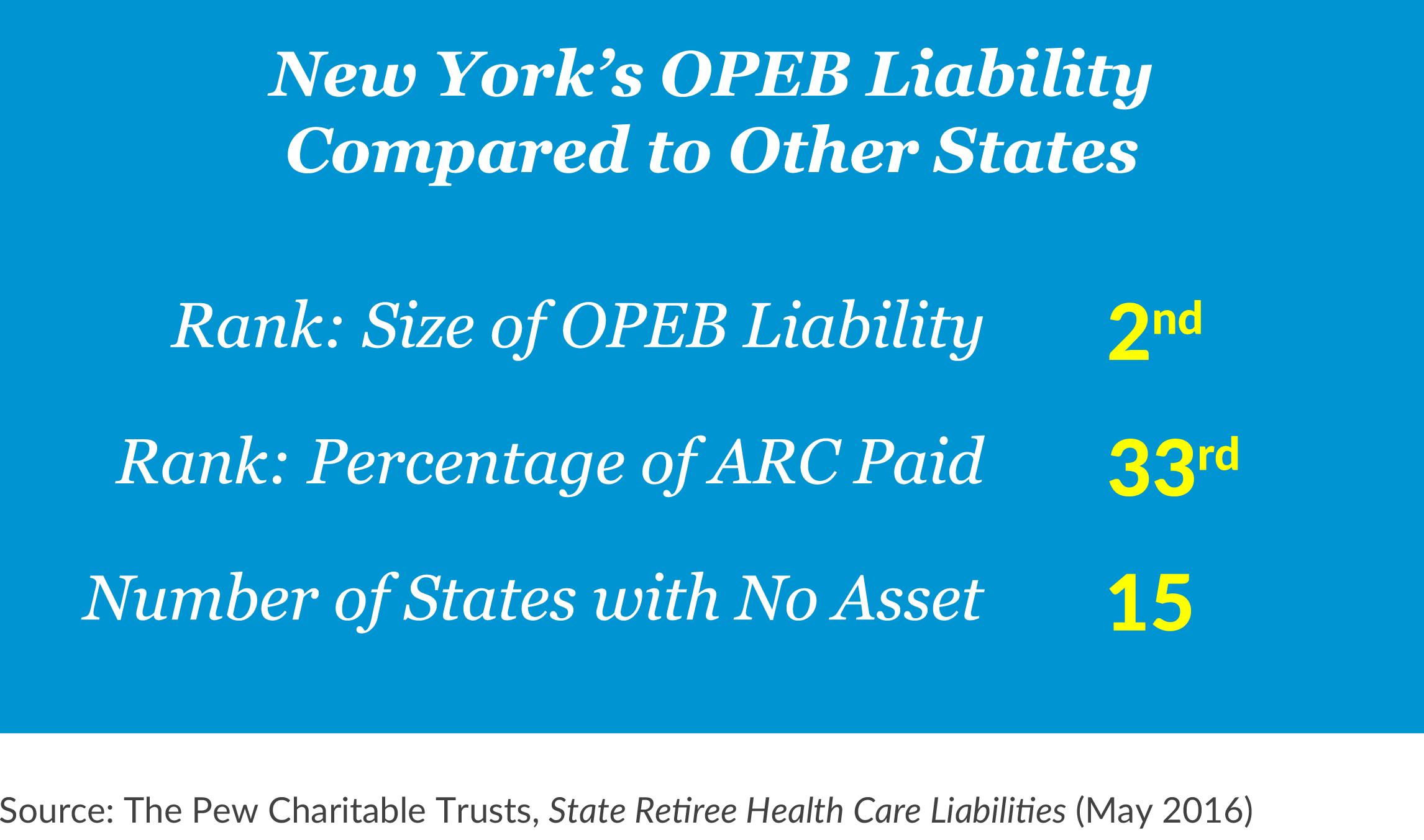

As defined by the Governmental Accounting Standards Board, OPEB represents any benefit to public retirees other than pensions. OPEB includes life insurance, disability payments, and other benefits, but the largest and most significant benefit is for health care.1 New York State offers health insurance to its retirees but does not set aside funds as current employees earn health insurance coverage in retirement; instead, the State uses a “pay-as-you-go” approach, paying retiree health insurance premiums as they come due. This currently costs approximately $1.3 billion annually.2 Of the 1.2 million enrollees in the New York State Health Insurance Program (NYSHIP), about 325,000 are active employees, 275,000 are retirees, and 600,000 are covered dependents. The commitment to provide retiree health coverage to employees, retirees, and their dependents produces an OPEB liability valued at approximately $78 billion.3 This liability is the second largest of any state—only California has a greater liability.4

New York’s OPEB liability is large because of the expansive benefits provided to retirees. Currently retirees pay a varying proportion of their health insurance premiums based on their retirement date and salary level, but no adjustments are made based on length of service. The State also pays the entire Medicare Part B premium for retirees, including the progressively-adjusted amounts charged to high-income retirees.5

Proposals to Reduce OPEB Should be Adopted

The Fiscal Year 2018 Executive Budget makes three proposals to increase employee and retiree premium-sharing, which would generate short-term budget savings and produce a significant reduction to the State’s OPEB liability.

- Eliminate additional Medicare Part B premium reimbursements for high earners (effective January 1, 2017)

The Federal government charges high-income earners a surcharge for Medicare Part B premiums, the Income Related Monthly Adjustment Amount (IRMAA). The State currently reimburses retirees for this cost, but the Executive proposes to cease this practice. This change is projected to save the State $8 million annually and to reduce the State’s OPEB liability by $450 million. - Freeze Medicare Part B Premium reimbursement (effective May 1, 2017)

The State currently reimburses the full cost of Medicare Part B premiums for retirees and dependents. The Executive Budget proposes capping the State’s share of Part B premium costs at 2015 levels for those enrolled in Medicare prior to January 1, 2016. The 2015 Part B premium is $104.90 per month. For those enrolling in Medicare on or after January 1, 2016, the State’s contribution to Part B premiums would be the lesser of $121.80 (the 2016 Part B premium) or the current applicable Part B premium. This component is projected to save the State $7.4 million annually and to reduce the State’s OPEB liability by $10.6 billion. - Create tiered cost-sharing for future retirees (effective October 1, 2017)

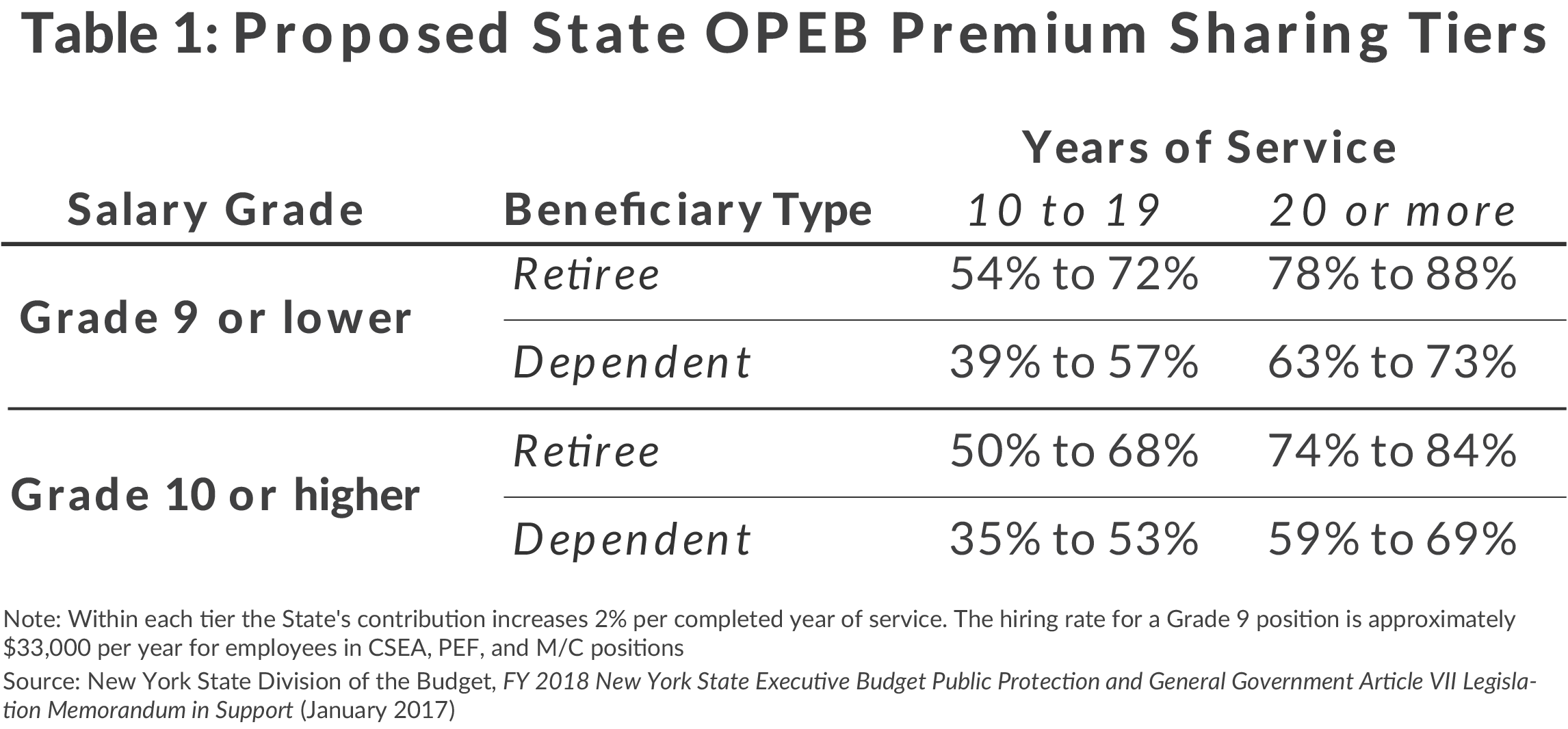

Employees retiring after October 1, 2017 will share costs of their health insurance premiums based on salary grade, years of service, and type of coverage, as summarized in the table below. The State’s contribution toward retiree health insurance premiums would increase 2 percent per each year of service, so the State would pay 54 percent of single premium coverage for a Grade 8 employee retiring with 10 years of service and 88 percent for a similar employee with 30 years of service. Creating this tiered system is projected to save the State $3.4 million in fiscal year 2018 and $10.9 million in fiscal year 2019. The proposal would reduce the State’s OPEB liability by approximately $17.6 billion.

Taken together these actions can reduce the State’s OPEB liability by approximately $28.2 billion or 36 percent.6 The proposals would make the State’s OPEB liability more manageable for future New Yorkers. Increased retiree cost-shares and the use of a tiered approach based on salary and years of service also align retiree health insurance with pensions.

Proposal to Create an OPEB Trust Fund Should be Strengthened

The Executive Budget also proposes the creation of a special investment fund under the control of the Commissioner of Civil Service. The creation of this fund is important because it allows the State to begin prefunding its OPEB liabilities, which is considered a best practice in public finance.7

Prefunding is beneficial for three reasons. First, it allows the State to earn interest on deposits. Second, this approach promotes intergenerational equity since current taxpayers will fund the cost of current employees rather than passing this burden on to future New Yorkers. Third, it mirrors the funding of pension obligations, which are financed in an ongoing fashion with investments made by the State Comptroller as employees earn benefits. In this manner, the State would finance its OPEB obligation in a more cost-effective and equitable way.

The OPEB Trust Fund proposal is incomplete, however. The relevance of the OPEB Trust is based on its deposits. An empty account does not help the State finance its liability, and the OPEB Trust proposal does not compel the State to make deposits. The language allows the Director of the Budget to transfer a portion of any future General Fund surpluses to the OPEB Trust, but does not specify in what amounts.

The State’s Comprehensive Annual Financial Report presents OPEB liability, including the annual required contribution (ARC). The ARC is the amount the State would need to set aside in a year to pay for OPEB liabilities accrued during the year and pay off currently unfunded liabilities over a 30-year period. Fully funding the ARC – a practice followed by only three states in 2013 – would require New York State roughly to triple its annual retiree health insurance costs. As of fiscal year 2016, the State’s ARC was projected at $3.3 billion.8 Any reductions to the State’s total OPEB liability would also reduce the ARC, making sufficient annual funding more achievable.

While this level of funding may not be practical in the short term, the State should develop a plan for making regular deposits into the Trust. Funding an OPEB liability with a trust can improve a government’s finances and credit rating. For example, Fitch Ratings considers exceptionally large OPEB liabilities in the context of a State government’s overall liabilities, but recognizes that OPEB liabilities are more flexible than other debts and pension obligations.9 Similarly, it is important to have a plan for when withdrawals from the Trust are appropriate. Without a codified deposit and withdrawal policy, the benefits of the OPEB Trust are limited in terms of finance and credit.

Conclusion

The Governor’s proposals related to OPEB should be adopted, and legislators should include a plan for funding the proposed OPEB Trust Fund. Without a plan to make deposits and withdrawals from this account, this proposal does little to promote fiscal prudence and equity. While the State’s OPEB liability will remain substantial even with these proposals, their enactment would help to contain this liability and place the State on a more stable fiscal footing.

Footnotes

- Governmental Accounting Standards Board, “Other Postemployment Benefits” (accessed February 28, 2017), www.gasb.org/opeb.

- Office of the New York State Comptroller, Comprehensive Annual Financial Report for Fiscal Year ended March 31, 2016 (September 2016), pp. 104-105, www.osc.state.ny.us/finance/finreports/cafr/2016cafr.pdf.

- Includes all State employees and employees from participating authorities, public benefit corporations, and local governments. See: Office of the New York State Comptroller, Comprehensive Annual Financial Report for Fiscal Year ended March 31, 2016 (September 2016), pp. 104-105, www.osc.state.ny.us/finance/finreports/cafr/2016cafr.pdf.

- Pew Charitable Trusts, State Retiree Health Care Liabilities (May 11, 2016), www.pewtrusts.org/en/research-and-analysis/issue-briefs/2016/05/state-retiree-health-care-liabilities.

- Most Medicare enrollees will pay the standard Part B premium ($134 monthly in 2017). For those with an income above $85,000 (or $170,000 for those filing jointly) the premium amount increases to as high as $428.60 for those earning above $214,000 (or $428,000 if filing jointly). See: U.S. Centers for Medicare & Medicaid Services,“Medicare.gov: Part B Costs” (accessed March 13, 2017), www.medicare.gov/your-medicare-costs/part-b-costs/part-b-costs.html.

- New York State Division of the Budget, FY 2018 New York State Executive Budget Public Protection and General Government Article VII Legislation Memorandum in Support (January 2017), pp. 27-31, www.budget.ny.gov/pubs/executive/eBudget1718/fy18artVIIbills/PPGG_ArticleVII_MS.pdf.

- Government Finance Officers Association, “Establishing and Administering an OPEB Trust” (accessed March 1, 2017), www.gfoa.org/establishing-and-administering-opeb-trust.

- Office of the New York State Comptroller, Comprehensive Annual Financial Report for Fiscal Year ended March 31, 2016 (September 2016), pp. 104-105, www.osc.state.ny.us/finance/finreports/cafr/2016cafr

- Fitch Ratings, U.S. Tax-Supported Rating Criteria (April 18, 2016), p. 13, www.fitchratings.com/site/re/879478.