The Giant Slice: Legacy Costs in the New York City Budget

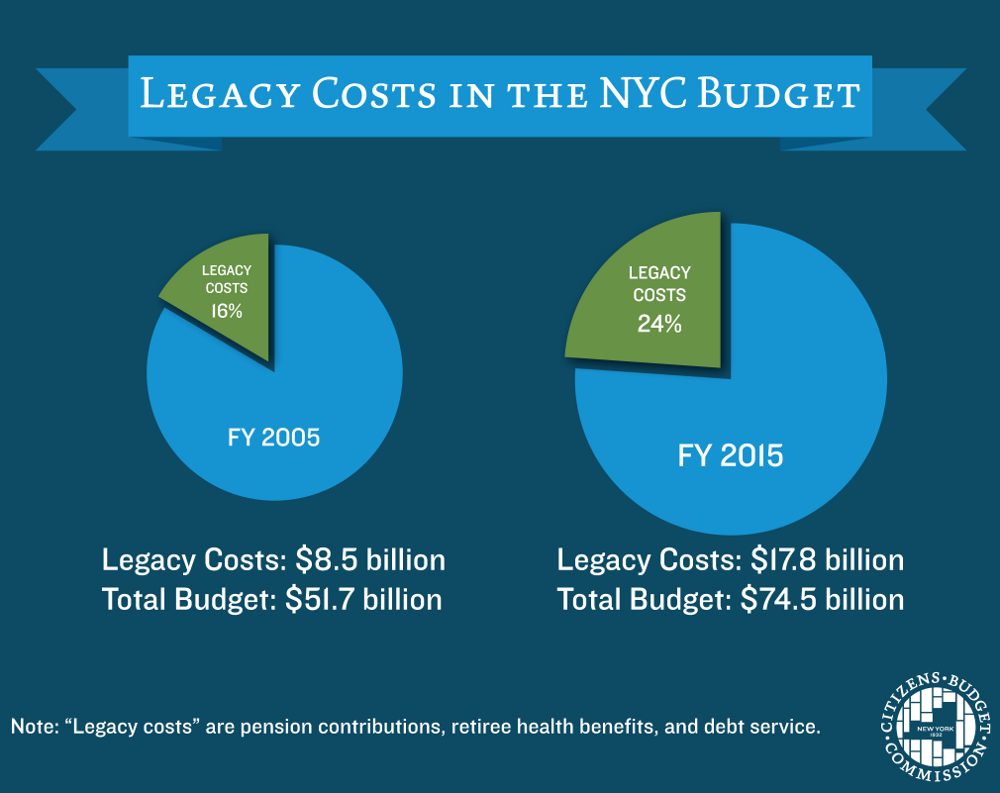

An alarming and little known fact is that a large slice of the New York City budgetary pie does not directly support current service provision. This giant slice, dedicated to “legacy costs,” will claim almost 25 percent of the budget by fiscal year 2015 – leaving fewer dollars for other budget priorities.

“Legacy costs” are expenses that result from commitments made by policymakers in the past. Unlike other expenses, which can be adjusted depending on necessity, priorities, and available resources, legacy costs are determined by factors that cannot be easily shaped by current policy makers. In short, rather than paying for current operations, these costs are driven by past promises.

Legacy costs include pension contributions, retiree health benefits and debt service:

- Pension contributions – These are payments made by the City to the pension funds to fund the benefits of current and future retirees. Annual pension contributions are determined by a number of factors, one of which is past decisions to offer relatively generous pension benefits for the public workforce. Pensions are constitutionally protected; benefits cannot be reduced, and the City must make its payments each year to keep the funds solvent. Pensions are the fastest growing of legacy costs; they will rise from $3.2 billion to $8.2 billion between fiscal years 2005 and 2015.

- Retiree health benefits – The City provides retirees comprehensive health insurance with no cost sharing for the premium, makes additional per member contributions to union welfare funds to supplement this insurance, and reimburses retirees over the age of 65 for the cost of their Medicare Part B premiums. [1] The annual cost of these benefits will be $2.4 billion by fiscal year 2015 – twice the $1.2 billion spent in fiscal year 2005.

- Debt service – This consists of principal and interest payments made to repay bonds issued for capital projects. Debt service payments are made according to a predetermined schedule, and failure to make a payment can result in adverse fiscal effects, like making future borrowing more costly. In 2005, debt service for the City’s major debt obligations – general obligation and lease purchase debt, debt of the Transitional Finance Authority and debt of the Municipal Assistance Corporation – totaled $4.2 billion and will increase to $7.2 billion by 2015.

The rapid growth of legacy costs far outpaces that of the rest of the budget: between fiscal years 2005 and 2015, legacy costs will have more than doubled from $8.5 billion to $17.8 billon – while all other spending will have grown 31 percent. In the same period, legacy costs will grow from 16 percent to 24 percent of operating expenses; this will leave a lot less on the plate for services to residents.

Footnotes

- Unlike pension benefits, retiree health benefits are not actuarially funded. The city pays the bill for retiree premiums as they come due, but does not fund the future obligation created by promising health benefits to current employees when they retire. The accrued value of this future obligation is at least $85 billion as of June 30, 2011. Retiree health benefits are not constitutionally protected; they can be changed by the City Council and Mayor, although changes have historically been made with the consent of the Municipal Labor Committee.