Up and Away

State Budget Proposals Miss the Mark and Compound Fiscal Problems

CONTENTS

As New York State lawmakers negotiate the State’s Fiscal Year 2025 Enacted Budget, they risk adding unsustainable spending, driving growth above 6 percent a year, and widening the structural gap to $20.3 billion. Aside from avoiding the question of why New York supposedly cannot provide the quality programs to meet its residents’ needs despite spending much more than other states, this further increases the likelihood the State becomes fiscally unstable and unattractive to residents and businesses.

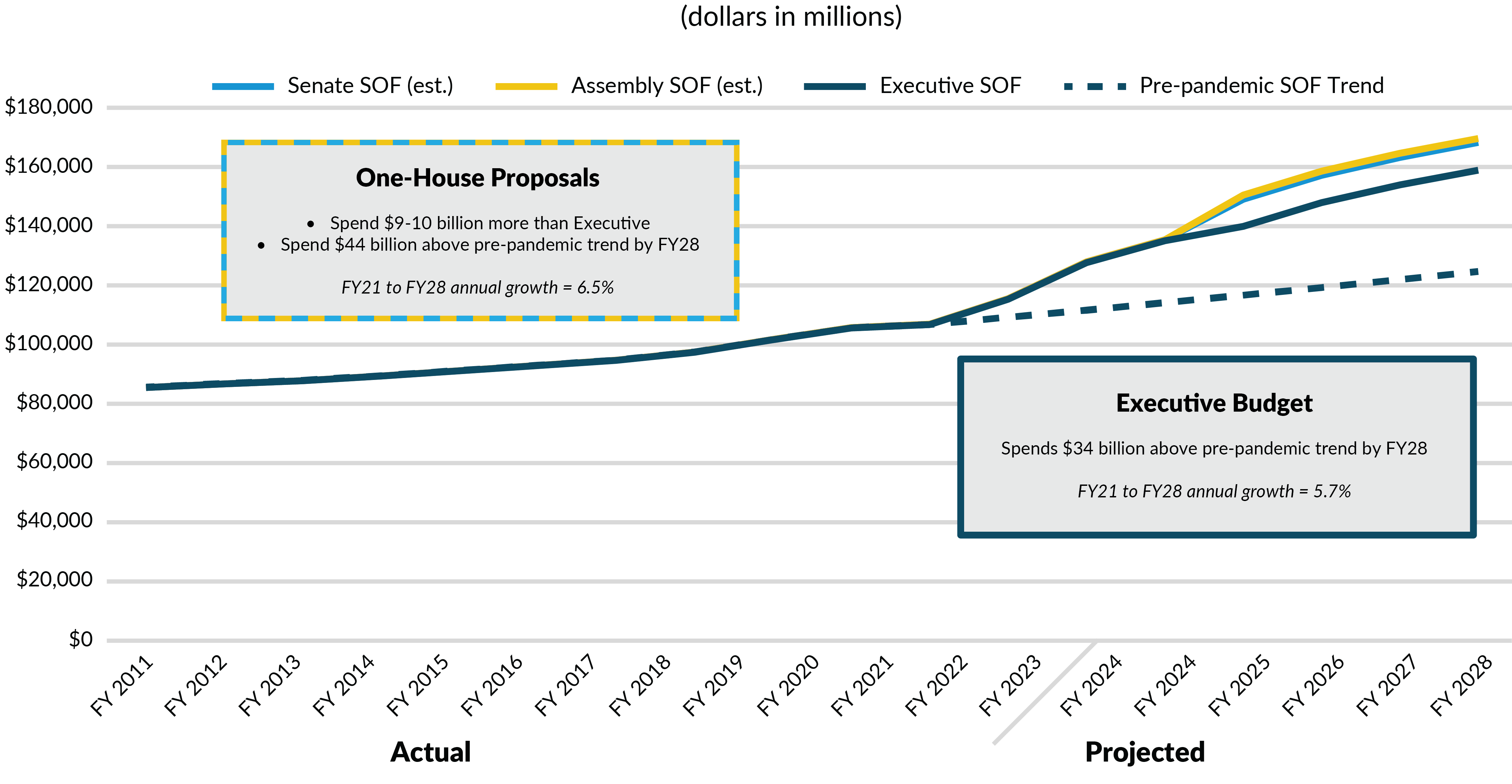

Spending Increases Significantly Outstrip Pre-Pandemic Trend

Over the past three years, Adjusted State Operating Funds (SOF) spending—the key measure of State costs—ballooned by $27.8 billion, a 26 percent increase. The Fiscal Year 2025 Executive Budget continues the climb, proposing to increase year-to-year SOF spending by $4.7 billion, and $18.7 billion over the next three years. The Legislature’s one-house budgets propose to add billions of dollars in fiscal year 2025 spending on top of the Governor’s already robust plan—up $14.8 billion year-over-year by the Assembly and $13.4 billion by the Senate.

The magnitude of these increases is even more stark when compared to what would have happened had the pre-pandemic 2.3 percent annual spending growth continued:

- Fiscal year 2024 SOF spending is $21 billion above the pre-pandemic trend;

- The Executive Budget would push spending $22.8 billion above the trend in fiscal year 2025 and $33.6 billion above the trend in fiscal year 2028; and

- The one-house budgets would push spending approximately $31.5 billion above the trend in fiscal year 2025 and $42.3 billion above the trend in fiscal year 2028. (See Figure 1.)

Figure 1: SOF Spending Trend, Executive and Legislative One-House Budgets

All values are based on CBC calculations of adjusted SOF spending. The adjustments to reported SOF spending include accounting for off-budget shifts, reclassifications, payment delays, pre-payments, certain federal aid that temporarily offsets State costs, and other maneuvers which shift spending across funds or across years. This provides a more consistent and complete analysis of State spending trends dating back to fiscal year 2011. “Senate SOF” is based on the Senate’s financial plan, which notes a variance of $8.7 billion in added SOF spending compared to the Executive Budget for fiscal year 2025, and extrapolated to all years. “Assembly SOF” is based on the Senate’s financial plan, which notes a variance of $10.0 billion in added SOF spending compared to the Executive Budget for fiscal year 2025, and extrapolated to all years. The Senate and Assembly appear to account for increases in Medicaid taxes differently, effectively reducing reported Senate spending by $4 billion. No adjustments are made for that action in this figure. “Pre-pandemic SOF Trend” is based on average annual growth from fiscal year 2011 through fiscal year 2021

New York State Division of the Budget, FY 2025 NYS Executive Budget Financial Plan (January 2024), www.budget.ny.gov/pubs/archive/fy25/ex/fp/fy25fp-ex.pdf, and prior editions; New York State Assembly, 2024-25 Assembly Budget Proposal (March 2024), www.nyassembly.gov/Reports/WAM/AssemblyBudgetProposal/2024/2024AssemblySummary.pdf; and New York State Senate, Financial Plan Overview (March 2024).

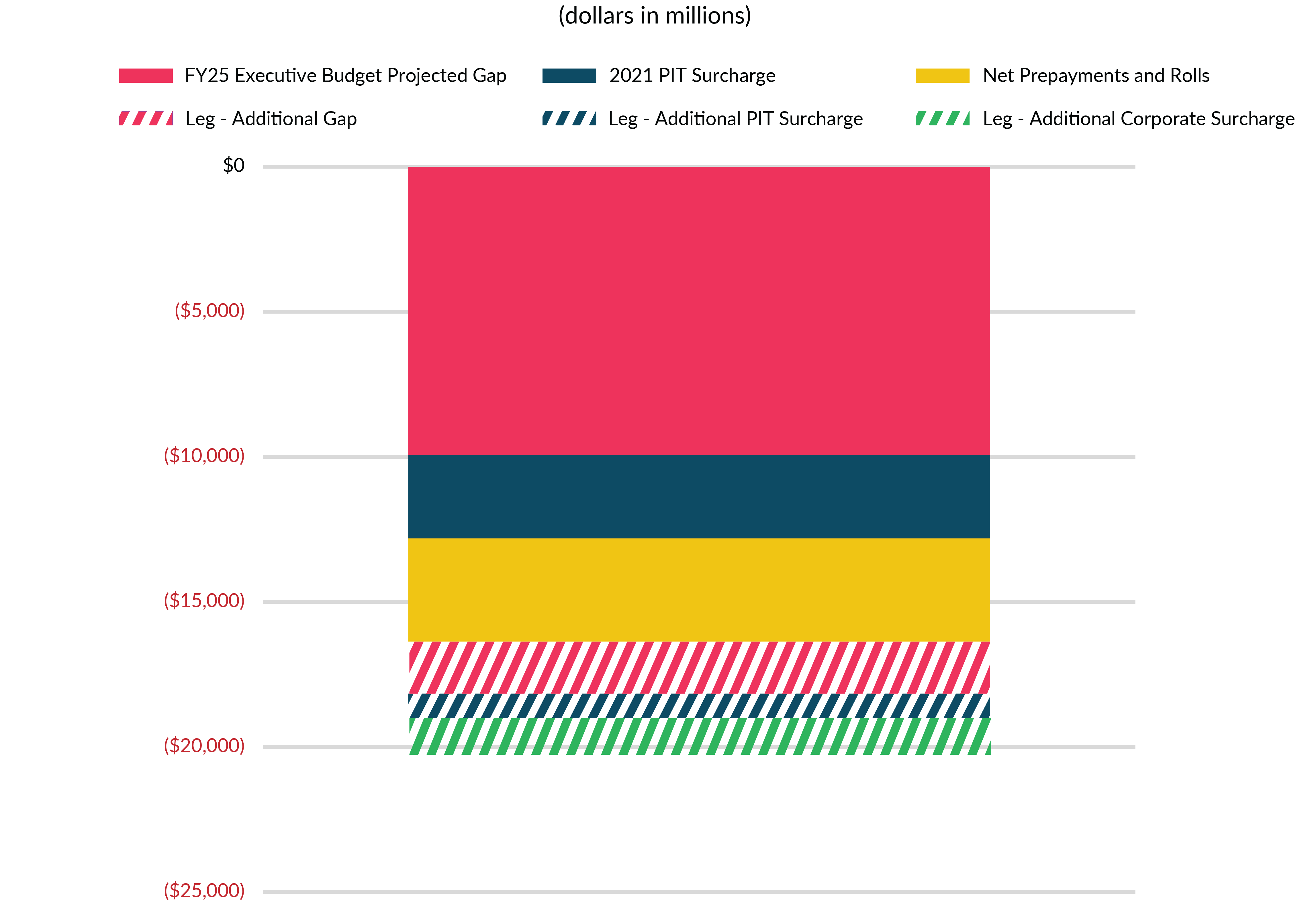

Use of Non-Recurring Resources Mask Structural Budget Gap of $20 Billion

Extremely concerning, a significant portion of next year’s spending would be supported only for a short time with non-recurring resources. The Executive Budget relies on approximately $16.8 billion in non-recurring resources—temporary tax increases, pre-payments/rolls, and expiring federal aid that will be exhausted over the coming three years—to achieve budget balance in fiscal year 2025.

The Legislature’s one-house budget proposals rely on an additional $6.3 billion in non-recurring resources coming from new temporary taxes. In the future, as non-recurring resources expire, projected budget gaps widen. Beginning in fiscal year 2029, when these non-recurring resources have all ended, the structural imbalance in the State budget would exceed $16.4 billion based on the Executive Budget; that jumps to $20.3 billion in the one-house budgets. (See Figure 2.)

High Taxes and Avoided Reserve Deposits Weaken Competitiveness and Preparedness

This trajectory would severely undermine the State’s economic competitiveness and fiscal preparedness.

- Temporary tax increases comprise the largest portion of non-recurring revenues, a majority ($5.0 billion) of fiscal year 2028’s $8.5 billion in non-recurring resources. New York’s high taxes threaten the State’s economic growth. New York already has the country’s highest marginal personal income tax rate and corporate tax rate, when combined with New York City and the Metropolitan Transportation Authority regional rates. New York State and local governments collect more in tax revenue per capita and per $1,000 of personal income than all other states.1 The significant spending growth proposed jeopardizes the expiration of the 2021 temporary tax increases after 2027. In fact, with spending growing faster than projected economic growth, continuing the State’s current path would require the State to reverse its plan that the taxes would be temporary, and may even require further increases. The Legislative budgets, in particular, would send a renewed and stronger message to taxpayers and businesses: Not only is the window for general tax relief closing, but greater tax increases will be needed every couple of years to cover lawmakers’ spending plans.

- The State is also not planning any additional deposits to its reserves, opting instead to use all available funds at closeout to pre-pay costs to manage out-year gaps. The principal reserves are already insufficient to cover receipts losses and spending growth of a typical recession, which currently require an additional $8 billion. The State should be using closeout balances each year to build reserves, rather than to support further spending increases.

Spending growth should be slowed significantly–especially in high-cost areas such as Medicaid and school aid–in order to stabilize the State’s fiscal foundation and avoid further damage to New York’s already shaky economic competitiveness. Restraining spending growth to 2.0 percent annually would close future gaps and eliminate the structural imbalance and allow temporary tax increases to expire.

Figure 2: FY 2028 Structural Imbalance, Executive Budget and Legislative One-House Budgets

Solid datapoints represent gaps and non-recurring resources outlined in the Executive Budget. Patterned datapoints represent gaps and non-recurring resources added by the Legislature, based on the Assembly’s budget summary. “Leg – Additional Gap” represents the gaps added by Legislative action, as discussed during floor debate on the Assembly’s budget resolution.

New York State Division of the Budget, FY 2025 NYS Executive Budget Financial Plan (January 2024), www.budget.ny.gov/pubs/archive/fy25/ex/fp/fy25fp-ex.pdf, and prior editions; New York State Assembly, 2024-25 Assembly Budget Proposal (March 2024), www.nyassembly.gov/Reports/WAM/AssemblyBudgetProposal/2024/2024AssemblySummary.pdf; and New York State Senate, Financial Plan Overview (March 2024).

Footnotes

- Adam Ciampaglio and Ana Champeny, Top of the Charts (Citizens Budget Commission, February 13, 2024), https://cbcny.org/research/top-charts.