The City’s FY 2011 Budget: The Buck Stops Here

In June the New York City Council voted to approve New York City's budget for fiscal year 2011. The Mayor and the City Council should be commended for passing a budget that responsibly deals with difficult financial realities without raising taxes and by achieving recurring savings of over $1 billion in agency spending. But with significant budget gaps looming in the outyears and the end of nearly a decade of multi-billion dollar surpluses, it is disappointing that more has not been done to lower spending.

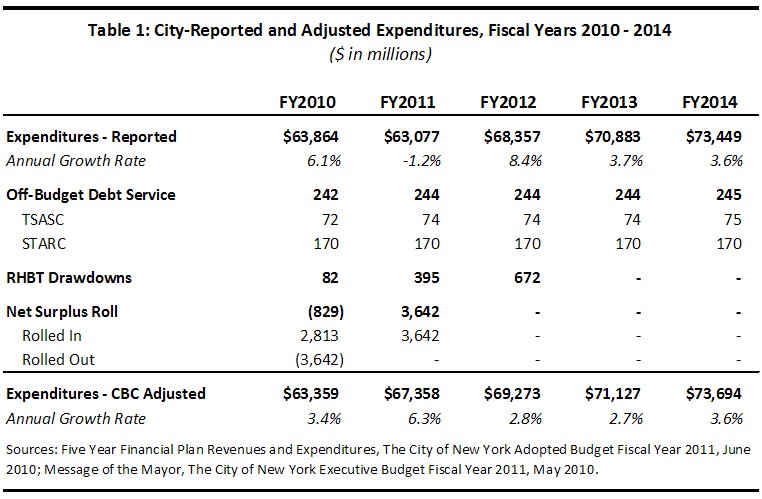

The Last of the Big Surplus Rollovers

While the total expenditures reported by the City appear to be flat between fiscal years 2010 and 2011, the reality is that expenditures are growing. After adjusting for prepayments and drawdowns from the Retiree Health Benefits Trust Fund (RHBT),[1] expenditures in FY2011 are actually 6.3 percent higher than they were in the last fiscal year.[2] (See Table 1.) Without the $3.6 billion surplus from FY2010 and money from the RHBT, the City would be facing a $4.3 billion gap in this fiscal year. And that's after $1 billion in agency cuts.

Surplus rollovers have been helping to hide the true growth of expenditures for quite some time. Since fiscal year 2003, the city has been consistently rolling surpluses in excess of $1 billion. Thanks to the economic boom of the mid-2000s, revenues continued to outpace expenditures, even as the annual growth in expenditures averaged 6.5 percent a year between fiscal years 2003 and 2008. By the end of fiscal year 2008, just before the bust, the accumulated surplus from those years totaled $4.6 billion. Much of it, about $1.8 billion to be exact, was used to steady the fiscal year 2009 budget in the face of a huge gap created by dismal tax collections; and the City has been drawing it down further ever since. This year, the City will exhaust the last of the accumulated surplus; the fiscal year 2011 budget is balanced thanks to $3.6 billion in surplus from fiscal year 2010, a combination of those accumulated surpluses from the boom-years and increased tax revenues due to a stunning comeback in profits on Wall Street fueled by low interest rates. After that, the buck literally stops here; such good fortune is unlikely to continue, and actual expenditures will exceed revenues by $4.6 billion in fiscal year 2012.

Program Cuts, Restorations and Pork Barrel Spending

The cuts to the agency program in this fiscal year will certainly be felt by New Yorkers. This year's Program to Eliminate the Gap, or"PEG" as it's commonly called, includes the loss of over 4,200 jobs, including about 1,100 through layoffs. Health and welfare programs face over $100 million in service cuts; several senior centers and child daycare centers will be closed. Libraries were spared closures, but will be reducing their hours to achieve savings. East River and Rockaway ferry services are still on the chopping block, impacting commuters from the outer boroughs. If the federal government does not come through with $600 million in aid for Medicaid that is included in the adopted budget, a scenario looking more and more likely, more cuts are all but certain.

The City Council restored $231.7 million of the Mayor's proposed cuts, providing some relief for the most seriously cut areas of the budget. But they also added another $165.2 million in new initiatives, including $48.9 million in local member items. These local items include things like $87,000 to a development coalition in Astoria to fund, among other things, a July 4th celebration; $170,000 to a Bronx development corporation for various programs and community and special events; $190,000 to the Staten Island Economic Development Corporation to fund economic conferences and a business solution center; and $215,000 to fund recreational programs at Asphalt Green on the upper east side. The Council has touted its restraint in discretionary spending, but while agencies still face over $1 billion in cuts, pork barrel spending at any level hardly seems appropriate.

Opportunities for Savings in the "Non-controllables"

Opportunities for both immediate and long-term savings were left on the table. The two fastest growing areas in the budget - public employee fringe benefits and debt service - are logical places to look for savings, but the Mayor and the Council continue to treat these as "non-controllable" and focus on cutting agency expenses instead.

Public Employee Fringe Benefits

City employee pension and fringe benefits together constitute nearly a quarter of the City's expenses and are slated to grow just under five percent on average annually during the plan years. The CBC has long urged the City to take a stronger stance on reforming health care and retirement benefits for its workers. Bringing these benefits more in line with those of the private sector would achieve significant savings now and into the future. Specifically, requiring employee contributions to health care premiums of 10 percent for individuals, 25 percent for families and 50 percent for retirees, would save the City over $1 billion annually, more than enough to prevent the 1,100 layoffs slated for this fiscal year. On the pension side, the City had estimated that creating a new pension tier that would require greater employee contributions and a longer vesting period would save $200 million annually. Removal of these savings from the budget was a strategic move: the Mayor has said that he will still seek these reforms, but that the savings would go back to the employees in the form of wage increases that were also excluded from the new budget. But at a time when many in the private sector are being forced to make difficult sacrifices - forgoing raises and facing furloughs and other cost-saving measures - it is only fair that City taxpayers also be able to share in the savings from such reforms.

Debt Service

The financial plan continues to reflect rapidly growing debt service costs, at the rate of nearly 9 percent on average annually.[3] By 2014 debt service will constitute nearly 12 percent of the City's budget. Debt service is a direct result of the City's large capital budget. The capital commitment plan for fiscal years 2010-2014 totals $43.5 billion, with a record-high $13.4 billion in commitments in FY2010.[4] While extensive capital investment and expansion may have made sense in economic boom times, the current financial climate and the growing pressures that debt service are putting on the budget call for scaling back the plan. It should focus on key priorities, such as state-of-good-repair work on the City's aging infrastructure, and trim back on development projects that are less urgent and that do not have demonstrable benefits for the City's continued prosperity.

With so many questions remaining about the persistence and strength of the current economic recovery, the City should be doing everything it can to ensure balanced budgets both now and into the future. This year, the Mayor and the Council were able to achieve a balanced budget in the midst of very difficult economic times, but only thanks to the residual surpluses of the past economic boom. As the multi-billion dollar surpluses of the past few years have all but dried up, the realities of unsustainable expenditure growth will have to be addressed.

Footnotes

- Prepayments for FY2011 totaled $3.642 billion. Drawdowns from the Retiree Health Benefits Trust Fund totaled $82 million in FY2010 and $395 million in FY2011. An adjustment has also been made for off-budget debt service, including planned interest and principal payments to TSASC and STARC totaling $242 million in FY2010 and $244 million in FY2011.

- FY2010 expenditures are exceptionally low due to prior years’ debt defeasances that reduce FY2010 debt service by $2.726 billion. Adjusting for the impact of the debt defeasances brings FY2010 expenditures up to $66,085 million. Thus growth between FY2010 and FY2011 would be 1.9 percent, or about $1.273 billion.

- Includes off-budget debt, including Water Finance Authority debt.

- Figures presented for the capital budget are from the FY 2010-2014 Capital Commitment Plan in the Mayor's Executive Budget for FY2011.