Six Things to Know About New York State Health Care Reform Act (HCRA) Taxes

The New York State Executive Budget for Fiscal Year 2021 includes an extension of the Health Care Reform Act (HCRA). HCRA is used commonly by policymakers to refer to the health care policies established in the law, as well as to describe the sources and uses of funding generated by its provisions. HCRA was initially enacted in 1996 and has been renewed and revised multiple times; typically renewals have been for three years.

The Executive Budget does not propose increases in the taxes authorized by HCRA; however, the State’s significant budget gap means such increases may be considered. The Medicaid Redesign Team is reconvening and is charged with finding $2.5 billion in State budget savings, including a directive to “find industry efficiencies and/or additional industry revenue,” which could include an expansion of HCRA’s taxes.1

HCRA tax increases should be avoided as a strategy for balancing the Medicaid budget because that action increases the cost of health insurance premiums and likely depresses wage growth for a majority of New Yorkers. The current HCRA structure uses revenues from the health care sector to fund a growing portion of the State’s Medicaid program. Given the significance of HCRA and the potential for changes, it is important for lawmakers to understand the significant impact of HCRA taxes and legislation.

1. The HCRA fund was created to fund a set of public health care programs

HCRA was enacted in 1996 to overhaul New York State’s regulation of payments from insurers to health care providers and create new revenue streams to fund specific programs. Between the 1960s— shortly after the federal creation of Medicare and Medicaid— and the mid-1990s the State used various structures to regulate rates that insurers paid providers to maintain providers’ financial stability. By the mid-1990s, the State found that its most comprehensive effort to regulate health care payments, the Prospective Hospital Reimbursement Methodology (NYPHRM), was not meeting its goals to contain hospital cost growth, promote the financial sustainability of safety net hospitals, and maintain access to hospital care for all New Yorkers.2

In 1996 the State replaced NYPHRM with HCRA, which allowed hospitals and private insurers to negotiate reimbursement rates.3 However, since support for certain “public goods”– notably graduate medical education, hospital charity care, and certain rural health facilities– would not be included in negotiated rates, HCRA levied new taxes and assessments on insurers and providers to fund them.4 These new receipts were directed into the HCRA fund, a dedicated revenue pool for the State to spend on health care purposes. In years when HCRA receipts exceed disbursements for dedicated purposes, the additional receipts can be swept, or “offloaded,” to pay for State costs of the Medicaid program, which otherwise would be paid from the General Fund.

Most HCRA provisions sunset periodically. HCRA’s first major reauthorization occurred in 1999.5 Subsequent revisions have added reporting requirements, authorized new uses for the funds, and increased revenue assessment rates. Recently, the State has reauthorized HCRA for three-year periods with minimal changes.6 HCRA was last re-authorized in the Fiscal Year 2018 Enacted Budget, and Fiscal Year 2021 Executive Budget proposes its reauthorization for three years.

2. HCRA revenues have increased markedly and are now about $6 billion annually

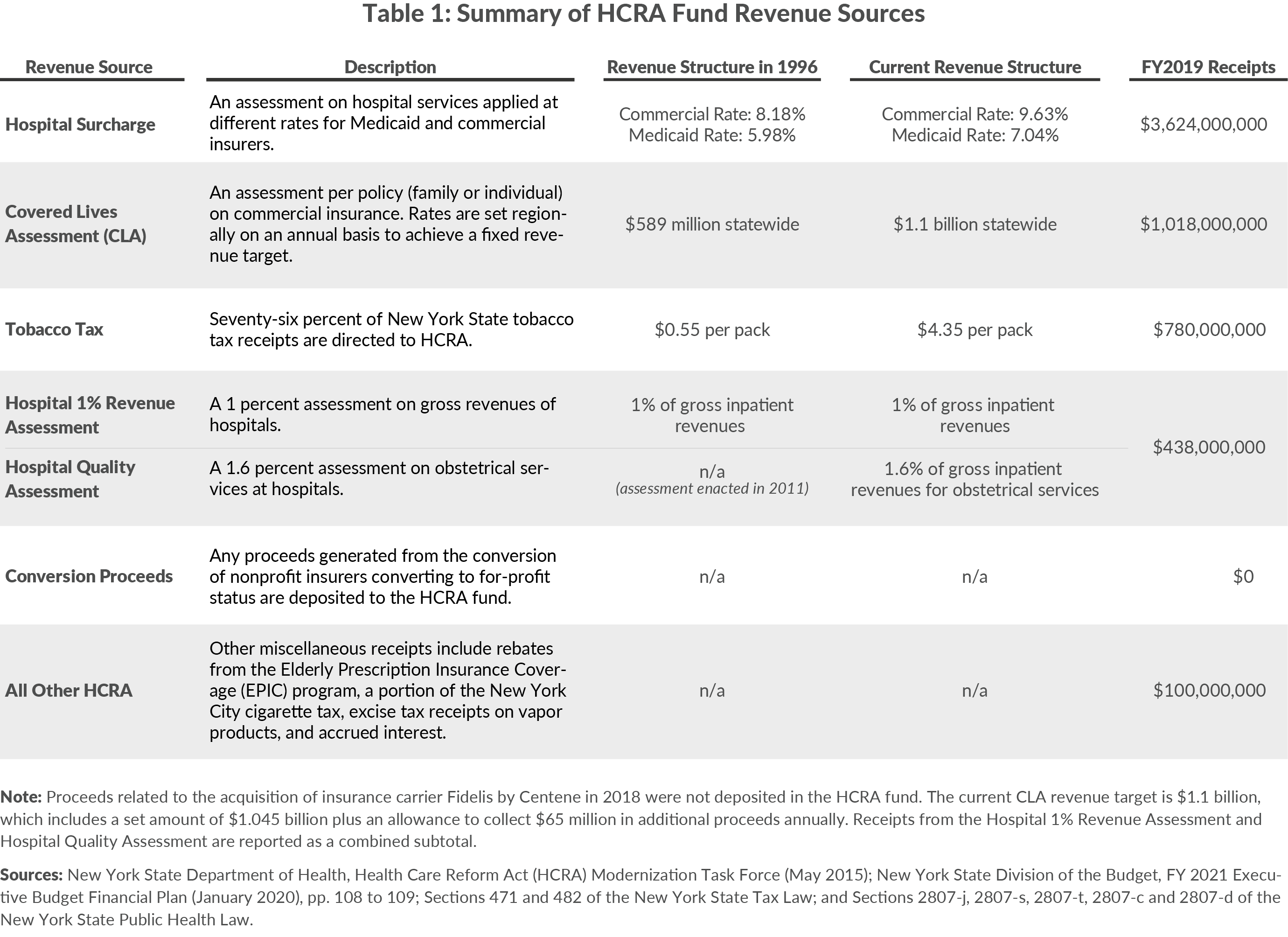

Table 1 summarizes the major sources of HCRA funds, along with the originally enacted and current rates associated with the major taxes.7 The two largest sources are the Hospital Surcharge (Surcharge), a tax on hospital services revenue that varies among payers, and the Covered Lives Assessment (CLA), a tax per “covered life” on insurers that varies regionally. Both tax rates have increased since initial enactment. Other HCRA revenues are from additional assessments on health care providers, insurers, and consumers.

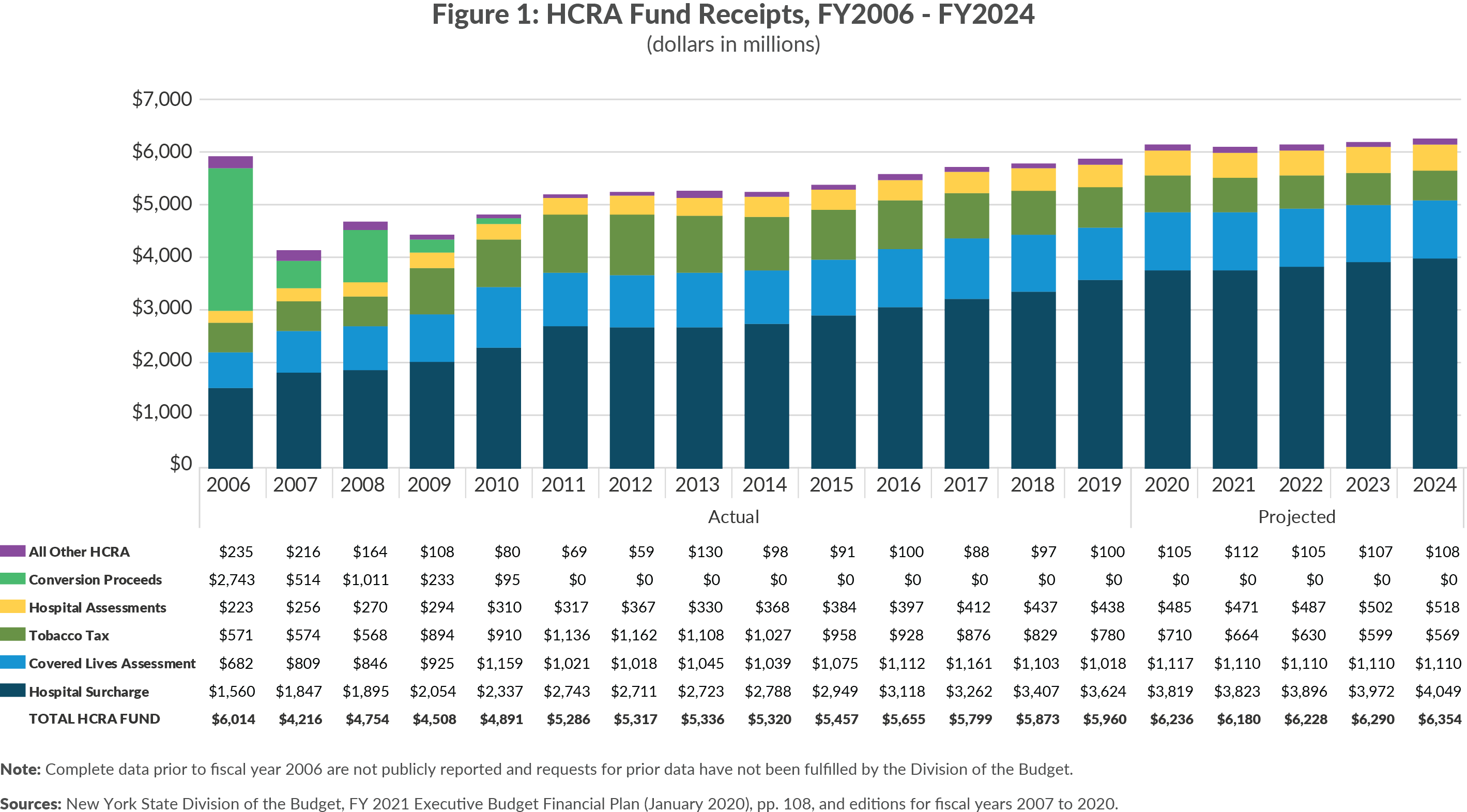

Receipts patterns prior to fiscal year 2010 are partially skewed by $4.5 billion in one-time receipts related to conversions and acquisitions of health insurance carriers, but there have not been deposits to HCRA for such one-time purposes since; receipts from the acquisition of nonprofit Fidelis by for-profit carrier Centene in 2018 were directed to a different fund.8 From fiscal year 2010 to fiscal year 2019, HCRA receipts grew 2.2 percent annually on average to reach nearly $6 billion. (Figure 1 shows HCRA receipts for all available years.9 Surcharge receipts grew the fastest, averaging 5.5 percent growth annually. In contrast, tobacco tax receipts declined an average of 1.7 percent annually. From fiscal year 2020 to fiscal year 2024, total HCRA revenues are projected to grow 1.6 percent annually.

3. HCRA taxes increase health insurance premiums at least 4.3 percent or about $1,000 annually for a family plan

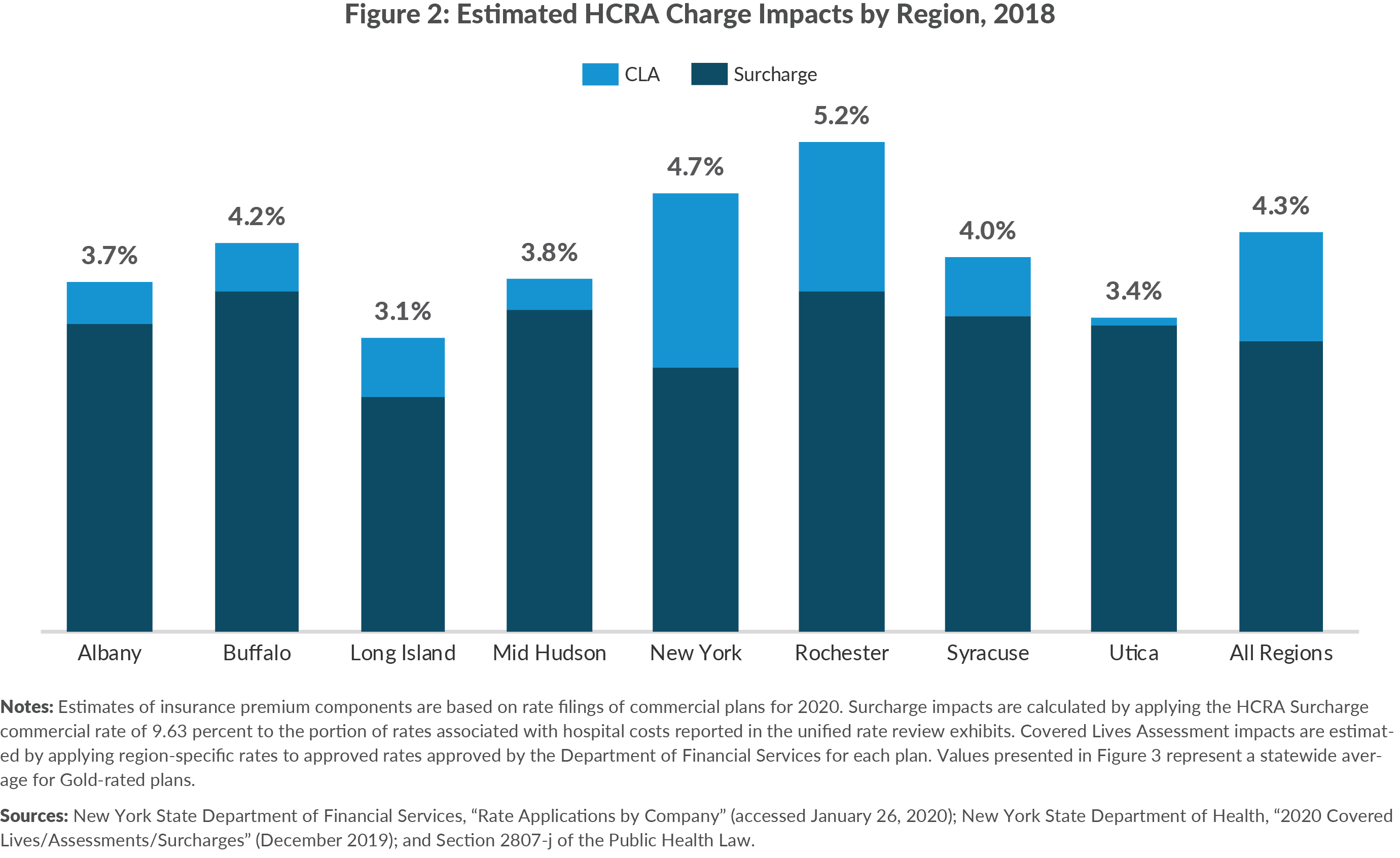

Most of these taxes are passed on to commercial health insurance purchasers in the form of higher premiums. (A portion of the Surcharge is paid by Medicaid.) Based on claims data of private insurers submitted to the State annually, the Surcharge increases commercial insurance costs by approximately 3.1 percent. The CLA increases premiums by approximately 1.2 percent for a combined impact of 4.3 percent.10(See Figure 2.) Other HCRA revenues, particularly Hospital 1% Revenue Assessment and the Hospital Quality Assessment, also increase premiums, but their impacts could not be estimated for this analysis.11

The impact of the HCRA taxes is not uniform across the State. The CLA rate is calculated on a regional basis based on the cost of graduate medical education conducted within that region; areas with higher spending on graduate medical education pay higher CLA rates. Due to varied regional rate-setting, commercial plans (and by extension commercially-insured New Yorkers) pay more into the HCRA fund, which helps support Medicaid payments for graduate medical education in a region. CLA rates vary widely; the New York City rate for an individual is $173.55 per year compared to $8.75 in the Utica region. As shown in Figure 3, the combined impact varies from 3.1 percent on Long island to 5.2 percent in Rochester.

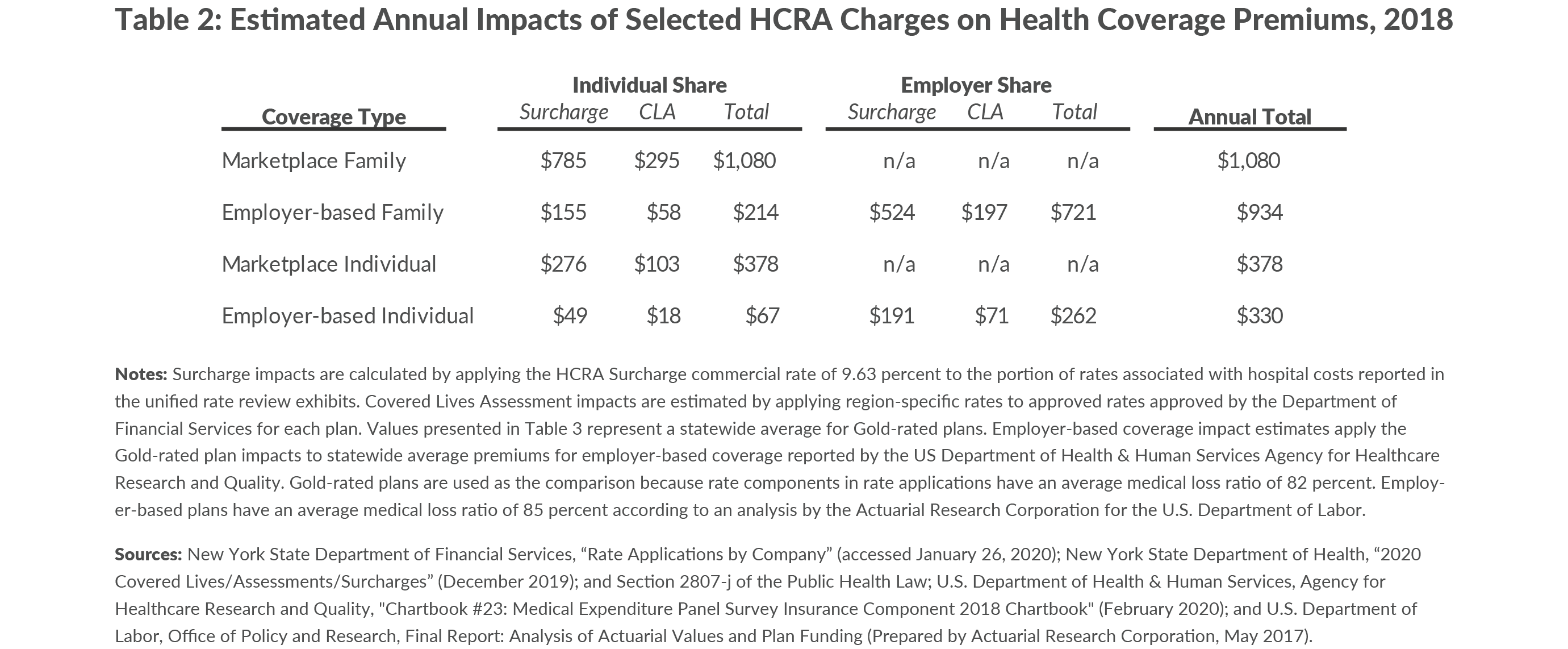

Converting the percent of premium impact to a dollar value shows the statewide average annual cost of HCRA taxes is approximately $350 for individual coverage and $1,000 for family coverage. (See Table 2.) More than half of New Yorkers are enrolled in commercial coverage, meaning HCRA taxes are a significant annual cost to most New Yorkers.

A majority of costs for employer-based plans is paid by the employer providing health insurance coverage as part of employee compensation; but research shows there is a tradeoff between wages and benefits, with the employee bearing the cost of coverage through reduced wages. That means HCRA taxes represent a reduction in employee wages, and an increase in HCRA taxes would depress income growth for New Yorkers.12 The inverse may be true of a reduction in HCRA taxes, depending on whether employers pass health care savings to employees.

4. About $600 million or 10 percent of HCRA revenue comes from the federal government rather than directly from New Yorkers

An interesting feature of the HCRA Surcharge is that it taxes most sources of hospital revenue including Medicaid. As shown in Table 1, the current Surcharge rate for Medicaid is 7.04 percent. The Medicaid payments are set by the State to include the cost of the Surcharge, and like other Medicaid costs these rates are partly funded (typically 50 percent) by the federal government. Thus, the federal government pays a significant share of Surcharge revenue.

In fiscal year 2020 approximately 29 percent, or $1.1 billion, of Surcharge revenues is derived from the Medicaid assessment.13 The federal government pays half this sum or $557 million, which will grow as Surcharge revenue grows.

New York’s ability to maintain the HCRA tax structure and shift cost to the federal government is related to a special “D’Amato Provision,” named after its champion former Senator Alphonse D’Amato, who championed the provision in federal law to accompany the original HCRA statute. The federal government has long been concerned that some states use taxes on health care providers to obtain federal Medicaid funding but then refund the money to the providers in other ways. This leverages federal funds without, in effect, actually requiring any State match. Accordingly federal rules require that the taxes be “broad-based and uniform.” The D’Amato Provision grants New York a unique exemption from the broad-based and uniform tax requirements for its HCRA taxes.14

5. More than $700 million of HCRA revenue is derived from State funds

Just as the federal government provides substantial HCRA revenue, the State government provides an even larger share. The State is a HCRA taxpayer in two ways—via the Surcharge on Medicaid and via premiums it pays to purchase insurance for its own workers and retirees.15

Like other costs in the Medicaid program, half of the Surcharge on Medicaid revenue is paid by the State. The current annual amount is approximately $557 million.16 Additionally, the State pays a share of health insurance premiums for its workforce and retirees. Based on the most recent premiums for each type of employee, the Surcharge annually costs the State approximately $120 million and the CLA costs approximately $45 million for a combined total of $165 million.17 Together with the Medicaid share, this yields nearly $700 million annually that the State pays via HCRA taxes.

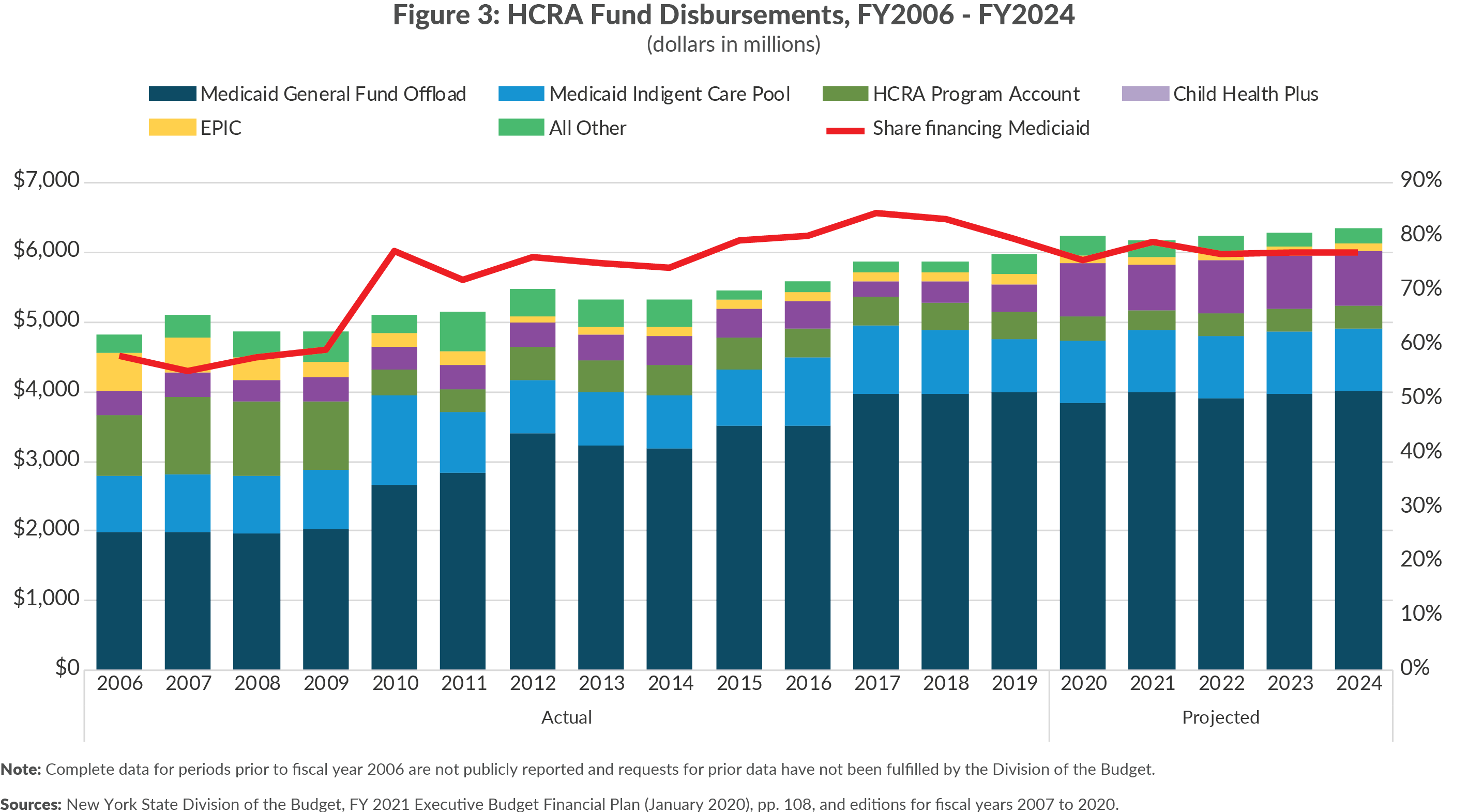

6. Most HCRA revenue is used to offset Medicaid costs in the General Fund, rather than for originally intended purposes

While HCRA taxes were initially enacted to pay for socially desirable services that would not be financed through competitively negotiated insurance payment rates to providers, in recent years about 80 percent of the revenue has been used to pay for the State’s share of Medicaid.18 (See Figure 4.) This compares with a lower 58 percent in 2006. The share may have been even lower in HCRA’s initial years, but the data are unavailable.

Much of this Medicaid funding is consistent with the law’s original intent. Nearly $1 billion annually finances the Disproportionate Share Hospital (DSH) Indigent Care Pool, supplemental Medicaid payments to hospitals backfilling financial losses from serving Medicaid or uninsured patients; this is comparable to the charity care funding that predated HCRA and which its taxes were intended to support. Another $4 billion pays for other Medicaid services that otherwise would be paid from the General Fund. A portion of that Medicaid funding covers graduate medical education and other costs originally intended to be covered by HCRA taxes, but the precise amount for those uses is unclear. It is likely that approximately $2 billion annually in HCRA taxes is effectively substituting for general fund revenues that would be required to support Medicaid services, which were not among the initial “public goods” HCRA taxes were designed to fund.19 This allocation is legally permitted, but is a deviation from the original intended uses of funding.

Conclusion

The Fiscal Year 2021 Executive Budget includes a three-year HCRA extension. However, as lawmakers negotiate this year’s budget and evaluate the State’s five-year financial plan, they should review HCRA’s role in health care funding and its impact upon privately insured New Yorkers. HCRA taxes place a real, significant cost upon New Yorkers and the State itself. This year’s budget negotiations will be driven by actions taken in the Medicaid program, and HCRA taxes should not be increased.

Footnotes

- New York State, “Governor Cuomo Announces Members of Medicaid Redesign Team II” (press release, February 4, 2020), www.governor.ny.gov/news/governor-cuomo-announces-members-medicaid-redesign-team-ii.

- Irene Fraser, “Rate Regulation as a Policy Tool: Lessons from New York State,” Health Care Finance Review, 1995 Spring 16(3), pp. 151-175.

- See Chapter 639 of the Laws of 1996 and Chapter 639 of the Laws of 1996.

- New York State Department of Health, 2015 HCRA Modernization Task Force Report (February 2017), www.health.ny.gov/regulations/hcra/mod_report.htm.

- See Chapter 1 of the Laws of 1999.

- As part of the fiscal year 2016 budget the “HCRA Modernization Task Force” was convened to “evaluate and make recommendations regarding the efficacy and transparency of the Health Care Reform Act resources fund (HCRA fund) and to evaluate and modernize the provisions of law related to the Health Care Reform Acts of 1996 and 2000 (HCRA).” See Part W of Chapter 57 of the Laws of 2015 of New York State; and New York State Department of Health, 2015 HCRA Modernization Task Force Report (February 2017), www.health.ny.gov/regulations/hcra/mod_report.htm.

- In this analysis, HCRA revenues are occasionally referred to as “taxes.” Certain HCRA revenues are technically classified as “miscellaneous receipts” in State financial reporting.

- New York State Division of the Budget, FY 2021 Executive Budget Financial Plan (January 2020), p. 10, www.budget.ny.gov/pubs/archive/fy21/exec/fp/fy21fp-ex.pdf.

- Amendments made to HCRA in the Fiscal Year 2006 Enacted Budget required that all HCRA spending be reported “on-budget” and improved reporting of HCRA funds. Complete data for periods prior to fiscal year 2006 are not publicly reported and requests for prior data have not been fulfilled by the Division of the Budget. See New York State Office of the Comptroller, Oversight of Health Care Reform Act Pool Disbursements (June 5, 2006), https://osc.state.ny.us/audits/allaudits/093006/05s10.pdf.

- Estimated HCRA impacts were calculated by CBC staff. See the notes in Figures 2 and 3 for a description of the methodology.

- A reasonable approximation of those impacts would be 0.5 percent of premiums attributable to the Hospital 1% Revenues Assessment and Hospital Quality Assessment. This estimate is based on the total impact being proportional to that of the CLA.

- This analysis assumes that the incidences of health care premiums and health care premium taxes on employer-sponsored coverage are borne by workers in the form of reduced wages. This assumption is supported by research on the incidence of premiums and taxes on premiums. See: Katherine Baicker and Amitabh Chandra, The Labor Market Effects of Rising Health Insurance Premiums Working Paper 11160 (National Bureau of Economic Research, February 2005) www.nber.org/papers/w11160.pdf; Jane G. Gravelle, The Excise Tax on High-Cost Employer-Sponsored Health insurance: Estimated Economic and Market Effects, Report for Congress R44159, (Congressional Research Service, January 12, 2017), https://fas.org/sgp/crs/misc/R44159.pdf; and Gary Burtless and Sveta Milusheva, “Effects of Employer-Sponsored Health Insurance costs on Social Security Taxable Wages,” Social Security Bulletin, vol. 73, no. 1, (2013), pp. 83—108, www.ssa.gov/policy/docs/ssb/v73n1/v73n1p83.pdf.

- New York State Department of Health, Health Care Reform Act (HCRA) Modernization Task Force (May 2015).

- Balanced Budget Act of 1997, P.L. 105-33, 111 Stat. 251; and New York State Department of Health, Health Care Reform Act (HCRA) Modernization Task Force (May 2015).

- These costs are also borne by local governments, but impacts on local governments are not included in this analysis.

- New York State Department of Health, Health Care Reform Act (HCRA) Modernization Task Force (May 2015).

- The calculated impact of HCRA assessments on the State workforce is estimated by multiplying the number of active employees enrolled in the New York State Health Insurance Program (NYSHIP) in State agencies (182,166) and other participating State entities (38,250) by the average monthly premium rate in NYSHIP ($1,102.53) in 2020 and applying statewide average impacts of HCRA assessments for the Surcharge and CLA. The calculated impact of HCRA assessments on State retiree health insurance is estimated by multiplying the number of retired employees enrolled in the NYSHIP in State agencies (165,631) and other participating State entities (20,491) by the average monthly premium rate in NYSHIP Empire Plan Mediprime ($419.80) in 2020 and applying statewide average impacts of HCRA assessments for the Surcharge and CLA. The resulting monthly estimates are then summed and annualized. See New York State Office of the Comptroller, Comprehensive Annual Financial Report for Fiscal Year Ended March 31, 2019 (September 2019), p. 118, www.osc.state.ny.us/finance/finreports/cafr/2019-cafr.pdf; and New York State Department of Civil Service, Empire Plan 2019 Second Quarter Experience Report (September 20, 2019), p. 10, www.cs.ny.gov/employee-benefits/hba/memos/2019/pa19-11report.pdf.

- See Chapter 639 of the Laws of 1996 and Chapter 639 of the Laws of 1996.

- This approximation is based on the $4 billion in Medicaid General Fund offload expenditures, less approximately $1.3 billion in State share graduate medical education supported by HCRA and an assumption the approximately $700 million annually supports public health programs for physicians in rural areas and system transformation projects funded directly from HCRA and the General Fund.