The Mid-Year Check-in

Six Takeaways from the NYS Financial Plan Update and Quick Start Budget Report

Highlights

In two months, Governor Kathy Hochul will present the New York State Fiscal Year 2025 Executive Budget. While her proposal will be shaped by the State’s fiscal landscape and her priorities, the decisions ultimately made during budget adoption in the following months will underpin the State’s future fiscal stability and its ability to provide core services to New Yorkers effectively and efficiently, making New York an attractive place to live and work.

Over the past three weeks, New Yorkers have learned a great deal about how the Governor, Comptroller, and Legislative caucuses view that fiscal landscape. Recently, State leaders reached several key planning milestones:

- October 30 – The Division of the Budget (DOB) released the Mid-Year Financial Plan Update;

- November 3 through 6 – The Comptroller, Senate Finance Majority and Minority staffs, and Assembly Ways and Means Majority and Minority staffs released their individual forecasts of receipts and disbursements;

- November 14 – Analysts for the Governor, Comptroller, and Legislature met for the “Quick Start” budgeting meeting to share and discuss their forecasts; and

- November 15 – DOB published the combined “Joint Report on Receipts and Disbursements.”

These updates provide critical information for the State’s fiscal year 2025 budget, including the economic and revenue projections of the State’s fiscal experts, and will inform budget making, negotiations, and oversight.

Here are six key takeaways:

1. THE MID-YEAR UPDATE SHOWED COST SAVINGS, A CONSERVATIVE RECEIPTS OUTLOOK, AND REDUCED BUDGET GAPS.

The Mid-Year Update re-estimated receipts and disbursements, which reduced out-year budget gaps by $4.7 billion, $4.3 billion, and $5.7 billion in fiscal years 2025 to 2027, respectively. (See Table 1.)

Specifically, the Update:

- Lowered the current year receipts estimate by $226 million—a $1.1 billion reduction in projected tax receipts offset partially by increases in other types of receipts, such as interest;

- Increased out-year receipts’ projections for taxes and other receipts by $1.5 billion in fiscal year 2025, and approximately $3.4 billion annually in fiscal years 2026 and 2027, in part because DOB no longer expects a recession;1

- Reduced current year disbursements by $3.5 billion, and more than $1 billion annually in the out-years; and

- Reserved and rolled forward fiscal year 2024 underspending of $3.5 billion to narrow future gaps.

The reduction in current year tax receipts is somewhat surprising, since tax receipts for the first half of the year are $1.7 billion above projections, suggesting fiscal year 2024 receipts may exceed, not underperform, financial plan projections.2 However, the current year tax receipts reduction is based on “continued weakness in estimated [personal income tax] payments through the first half of the fiscal year.”3 Given DOB’s conservative estimates and updated economic forecast, current year tax receipts may be revised upward over the second half of the year.

Table 1: Mid-Year Financial Plan Update Re-estimates and Actions

New York State Division of the Budget, Fiscal Year 2024 Enacted Budget Financial Plan Mid-Year Update (October 2023), pp. 10, t-3 to t-6.

2. DESPITE HIGHER TAX RECEIPTS, SIGNIFICANT BUDGET GAPS ARE STILL PROJECTED.

While the Mid-Year Update reduced out-year budget gaps substantially, lawmakers still will have to close a significant gap in the forthcoming budget. Next year’s gap stands at $4.3 billion, and gaps grow to $9.5 billion in fiscal year 2026 and $7.7 billion in fiscal year 2027. Closing these gaps will require the State to shift to restraining spending growth, rather than the recent trend of adding new spending.

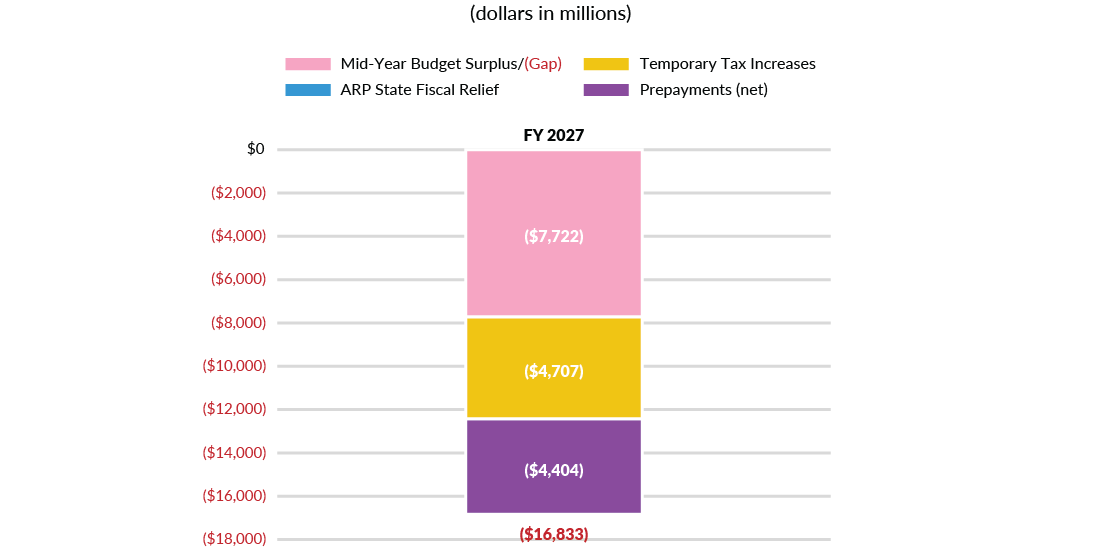

3. THE USE OF NON-RECURRING RESOURCES ALSO MASKS THE STATE'S MUCH LARGER STRUCTURAL GAP.

The reported gaps – while already challenging – would be substantially larger if the State were not supporting recurring spending with non-recurring resources. Prepayments, expiring federal aid, and receipts from temporary tax increases mask the underlying structural imbalance between the State’s recurring receipts and recurring spending. After accounting for the use of these nonrecurring resources, the $16.8 billion structural gap between recurring receipts and disbursements comes into stark view. (See Figure 1.)

Figure 1: Structural Gaps

Prepayments (net) includes program expense prepayments, debt service prepayments, and the rolling of undesignated fund balance for use in future years.

New York State Division of the Budget, Fiscal Year 2024 Enacted Budget Financial Plan Mid-Year Update (October 2023), and prior editions.

4. QUICK START REPORTS FROM THE EXECUTIVE, LEGISLATURE, AND COMPTROLLER REFLECT A RESILIENT, ALBEIT SLUGGISH ECONOMY AND HIGHLIGHT RISKS TO THE STATE'S FINANCES.

The State’s fiscal experts identified many of the same trends and risks in their fiscal outlooks for the coming year:

- Waning risk of a recession: The State Financial Plan no longer assumes a short, shallow recession going into 2024.4 In fact, all of the reports forecast positive economic growth in the upcoming period. For example, DOB expects state personal income growth of 3.7 percent for the current calendar year; this forecast is more conservative than the other reports. Going forward, personal income growth is expected to continue growing at approximately 4 percent annually for 2024 and 2025.

- Slowing job growth: New York State continues to lag the nation in job growth during the pandemic recovery. While some regions of the State continue to struggle to recover and grow jobs, employment growth is projected to slow even further. After 5 percent job growth in 2022, the various reports project employment growth of approximately 2 percent in 2023, slowing to below 1 percent annually in 2024 and 2025.

- Unbudgeted cost pressures: While DOB identified billions in spending reductions in the Mid-Year Update, the Quick Start reports also note areas of rising spending, especially in Medicaid and asylum seeker and migrant service costs. Medicaid enrollment is expected to decrease by more than one million enrollees over the coming months. If fewer enrollees shift out of Medicaid coverage than expected, program costs would be higher than is currently budgeted.5 The State budget includes $1.9 billion in State assistance for asylum seeker and migrant services costs, but those costs are growing in size and duration.6 Higher costs in either of these areas would widen budget gaps.

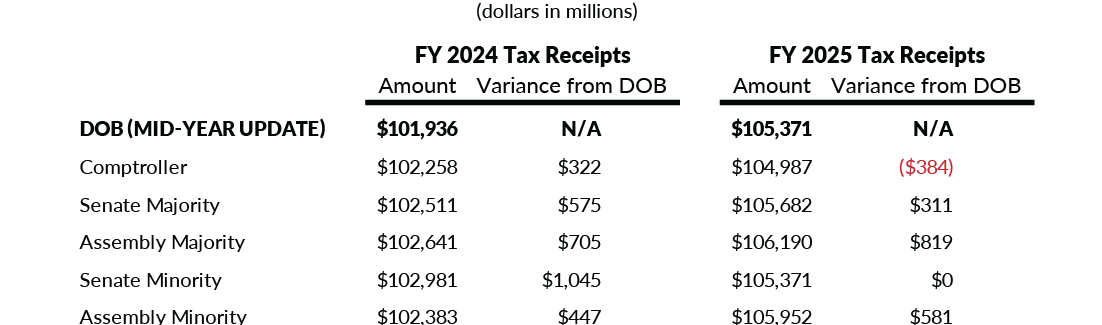

Projections for the State’s receipts are of particular importance. As noted above, year-to-date operating results suggest that tax receipts will exceed projections for the current year, which could continue into out-years. However, all of the fiscal experts remain conservative in receipts projections. Table 2 reflects the projected tax receipts in each report and the variance from the Executive’s Mid-Year Update. Among all parties, variances are all around 1 percent over both years. These figures are much more consistent than prior years, when tax receipts projections varied by as much as nearly 5 percent.7

Table 2: Estimated Tax Receipts and Variance

New York State Division of the Budget Director Blake Washington, presentation to the FY 2025 Quick Start Meeting (November 14, 2023), and Office of the New York State Comptroller, Report on Estimated Receipts and Disbursements, State Fiscal Years 2023-24 through 2025-26 (November 2023).

5. STATE SPENDING GREW 19 PERCENT IN THE PREVIOUS 2 YEARS, MORE THAN IT HAD OVER THE PRIOR 10 YEARS; PROJECTED SPENDING GROWTH IS EXPECTED TO OUTPACE TAX RECEIPTS PROJECTIONS AND ECONOMIC INDICATORS GOING FORWARD.

Temporary increases in receipts—higher than expected tax receipts, especially as personal income lurched higher due to a doubling in total capital gains income from 2019 to 2021, and unprecedented levels of federal aid—were used to support higher, recurring spending.

State Operating Funds (SOF) spending (the key measure of State spending) increased $19.5 billion (19 percent) from $104.2 billion in fiscal year 2021 to $123.8 billion in fiscal year 2023. For comparison, SOF spending grew a nearly identical amount ($19.8 billion) over the prior decade.

Spending is set to grow by a similar amount over the next three years, increasing by $20.6 billion from fiscal year 2024 to fiscal year 2027, an average annual rate of 5.3 percent, and outpacing projected growth in receipts (3.4%), inflation (2.7%), and personal income (4.4%).8 (See Figure 2.)

Figure 2: Projected Average Annual Growth, FY 2024 to FY 2027

State receipts are adjusted for timing of pass-through entity taxes. State receipts include personal income, business, consumption, other taxes, and miscellaneous receipts.

New York State Division of the Budget, Fiscal Year 2024 Enacted Budget Financial Plan Mid-Year Update (October 2023), and prior editions, and Fiscal Year 2024 New York State Executive Budget Economic and Revenue Outlook (February 2023).

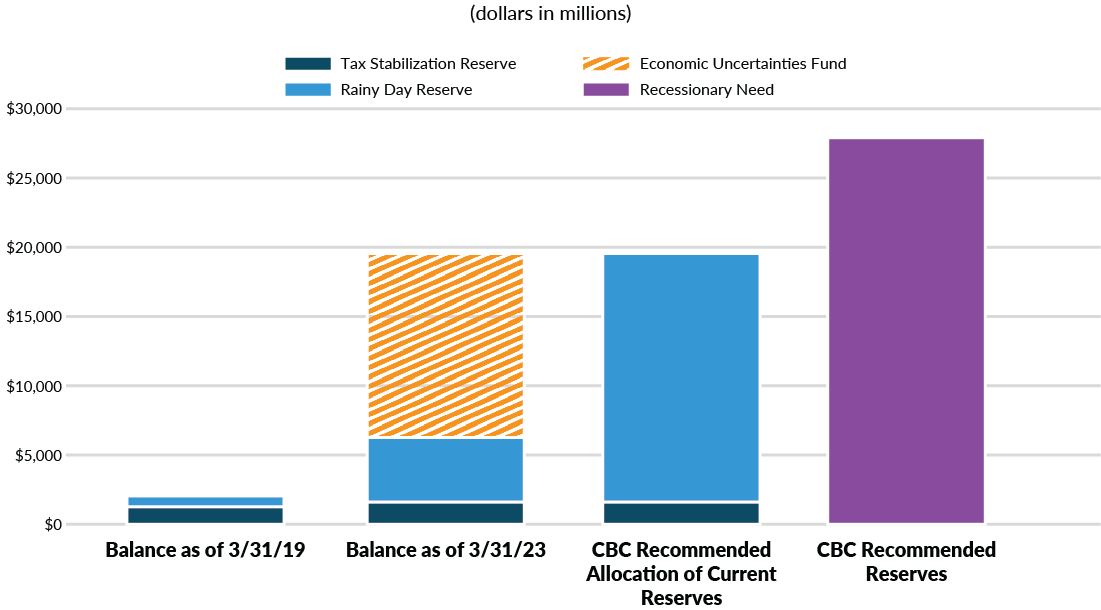

6. THE STATE'S RESERVES, WHILE SIGNIFICANTLY INCREASED, REMAIN INADEQUATE TO DEAL WITH A RECESSION, UNLESS INCREASED AND SECURED.

Over the past two years, Governor Hochul led lawmakers to vastly increase the State’s reserves: “Principal reserves” (including the statutory rainy day funds and related accounts) increased from $2.4 billion to $19.6 billion.

While $19.6 billion is a major accomplishment, it remains short of the amount needed to weather a recession and deliver needed services. To deal with two years of recessionary tax receipt losses and fund modest annual SOF spending growth of 1 percent for two years of a recession, the State should have more than $27 billion in reserves. (See Figure 3.) If receipts exceed projections this year, additional funds should be deposited in the Rainy Day Reserve.

In addition to growing rainy day savings, the funds should also be better protected. Nearly two-thirds of the State’s principal reserves remain in the unprotected Economic Uncertainties Fund, meaning they can be used without a recession or other catastrophe.9 These are emergency reserves in name only; the full balance of the State’s principal savings should be moved immediately into statutory lockboxes.

Figure 3: NYS "Principal Reserves" versus Recessionary Need

CBC calculates “Recessionary Need” based on average two-year recession impact on tax receipts plus two years’ growth of 1 percent in SOF spending.

New York State Division of the Budget, Fiscal Year 2024 Enacted Budget Financial Plan Mid-Year Update (October 2023), and prior editions.

Conclusion

The fiscal news of the last three weeks makes one thing clear: This year’s budget process will be unlike those of recent years. The cash boons generated by exceptional increases in personal income coupled with unprecedented COVID-related federal aid prompted a massive increase in State spending. Now, tax revenues are returning to a more typical trend as federal aid sunsets. Even as the State uses excess revenues to prepay future expenses, multi-billion-dollar gaps are projected for the upcoming fiscal year and out-years. Balancing the budget will require spending restraint. The more disciplined the State is in managing toward a balanced budget, the clearer and brighter its fiscal horizon becomes and the stronger position it is in to deliver quality services to New Yorkers.

Footnotes

- New York State Division of the Budget, Fiscal Year 2024 Enacted Budget Financial Plan Mid-Year Update (October 2023), p. 67, www.budget.ny.gov/pubs/archive/fy24/en/fy24en-fp-myu.pdf.

- Office of the Comptroller of New York State, Comptroller’s Monthly Report on State Funds Cash Basis of Accounting, September 2023 (October 2023), www.osc.state.ny.us/files/reports/finance/cash-basis/pdf/cash-basis-september-2023.pdf.

- New York State Division of the Budget, Fiscal Year 2024 Enacted Budget Financial Plan Mid-Year Update (October 2023), p. 11, www.budget.ny.gov/pubs/archive/fy24/en/fy24en-fp-myu.pdf.

- New York State Division of the Budget, Fiscal Year 2024 Enacted Budget Financial Plan Mid-Year Update (October 2023), p. 67, www.budget.ny.gov/pubs/archive/fy24/en/fy24en-fp-myu.pdf.

- See New York State Assembly, Mid-Year Update (November 2023), p. 27, www.assembly.ny.gov/write/upload/postings/2023/pdfs/20231106_0107925.pdf; New York State Senate Democratic Majority Finance Committee, 2023 Midyear Report on Receipts and Disbursement (November 2023), p. 12, www.nysenate.gov/sites/default/files/admin/structure/media/manage/filefile/a/2023-11/fy25-quickstart-report.pdf; and Office of the New York State Comptroller, Report on Estimated Receipts and Disbursements, State Fiscal Years 2023-24 through 2025-26 (November 2023), pp. 14 to 15, www.osc.ny.gov/files/reports/pdf/budget-receipts-disbursement-23-26.pdf.

- See Bernadette Hogan, “Gov. Hochul considers cutting back 'unsustainable' migrant crisis spending: report” (Spectrum News, October 31, 2023), https://spectrumlocalnews.com/nys/central-ny/news/2023/10/30/hochul-new-york-migrant-crisis-spending-money.

- New York State Division of the Budget, 2021 Joint Report On Receipts and Disbursements (November 2021), p. 6, www.budget.ny.gov/pubs/press/2021/fy23-quickstart/report-fy23-quickstart.pdf, and 2022 Joint Report On Receipts And Disbursements (November 2022), www.budget.ny.gov/pubs/press/2022/fy24-quickstart/report-fy24-quickstart.pdf.

- Spending reflects reported SOF spending growth. Receipts includes all state taxes and miscellaneous receipts. Inflation is CPI-U and personal income is total personal income, both as projected in the Fiscal Year 2024 New York State Executive Budget Economic and Revenue Outlook. These figures are the most recent published projections for all years of the financial plan. See New York State Division of the Budget, Fiscal Year 2024 New York State Executive Budget Economic and Revenue Outlook (February 2023), www.budget.ny.gov/pubs/archive/fy24/ex/ero/fy24ero.pdf.

- New York State Division of the Budget, Fiscal Year 2024 Enacted Budget Financial Plan Mid-Year Update (October 2023), p. 7, www.budget.ny.gov/pubs/archive/fy24/en/fy24en-fp-myu.pdf.