Complement, Don't Duplicate

Targeting NYC Small Business Recovery Programs

The economic hardship caused by the COVID-19 pandemic and recession has been particularly acute for small businesses, especially those in the accommodation, food service, and entertainment sectors.1 As of April 2021, New York City employment for these sectors was 43 percent below its February 2020 level, compared with 9 percent below February 2020 for the rest of the City’s private sector.2 To support the recovery of small businesses including specifically these sectors, both federal and New York State governments have allocated significant resources to provide loans and grants to the hardest hit businesses.

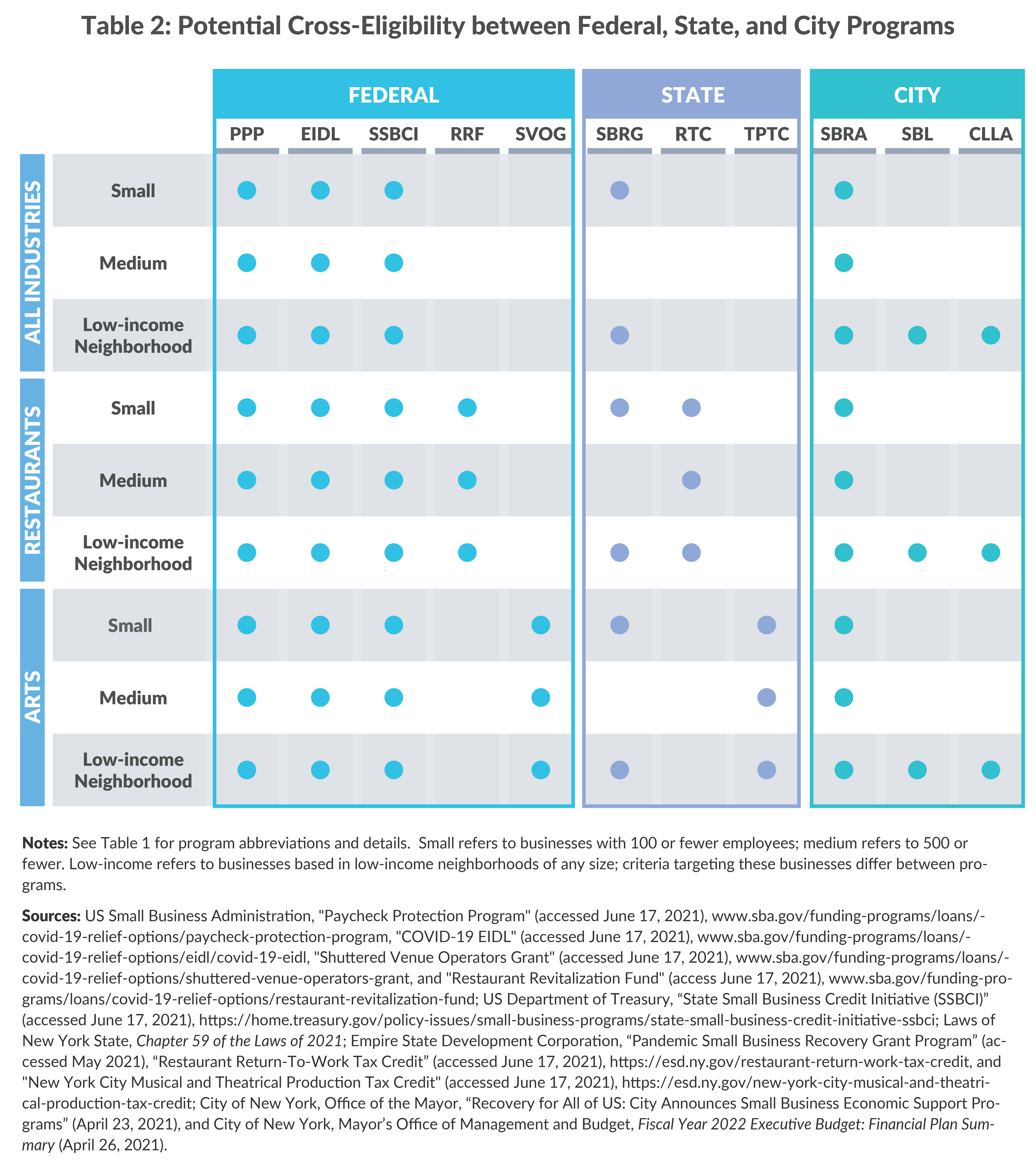

The New York City Fiscal Year 2022 Executive Budget proposed several new programs to support small businesses, many of which also are eligible for federal and State programs. Supporting these hard-hit enterprises in the effort to accelerate economic recovery from the pandemic is important. To maximize impact, City programs should focus on filling gaps left by the federal and State programs, assisting eligible businesses to access programs as needed, and providing additional support for already eligible businesses where the federal and State programs do not provide a reasonable amount of needed support. Creating duplicative programs risks diverting resources away from other uses that would more efficiently support New York City’s economic recovery and help improve the City’s long-term fiscal stability.

It is critically important for the City to identify potential gaps first by determining which businesses are eligible for which existing programs and whether those programs reasonably meet their needs. By identifying and targeting gaps, the City will better leverage existing funding and maximize the benefits flowing to businesses. The following describes the enacted federal and State programs and identifies the types of business that are eligible for each of those. As the City both finalizes programs in budget adoption and determines the details of eligibility during implementation, it should avoid these potential redundancies to maximize the value of its efforts.

Federal Policies to Support Small Businesses

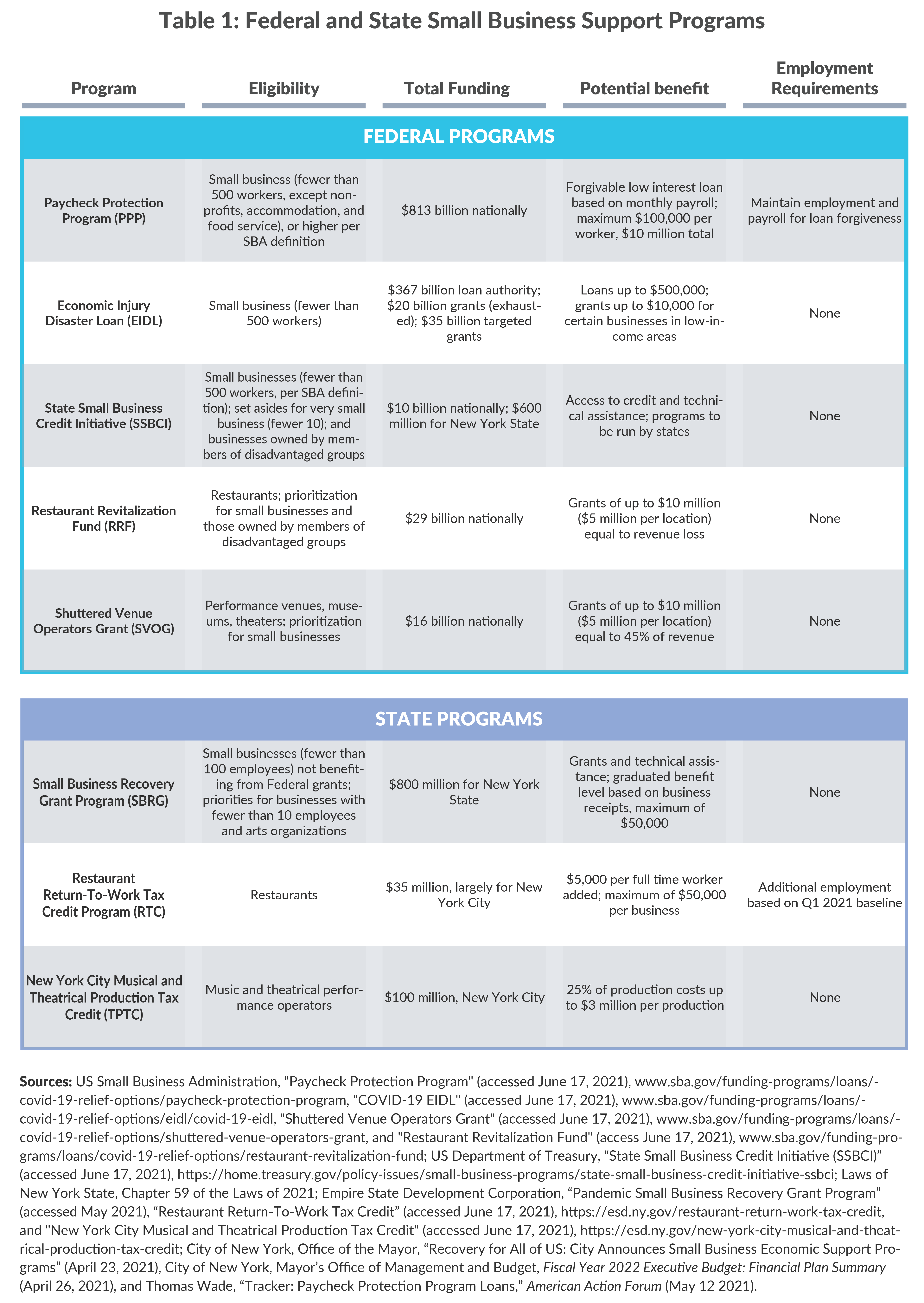

Since March 2020, the US Congress has passed several relief bills to stabilize the economy amid the COVID-19 pandemic, most recently the American Rescue Plan Act (ARP). These bills have funded five programs, described below, totaling more than $1 trillion in loans and more than $100 billion in grants designed to support businesses damaged by the economic crisis, separately targeting businesses by size and sector. (See Table 1.)

Paycheck Protection Program

The largest of these programs is the Paycheck Protection Program (PPP). PPP was established by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) that was signed into law in March 2020. The CARES Act’s initial appropriation of $349 billion was supplemented by $320 billion in April 2020. While PPP’s 2020 loan program closed for new applications on August 8, 2020, the Consolidated Appropriation Act, 2021 (CAA) that was signed into law December 2020 appropriated $284 billion, including reappropriated unused funds, for an additional round of loans.3 The CAA also allowed businesses that already had received loans to apply for a second loan. Finally, the ARP added $7 billion in funding, bringing the total appropriation for PPP to $813 billion.4 As of May 10, 2021, the program nationally had made 10.9 million loans worth $782 billion, with New York City businesses receiving 350,500 loans totaling $30 billion.5

PPP loans, which generally are available for businesses with 500 or fewer employees, carry terms of 2 to 5 years and offer an interest rate of 1 percent with the possibility of loan forgiveness if businesses maintain employment and payroll at constant levels over the course of the loan. PPP restricts proceeds to payroll (which must account for 60 percent of funds to be eligible for loans forgiveness), rent, and utilities. Loan amounts are based on businesses’ average monthly payrolls, with most recipients qualifying for loans equal to two-and-a-half months of payroll. Loans are capped at $100,000 per employee and $10 million for each business.

Economic Injury Disaster Loan

The Economic Injury Disaster Loan (EIDL) program provides small businesses with loans that are more conventional than PPP.6 EIDL loans carry a higher interest rate (3.75 percent), longer terms (30 years), and are available for a broad range of operating expenses. Administered by the Small Business Administration (SBA), EIDL is available to the same set of businesses as PPP and businesses can receive both loans provided the funds support different uses.

EIDL is authorized to issue up to $367 billion in loans. The program initially provided a forgivable sum of up to $10,000, although the $20 billion appropriated for that feature has been exhausted. As of May 2021, businesses could borrow up to $500,000, though the SBA has changed this amount over the course of the program. SBA has made 3.8 million EIDL loans totaling $207 billion as of May 6, 2021.7

State Small Business Credit Initiative

The ARP appropriated $10 billion for the State Small Business Credit Initiative (SSBCI). The initiative provides grants to states to provide support services to small businesses, including facilitating access to credit and providing legal, financial advising and other technical assistance. SSBCI’s initial allocation to New York State was $377 million, although the State’s total allocation is expected to rise to $600 million.8 Of the State’s initial allocation, $49 million was set aside for businesses owned by “socially and economically disadvantaged individuals” and $28 million was reserved for small businesses employing ten or fewer workers.9

Restaurant Revitalization Fund

The ARP also created the $28.6 billion SBA-administered Restaurant Revitalization Fund (RRF) program to support restaurants and bars that lost revenue in 2020. In general, businesses are eligible for grants equal to their pandemic-related revenue loss, up to $5 million per establishment and $10 million for businesses with multiple locations. Recipient businesses also are allowed to draw PPP loans, but PPP funds lower the amount of losses used to calculate RRF funding. The RRF directs SBA to prioritize small businesses and businesses owned by members of marginalized groups, though it does not set specific allocations for these groups. The program opened for applications on May 3, 2021. As of June 16, 2021, the SBA has awarded more than 100,000 restaurants loans totaling $27.4 billion; legal action is impacting the distribution of the remaining funds.10 Several lawsuits have been filed arguing that prioritizing minority- and women-owned businesses is discriminatory under the US Constitution; recent rulings in response to the lawsuits has halted the distribution of $1.2 billion to 2,965 priority businesses that had been approved, while all applications are reviewed.11

Shuttered Venue Operator Grant

The Shuttered Venue Operator Grant (SVOG), administered by SBA, was created by the CAA and supplemented by the ARP to support arts establishments, theaters, and museums that experienced revenue loss in 2020. Eligible businesses may receive grants of 45 percent of gross revenue, up to $10 million. SVOG allows participation by businesses that received prior PPP loans, the proceeds of which lower SVOG amounts. The program, which totals $16 billion, began accepting applications April 2021. As of June 14, 2021, the program has made just 411 awards, but has received 14,214 applications.12

New York State Small Business Programs

New York State enacted its Fiscal Year 2022 budget about one month after the ARP provided the State with substantial fiscal relief. Among the State’s small business priorities were three programs allocating $935 million to support small businesses, hard-hit restaurants, and performing arts organizations.13

Small Business Recovery Grant Program

The State’s largest business recovery program is the Small Business Recovery Grant Program (SBRG), which establishes an $800 million grant fund. The fund, which is administered by the New York Empire State Development Corporation (ESD), targets micro and small businesses employing one hundred or fewer workers and independent arts organizations, with the amounts allocated to each group at the discretion of ESD. Individual grant levels are based on business receipts: business under $50,000 in revenue may receive $5,000; those under $100,000 may receive $100,000 and those from $100,000 to $500,000 may receive grants up to 10 percent of revenue to a maximum of $50,000. The program stipulates that recipients must have lost revenue as a result of the COVID-19 pandemic, but not received federal support in excess of specific limits from other COVID-19 relief programs.14 Because the RRF and SVOG programs may support the same businesses as SBRG, eligible businesses may have difficulty deciding between federal and State support. Because many federal programs opened for applications before ESD released guidance on SBRG, the scope of eligible businesses is unclear, potentially setting the stage for underutilization of the program.

Restaurant Return-to-Work Tax Credit Program

This program is designed to support restaurants and food service establishments affected by COVID lockdowns. Restaurants with fewer than 100 employees that experienced revenue loss in 2020 and are located in New York City or in orange or red zone lockdowns elsewhere in the state are eligible for Restaurant Return-to-Work Tax Credit (RTC) Program tax credits of $5,000 for each net new full-time equivalent worker they hire in 2021.15 Tax credits are capped at $50,000 for a restaurant and $35 million for the program overall.

New York City Musical and Theatrical Production Tax Credit (TPTC)

New York State also enacted a tax credit program, not to exceed $100 million, to support the reopening of theatrical production companies in New York City. Operators of musical and theatrical productions are eligible for tax credits equal to one-quarter of production expenses. Productions can claim credits of up to $3 million during the program’s first year and $500,000 in the second year. The program is available only for productions at qualified New York City production facilities with 500 or more seats, which will include Broadway’s 41 theaters.16 Because the program has not started accepting applications, the timing of potential grant periods is not yet clear.

Proposed New York City Programs

The New York City Fiscal Year 2022 Executive Budget included three proposed small business support programs totaling $140 million. These may risk being redundant of the federal and State programs. Like New York State’s SBRG, these programs are intended to reach businesses not receiving other support. However, while new State and local programs seek to reach businesses not covered, or inadequately supported by federal aid, potential gaps in these programs’ eligibility or adequacy are not yet clear.[i]

Small Business Rental Assistance

The Small Business Rental Assistance (SBRA) program would provide up to $100 million in grants to support businesses to hire staff or cover expenses like rent. The program allocates $50 million to the arts and entertainment, accommodation, and food services sectors, and $50 million to businesses of any sector located in low-income neighborhoods.

By targeting hard-hit sectors, this program may fund businesses already eligible for the federal RRF and SVOG programs, and the State’s tax credits to support restaurants and theatrical productions. Both the sector-targeted and the neighborhood-targeted grants also potentially support businesses eligible for PPP and the State’s SBRG program for businesses that have not drawn substantial PPP loans.

Small Business Loans (SBL)

The City plans to create a $100 million loan fund, comprised of $30 million of City funds and $70 million in private investment, to support small business employment retention. The program would fund businesses in low-income neighborhoods rather than in a particular industry. The City aims to support 2,000 small businesses with low-interest loans of up to $100,000 each.

Most, if not all, businesses eligible for this program also are likely to be eligible for federal PPP and EIDL loans and State SBRG grants. The loan-eligible small businesses also may be eligible for the geographically-targeted portion of the City’s proposed rental assistance program, though it is not clear if they would be able to apply for both.

Commercial Lease Legal Assistance (CLLA)

Finally, the City would allocate $10 million across two years to provide legal services related to entering into, modifying, or terminating commercial leases. The program would target businesses based in the neighborhoods hit hardest by the pandemic. While this proposal may overlap the least with existing federal or State programs, the federal SSBCI program will provide small businesses with several types of business support services, including legal, accounting, and financial advisory services.

Conclusion

The pandemic’s devastating economic consequences create a clear rationale to support small businesses, including those in hard-hit performing arts, entertainment, and food services sectors. Programs proposed in the Mayor’s Fiscal Year 2022 Executive Budget could support many of these. However, these programs risk being redundant of State and federal programs in some cases, which may reduce the impact of the City’s federal recovery funding. Existing federal and State programs already cover most of the enterprises that would be eligible for new City programs. Except where additional City funds are required to meet well-justified needs, duplicating federal and State programs diverts resources from efforts that could more effectively support economic recovery and fiscal stability.

Further, the existence of similar programs at three levels of government may well create confusing, cumbersome processes for businesses, which may have difficulty determining each program’s potential benefits and for which they should apply. Finally, the City already is supporting small businesses in accessing federal support and should consider whether increasing these efforts may be an efficient use of resources, and whether to expand this to State programs when they begin accepting applications.

As the City adopts its fiscal year 2022 budget and then finalizes program eligibility, it should clearly identify gaps left by the multiple federal and State programs, where federal and State programs do not provide sufficient needed support, and where City technical assistance to leverage those programs would be most valuable. Using these as a guide will help ensure the City’s resources provide the most value in supporting economic recovery.

Footnotes

- Opportunity Insights, “Economic Tracker” (accessed May 2021), www.tracktherecovery.org/.

- City of New York, Mayor’s Office of Management and Budget, NYC Employment Data (SA)—April 2021 (May 21, 2021), https://www1.nyc.gov/assets/omb/downloads/csv/nycemploy-sa04-21.csv.

- The funds added by the CAA included $147 billion that was reappropriated from unused prior PPP funding. This funding, together with the later ARP supplement, brought the funds available for PPP to $813 billion. See Thomas Wade, “Tracker: Paycheck Protection Program Loans,” American Action Forum (May 12 2021), www.americanactionforum.org/research/tracker-paycheck-protection-program-loans/.

- US Small Business Administration, “PPP data” (accessed May 2021), www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program/ppp-data.

- US Small Business Administration, “PPP FOIA” (accessed May 2021), https://data.sba.gov/dataset/ppp-foia.

- EIDL was an existing program temporarily expanded by the CARES Act. Prior to the CARES Act, EIDL was available to small businesses in federally designated disaster areas.

- US Small Business Administration, “Disaster Assistance Update: Nationwide COVID EIDL and Targeted EIDL Advances” (May 6, 2021), www.sba.gov/sites/default/files/2021-05/COVID%20EIDL%20%20Targeted%20Advance%20FOIA%2005.06.2021%20rev%205.11.2021_FINAL-508.pdf; and Robert J. Dilger and Sean Lowry, Small Business Administration: A Primer on Funding, Report for Congress RL 33243 (Congressional Research Service, March 18, 2021), https://fas.org/sgp/crs/misc/RL33243.pdf.

- US Department of Treasury, “State Small Business Credit Initiative Preliminary Allocation Table” (accessed May 2021), https://home.treasury.gov/system/files/256/Preliminary-Allocation-for-States-Decline-in-Employment.pdf; and Office of the New York State Comptroller, Review of the Enacted Budget: State Fiscal Year 2021-2022 (April 2021), www.osc.state.ny.us/files/reports/budget/pdf/enacted-budget-report-2021-22.pdf.

- American Rescue Plan Act of 2021, H.R. 1319, (March 10, 2021).

- Beth Fertig, “Thousands of Minority and Women-Owned Restaurants Won’t Get Aid Because of Lawsuits,” Gothamist (June 15, 2021), https://gothamist.com/food/thousands-of-minority-and-women-owned-restaurants-wont-get-aid-because-of-lawsuits?mc_cid=29c487127f&mc_eid=0a96069b4d.

- Stacy Cowley, “Judges Halt Race and Gender Priority for Restaurant Relief Grants,” The New York Times (June 14, 2021), www.nytimes.com/2021/06/14/business/restaurant-relief-fund-covid-sba.html.

- Small Business Administration, Shuttered Venue Operators Grant Public Report (June 14, 2021), www.sba.gov/sites/default/files/2021-06/SVOG%20Public%20Report%20-%20Midday%20June%2014%202021-508.pdf; and Robert J. Dilger and Sean Lowry, SBA Shuttered Venue Operators Grant Program (SVOG), Report for Congress R46689 (Congressional Research Service, April 26, 2021), https://crsreports.congress.gov/product/pdf/R/R46689.

- Laws of New York State, Chapter 59 of the Laws of 2021.

- To benefit from SBRG, business must have received no more than $100,000 in PPP loans, $15,000 in EIDL grants ($10,000 Targeted Advance Grant, $5,000 Supplemental Targeted Advance Grant, and $150,000 in SVOG. Empire State Development Corporation, “Pandemic Small Business Recovery Grant Program” (accessed May 2021), https://esd.ny.gov/pandemic-small-business-recovery-grant-program.

- The restaurant return-to-work tax credit determines businesses’ net increase in employees by comparing the average number of full-time equivalent employees (FTES, or the number of employees if all of a businesses’ work-hours were performed by full-time employees) over the first quarter of 2021 to the number of FTEs on either August 31, 2021 or December 31, 2021, whichever the businesses chooses.

- The Broadway League, “Broadway Theaters in NYC” (accessed May 2021), www.broadway.org/broadway-theatres.

- City of New York, Office of the Mayor, “Recovery for All of US: City Announces Small Business Economic Support Programs” (April 23, 2021), https://www1.nyc.gov/office-of-the-mayor/news/300-21/recovery-all-us-city-annouces-small-business-economic-support-programs; and City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2022 Executive Budget: Financial Plan Summary (April 26, 2021), https://www1.nyc.gov/assets/omb/downloads/pdf/sum4-21.pdf.