NYCHA's Untapped Assets

How NYCHA Can Maximize the Value of Infill Development

In July the New York City Housing Authority (NYCHA) announced that its public housing needs nearly $32 billion in repairs over the next five years–a staggering $180,000 per unit on average. As a result NYCHA is enhancing its efforts to raise revenue through a range of strategies, including leveraging its most valuable resources: land and air rights.

“Infill development” is one of NYCHA’s most promising–but also most-controversial–revenue-raising strategies. NYCHA partners with a private developer to build a new building on a portion of an existing NYCHA development. In exchange for the right to build, the developer agrees to make an upfront payment to NYCHA, which in turn uses the funding to pay for much-needed repairs at the development and, in some cases, at other developments, too.

How Infill Development Works

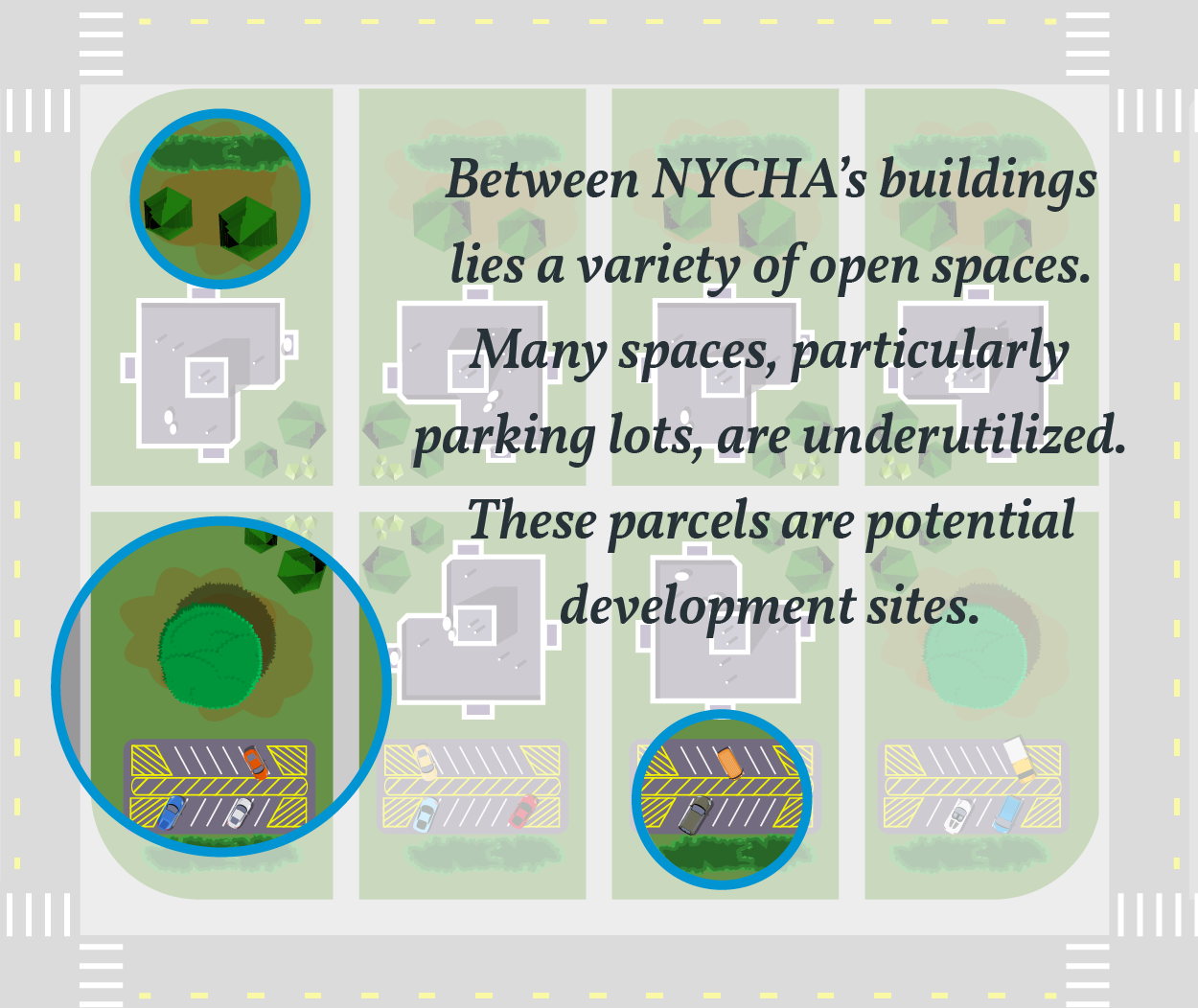

NYCHA controls a significant amount of unused development rights because NYCHA properties are smaller than what could be built at those locations today under the City’s zoning code. Many NYCHA developments were built as part of so-called super blocks, with buildings set back from the street in campuses that span multiple city blocks.

Between buildings lies a variety of open spaces, including playgrounds, open fields, and parking lots. Some open spaces are heavily utilized by NYCHA residents, but many others, particularly parking lots, are not. These underutilized parcels are potential development sites. In total NYCHA developments could accommodate an additional 58 million square feet of new development–the equivalent of more than 20 Empire State Buildings.1

The value of these unused development rights varies widely based on two factors: location and the type of housing erected.

- Location: Land prices vary greatly by neighborhood throughout New York City.2 A 2015 study commissioned by the Department of Housing Preservation and Development (HPD) found that developers would be willing to pay 2 to 3 times as much for development rights in very strong markets like Chelsea as opposed to middle or moderate-strength markets like East Harlem or Jamaica, and more than 10 times as much as compared to weak markets like East Tremont.3

- Type of Housing: The amount that a developer is willing to pay for development rights depends on the number and mix of residential units that could be built at the site. The same 2015 HPD study found a substantial difference in land values even within markets based on the share of units required to be set aside as affordable housing. Developers would pay 50 percent less for a project with a 20 percent affordability set aside and 86 percent less for a project with a 50 percent affordable set aside.4 In other words, stricter requirements to produce greater amounts of affordable housing make the land less valuable to developers, and hence, generate less revenue for NYCHA.

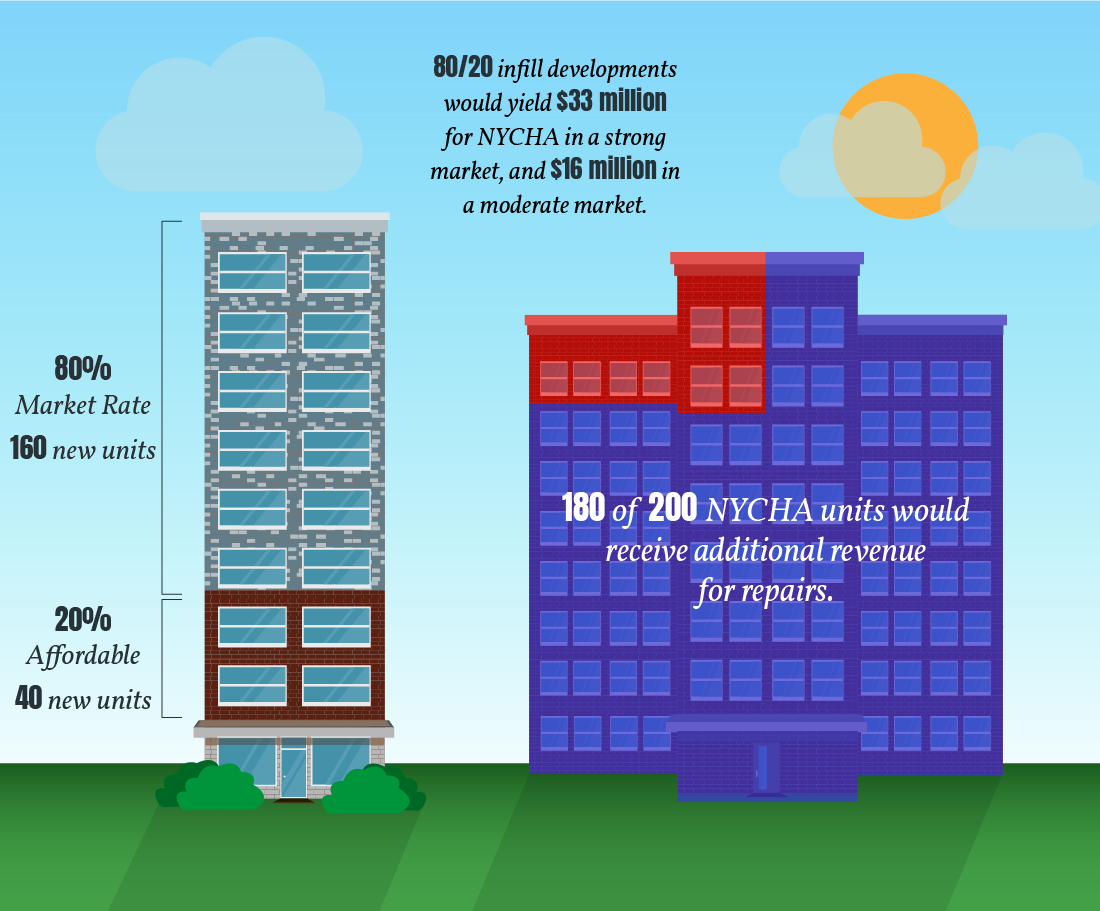

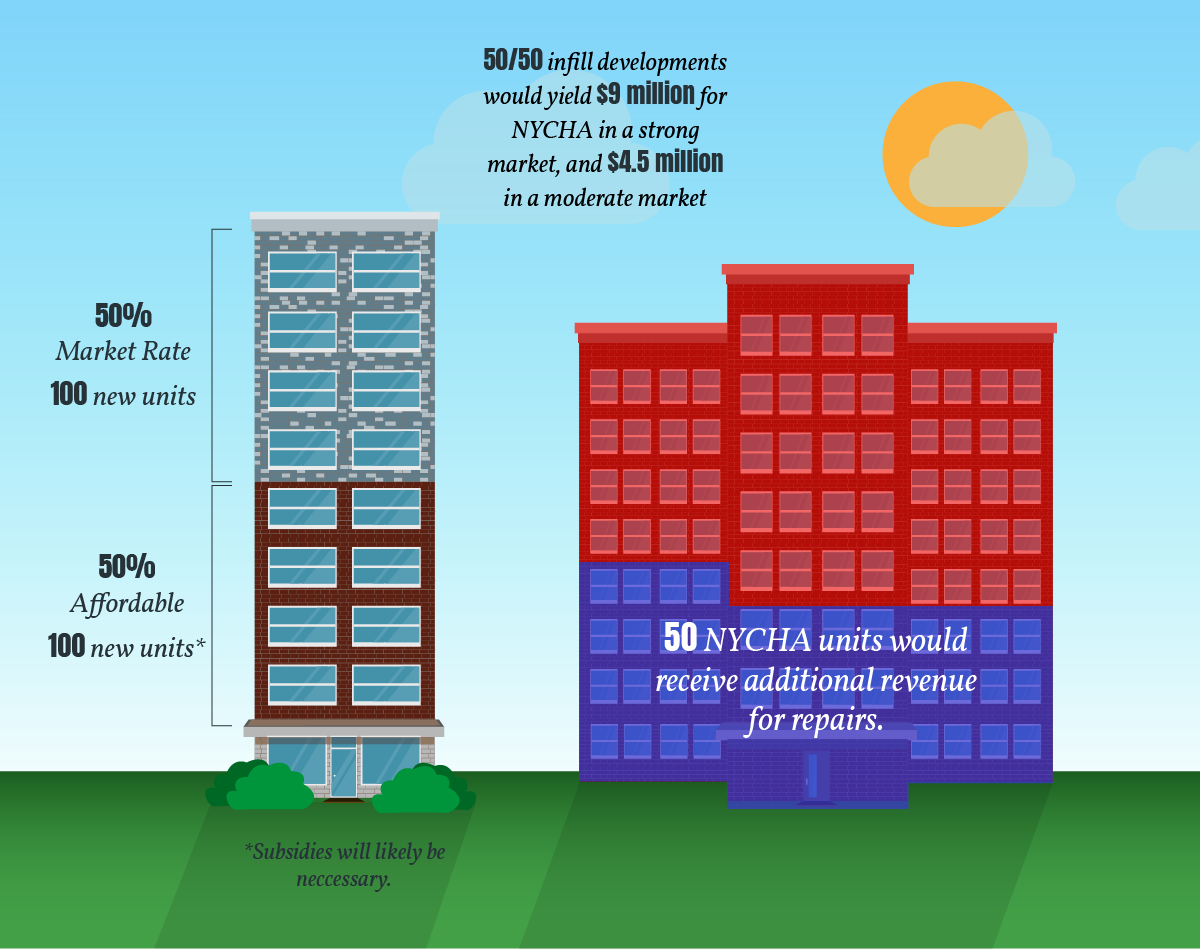

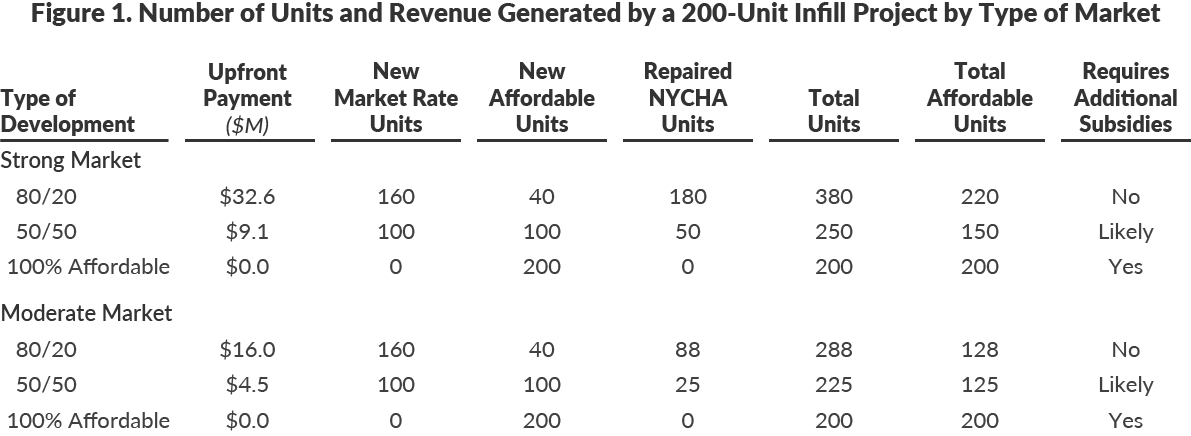

The table below shows how these tradeoffs play out for a 200-unit high rise rental building in two different neighborhoods: a strong market (such as the Lower East Side or Park Slope) and a moderate market (like Jamaica or East New York). Three development options are considered in each case: a building with 80 percent market rate and 20 percent affordable units (80/20 option); a building with 50 percent market rate and 50 percent affordable units (50/50 option); and a building that is 100 percent affordable units.

NYCHA’s opportunities are greatest in strong markets. In a strong market, the 80/20 option would yield $33 million for NYCHA and produce the greatest number of new and preserved affordable units. In sum the deal would create or save 380 units: 160 market rate units and 220 affordable units. Forty new affordable units would be constructed, and 180 NYCHA units would be preserved.

In contrast, the same building developed as a 50/50 development would raise only $9 million for repairs. Under this scenario, 250 units are created or preserved, of which 150 would be affordable—100 new affordable units and 50 preserved NYCHA units. In addition, the new 50/50 development would likely require some level of public subsidy to be financially viable. The 100 percent affordable development would require even greater public subsidy and would yield 200 new affordable units, but would not raise any revenue for NYCHA to preserve its units.5

A similar story occurs in the moderate markets. The 80/20 option would yield $16 million for repairs–enough to fix 88 NYCHA units–while the 50/50 and 100 percent affordable options would generate minimal revenue for repairs. The 80/20 option limits the amount of public subsidy needed and produces the greatest number of units overall.

Download Infographic

Download Infographic for "NYCHA's Untapped Assets"Footnotes

- CBC staff analysis of data from City of New York, Department of City Planning, Primary Land Use Tax Lot Output 17v1.1.

- This analysis focuses solely on entitled residential development. Land values also vary by use and by zoning status. Assuming all uses are permissible, a developer looking to build a condominium project would likely be willing to pay more than a developer looking to build a warehouse. Similarly, a project that can be built as-of-right, without the need for a rezoning or variance, is more valuable than a project that would need to secure additional entitlement.

- New York City Housing Development Corporation, “Market and Financial Study NYC Mandatory Inclusionary Housing” (September 2015), http://www1.nyc.gov/assets/planning/download/pdf/plans-studies/mih/bae_report_092015.pdf.

- New York City Housing Development Corporation, “Market and Financial Study NYC Mandatory Inclusionary Housing” (September 2015), http://www1.nyc.gov/assets/planning/download/pdf/plans-studies/mih/bae_report_092015.pdf.

- The ultimate level of subsidies depends on the mix of different levels of affordability and assumes that all types of infill development on NYCHA land will be exempt from property taxes. See: Rahul Jain and Michael Dardia, The Cost of Affordable Housing, Citizens Budget Commission Blog (December 15, 2015), https://cbcny.org/research/cost-affordable-housing.