New York State's Hard Choices

Next Steps to Address Fiscal Stress

On April 2, 2020 New York State leaders adopted a budget that took some action to ameliorate the budget gaps driven by revenue shortfalls, but deferred the hardest decisions to May, July, and January when revenue projections will become clearer. The Adopted Budget for Fiscal Year 2021 used federal aid in fiscal year 2021 to offset a portion of projected revenue shortfalls and accepted most Executive Budget proposals for Medicaid savings, but rejected or reversed some proposed reductions to spending on Medicaid and State operations. On April 25, 2020 the State released the Enacted Budget Financial Plan, which included a gap-closing plan that contained a 4.9 percent cut to State operations and an 11.5 percent cut in Aid to Localities. While specifics were not presented, such a large local aid cut would require significant additional Medicaid and school aid reductions. Applying the Citizens Budget Commission’s (CBC) Hard Choices Framework (see textbox below for a summary or click link for full text) shows the State has options that would not require such steep cuts to balance the fiscal year 2021 budget and reduce future gaps. Still, significant future gaps remain; additional federal fiscal aid can ameliorate the need for very significant future cuts.

Summary of Hard Choices Framework

The Hard Choices Framework identifies a range of options to balance revenues and expenditures: expenditure reductions, use of reserves, asset sales, tax increases, and borrowing. State and local leaders should choose among them based on their impacts, with the aim of minimizing harm, particularly to New Yorkers most in need, and maximizing benefit for the greatest number of New Yorkers. Two other implications should be given strong weight in these decisions. First is the impact on the long-run competitiveness of the jurisdiction as a place to live and grow a business. To the extent possible actions taken should have minimal impact on the factors that have made New York a desirable and economically competitive location. Second is the impact on future generations of New Yorkers. Actions should preserve “intergenerational equity;” future generations should not be obliged, usually through long-term borrowing, to pay for services for today’s residents. Moreover, the debt service for such borrowing constrains future resources available and makes future budget decisions harder. Wise public officials will give careful consideration to the implications of their decisions for their heirs.

Enacted Budget Financial Plan Identifies and Partially Closes Significant Gaps

The starting point to address the State’s current fiscal stress is to gauge the scale of the problem. The Division of the Budget (DOB) estimated tax revenue shortfalls and projected budget gaps in fiscal years 2021 through 2024. Currently anticipated revenue losses are greater in the first year, but in line with prior recessionary losses for the second and third year. If this recession proves to be deeper or extend longer than prior recessions—a real risk of potentially significant magnitude—the revenue shortfalls could be greater than current projections. Using the Executive Budget presented in January 2020 as a baseline, DOB expects a budget gap of $13 billion in fiscal year 2021, growing to $18 billion in fiscal year 2022 and $19 billion in fiscal years 2023 and 2024. The entire first-year gap is attributable to revenue shortfalls; in subsequent years the bulk of the gap also is attributable to these revenue shortfalls, but $1.9 billion of the fiscal year 2022 gap and $3.3 billion of the fiscal year 2023 and 2024 gaps are due to baseline expenditures exceeding baseline revenues.

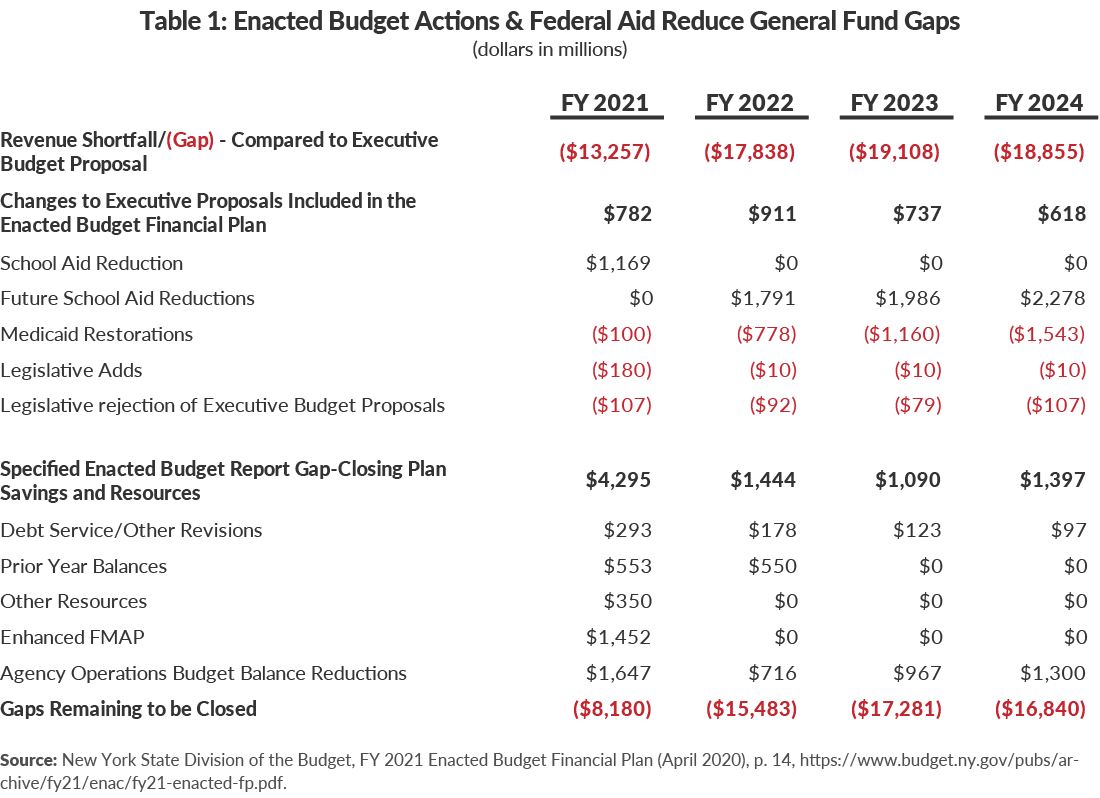

The Enacted Budget reduced State school aid $1.2 billion in fiscal year 2021, growing to $2.3 billion in fiscal year 2024 compared to projections released in January. (See Table 1.) The fiscal year 2021 State aid reduction of $1.2 billion is offset by increased federal aid of the same amount, resulting in districts receiving the same level of aid in fiscal year 2021 as in fiscal year 2020. The reduction in aid in the outyears is approximately in line with CBC’s prior recommendation to eliminate $1.6 billion in aid to primarily wealthy districts that already have sufficient local resources to support a Sound Basic Education (SBE). These financial plan savings were offset by $180 million in legislative additions to fiscal year 2021 spending; rejection of $107 million in cuts proposed in the Executive Budget; and Medicaid savings that were $100 million less than planned in fiscal year 2021 but grow to $1.5 billion less than planned in fiscal year 2024. These offsets increased budget gaps by $387 million in fiscal year 2021 and grow to $1.7 billion in fiscal year 2024.

The Enacted Budget Gap-Closing Plan included other savings and resources that are in line with CBC’s Framework. Prior year balances and other resources provide $900 million and $550 million to reduce the fiscal year 2021 and 2022 gaps, respectively. The federal government has committed to increased Medicaid funding of $1.5 billion, covering the period of January 1, 2020 to June 30, 2020 to be paid in state fiscal year 2021. In addition, the Gap-Closing Plan includes a 4.9 percent reduction in State operations spending, saving $525 million in personal service savings and $455 million in non-personal service spending in fiscal year 2021. This reduction can be achieved in a number of ways, including a focus on improving the efficiency of State operations and the higher education system and from extending the pay freeze for the duration of the recession, implementing a hiring freeze, or temporarily furloughing underutilized staff. Extending the pay freeze from its current end on June 30th to the end of fiscal year 2021 would reduce spending by $260 million.

Together the actions taken in the Enacted Budget and those presented in the Gap-Closing Plan reduce the gap by $5.1 billion in fiscal year 2021 and by approximately $2 billion in the remaining years of the financial plan. An $8.2 billion budget gap remains in fiscal year 2021. (See Table 1.)

Enacted Budget Financial Plan Identifies and Partially Closes Significant Gaps

The Gap-Closing Plan closes the remaining fiscal year 2021 gap and reduces the subsequent year gaps with an $8 billion reduction in Aid to Localities. The Enacted Budget Financial Plan does not specify how cuts would be allocated among school aid, Medicaid, or other spending areas. This would represent an 11.5 percent reduction in Aid to Localities in fiscal year 2021 from projections, declining to a 10.2 percent reduction in fiscal year 2024. Following the principles laid out in CBC Framework, however, the State can utilize other options that can reduce the proposed cut to Aid to Localities to between 1.1 and 2.0 percent.

CBC Recommendations for Closing Remaining Gap

Table 2 summarizes a package of recommended actions that would close the fiscal year 2021 gap and reduce future gaps by roughly the same magnitude as the State’s Gap-Closing plan.

Modification to Enacted Budget Actions

Modifying certain Enacted Budget actions would increase the fiscal year 2021 gap by $560 million, but reduce the following years’ gaps by $1.2 billion, $1.6 billion, and $1.7 billion in fiscal years 2022, 2023, and 2024, respectively. First, Medicaid Redesign Team efforts should continue in order to find additional savings starting in fiscal year 2022. Given the size and recent growth of the Medicaid program, the State should be able to find savings in line with Executive Budget projections, which would still allow the state’s share of Medicaid to grow more than 4 percent annually.

Second, Executive Budget proposals to increase the fee for Certificate of Need applications that are assessed on health-care facilities construction projects, eliminate video lottery terminal (VLT) aid for cities other than Yonkers, and eliminate certain quick draw restrictions should be accepted to increase revenues between $79 million and $107 million annually.

Third, the Enacted Budget takes advantage of the federal policy allowing employers to defer the payment of social security payments in fiscal year 2021 to fiscal years 2022 and 2023. This decreases the fiscal year 2021 gap but increases the future gaps. Given the magnitude of future gaps and the resources available in fiscal year 2021, this payment should not be delayed.

Local Aid Reduction

Considering alternative available resources, a local aid decrease of $800 million should be sufficient – rather than the $8 billion presented in the Gap-Closing plan. In fiscal year 2021, the presence of additional federal aid allowed the State to hold school aid steady while reducing state costs by $1.2 billion. However, given the enormity of the State’s fiscal woes and amount of State aid going to wealthy districts, the State can reduce school aid by $800 million in the current year without undermining districts’ ability to fund a constitutionally guaranteed SBE if the distribution of cuts is based on district need. This follows CBC’s Framework by reducing funds serving lower priority needs (funding to districts that spend well in excess of an SBE) and shifting the burden to districts that can afford to pay for additional services if they choose.

Capital and Debt Financing Changes

In line with the CBC Framework recommending eliminating low impact capital projects and using debt to finance essential capital investments, the State should modify its capital plan for the current period of fiscal stress and eliminate unproductive economic development capital spending. Eliminating 50 percent of most Empire State Development (ESD) economic development capital spending decreases projected debt service between $36 million and $134 million annually during the financial plan period.

In addition, prioritizing essential projects should allow an additional 10 percent reduction in capital spending, reducing annual debt service by $36 million to $132 million annually during the plan period. Using debt to finance the remaining 90 percent of capital projects now funded on a pay-as-you-go (paygo) basis would save a net $3.2 billion in fiscal year 2021, decreasing to $2.1 billion in fiscal year 2024. The tax revenues or legal settlement funds used now to fund these capital projects could instead be used to close budget gaps and preserve intergenerational equity by funding investments over the useful life of the project. Continuing to fund 10 percent of capital projects with paygo capital leaves room for the State to determine on a project-by-project basis if using cash is still preferable over issuing debt due to specific circumstances, such as taxability of debt issued for certain projects.

Tax Policy Changes

Tax increases deserve a high level of scrutiny due to their potential impact both on competitiveness and in the current economic environment. Nevertheless, the State should consider two temporary policy changes. First, the State should freeze the implementation of middle class tax cuts at the calendar year 2020 rate. Taxpayers will still get the benefit of this year’s rate reduction but would not get the cut that was scheduled to take effect January 1, 2021.

Additional resources can be generated by expanding the sales tax base, either by temporarily suspending the sales tax exemption on clothing items costing less than $110 or alternatives that would modernize the tax to better align with the evolution of consumption from goods to services. The clothing exemption provides some benefits to low-income households, but a temporary suspension would be widely shared and help the State avoid cutting needed services. This would generate $774 million in additional resources in fiscal year 2021, growing to $2.0 billion in fiscal year 2024. Alternatively, the State could expand the sales tax base to include services largely enjoyed by middle- and high income households, such as cosmetology services, entertainment, and/or professional services.

Federal Aid Very Likely

The State also reasonably can assume it will receive enhanced Medicaid funding through the third quarter of 2020. Pursuant to current federal law, the enhanced aid is extended quarterly as the public health emergency is extended. If the health emergency extends beyond June 30, which appears likely based on continued new Covid-19 infections, the additional aid will be in place for all of the third quarter of 2020.

Asset Sales

The State also should identify assets that can be sold with minimal adverse impacts for a target of $1.0 billion in fiscal year 2022 and in fiscal year 2023. The State has closed a number of prisons and is intending to close up to three more. Likewise, the State has significant real estate holdings, including golf courses on highly sought-after property.

Use of Reserves

The State should use some of its reserves to close current and future gaps. If the State were to adopt CBC’s recommendations and the economic forecast proved accurate, the State would need to use $3.1 billion of its reserves in fiscal year 2021. Given the size of the future gaps, the State should spread out use the rest of the reserves across future years. (See Table 2.)

Together these actions provide sufficient resources to close the fiscal 2021 gap and reduce future gaps. Still, significant gaps of $8.2 billion in fiscal year 2022, $9.4 billion in fiscal year 2023, and $10.0 billion in fiscal year 2024 remain. Additionally, it is important to consider that these gaps are predicated on the accuracy of the economic forecast and presumption the federal government will pay for all new Covid-19-related spending– both significant risks.

Impact of Potential Federal Aid

The federal government has an extremely important role to play in stabilizing not only the economy, but the finances of state and local public entities. Historically the federal government has not fully filled revenue shortfalls or funded expanded services, but it provides a backstop to ensure continuity of critical services and stability of state and local governments, and that serves the public well.

New York State has requested $61 billion in additional federal aid beyond what is needed to respond to the pandemic.1 The United States House of Representatives passed the “Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act,” which, while unlikely to be enacted into law in its current form, would provide $500 billion in direct aid to states. Based on what the State received in the most recent recession, Table 3 shows the impact of the State receiving an additional $10 billion over 2 fiscal years to illustrate both the benefit and the significant gaps remaining.2

It is reasonable to assume fiscal year 2021 supplemental federal school aid will be made available in fiscal year 2022 and increased Medicaid support will extend beyond September 2020 through June 2021 given the expected extended impact of the recession. Similar aid was made available for two fiscal years after the Great Recession of 2008. A larger uncertainty is the potential for unrestricted federal aid. While the HEROES Act suggests much greater aid is possible, for illustrative purposes the table below assumes an additional $6.6 billion in other general aid.

This level of aid, along with the actions recommended according to the CBC Framework, would close the fiscal year 2022 gap by allowing the State to defer use of its reserves until fiscal year 2022. It would also reduce the fiscal year 2023 gap to $7.6 billion; however, the State would still be facing a fiscal year 2024 gap of $10 billion. (See Table 3.)

Conclusion

By applying the CBC Hard Choices Framework to the State’s current financial plan, State leaders can balance this year’s budget without requiring extremely deep cuts to Medicaid, school aid, or other forms of local assistance. An additional $10 billion in aid would substantially help the State in the near and mid-term, but by no means would address the problems caused by the crisis. Absent significantly more federal aid, New York State would need to make additional hard choices that would affect New Yorkers now and in the future. Furthermore, this is premised on the assumption that the economic forecast holds, which may be optimistic based on recent economic reports and the challenges of reopening the economy.3

Footnotes

- Chris Sommerfeldt, “$61B bailout or ‘devastating’ cuts: Cuomo says next coronavirus stimulus must include money for New York” (Daily News, May 12, 2020), www.nydailynews.com/coronavirus/ny-coronavirus-cuomo-needs-bailout-cuts-20200512-cndwjmlkgjcs5aytavsin5xut4-story.html.

- In fiscal years 2010 and 2011, the State received approximately $5 billion of federal aid under the American Reinvestment and Recovery Act. See: New York State Division of the Budget, 2010-11 Enacted Budget Financial Plan (August 20, 2010), p. 21, https://www.budget.ny.gov/pubs/archive/fy1011archive/enacted1011/2010-11FinancialPlanReport.pdf.

- U.S. Bureau of Economic Analysis, “Gross Domestic Product, 1st Quarter 2020 (Advance Estimate)” (April 29, 2020, https://www.bea.gov/news/2020/gross-domestic-product-1st-quarter-2020-advance-estimate.