Pension Sweetener Scorecard – Disability Benefits Edition

Each year, Citizens Budget Commission (CBC) monitors bills introduced by State legislators to enhance the health and pension benefits of state and local public employees. At least 60 such bills have been introduced in this session; 10 bills introduced to benefit recently hired New York City uniformed employees are gaining momentum and are worth flagging now.

Ostensibly, these bills respond to a concern that recently hired New York City police and fire employees injured in the line of duty receive insufficient disability benefits because of pension changes made in 2009, which were later extended to all uniformed City employees as part of pension reforms that created a new “tier” of benefits for all State and local employees hired after April 1, 2012. In reality, all but one of the bills attempt to roll back important and sensible reforms projected to save New York City $21 billion over 30 years.

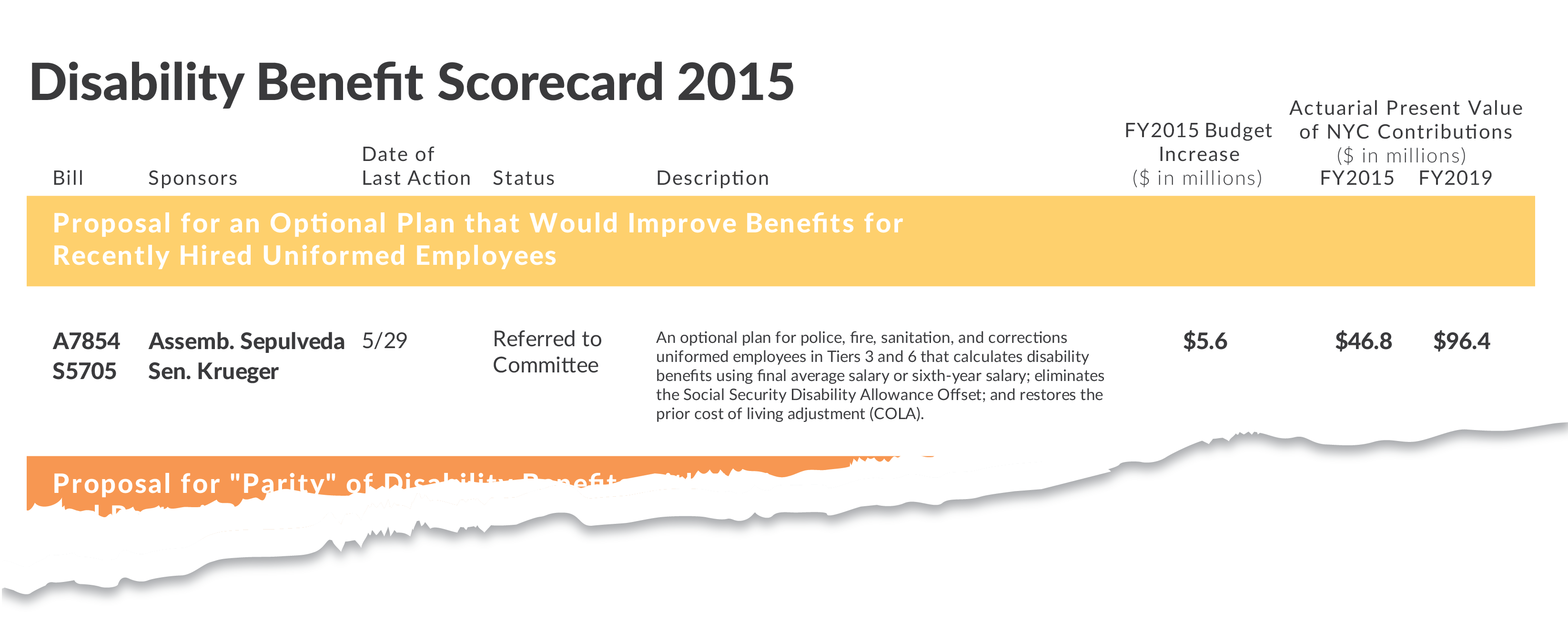

Bill number A.7854 addresses stated concerns without undoing key cost-saving reforms. The bill, supported by Mayor Bill de Blasio, would provide an optional retirement plan that eliminates the social security offset to disability benefits, provides an alternative for calculating final salary, and modifies cost of living increases. The bill would require $5.6 million in the first year and a total of $47 million over fiscal years 2015 to 2019. The city’s actuary calculates the present value of additional City contributions needed to fund the benefit would grow to $96 million by fiscal year 2019.

In contrast, five of the bills (A.7185, A.7108, A.5311, A.5295, and S.3966) would grant “parity” in disability benefits with peers in older tiers, raising accidental disability benefits to 75 percent of final salary. Under the current tier, accidental disability benefits are calculated as 50 percent of final salary, offset by any social security disability insurance payments received. These bills also restore presumptions that certain ailments, such as heart disease and cancer, were incurred as a result of the performance of duties, thereby entitling a retiree to more generous disability benefits. The first-year budget cost would be $37.6 million for police and fire uniformed employees and $1.3 million for sanitation and correction uniformed employees. The present value of all additional City contributions would be $889 million by 2019.

Three bills (A.6046, S.5596, and S.5656) go even further. These bills would grant enhanced disability benefits, restore presumptions of injury, and add a new presumption that heart disease, lung disease, HIV, and cancers were incurred in the line of duty for medical officers in the fire department. S.5596, which covers City police and fire uniformed employees and has been passed in the Senate, has a first year cost of $37.8 million. The present value of additional City contributions is $289 million growing to $850 million by 2019.

The most extensive bill is A.7816. While the language of the legislation is unclear, its sponsor in the Assembly, Peter Abbate, has indicated its intent is to place recently hired and future uniformed employees in Tier 2.[1] This change would not be limited to disability benefits; it would cover all types of pension benefits and would revert contribution rates, service requirements, and other factors to more generous levels. This bill lacks a fiscal note by the City, but would surely be more expensive than the others mentioned here.

New York City taxpayers already pay $8.6 billion annually in pension fund contributions. Any measure that would add to these costs should be closely scrutinized. It should be strictly limited to addressing line of duty injuries— not erasing hard won reforms and savings for New Yorkers. CBC will monitor and report on these sweeteners and others in the coming weeks.

[1] Testimony of Peter Abbate, New York State Assemblyman, before the New York City Council Committee on State and Federal Legislation (May 29, 2015).