What to Look For in the MTA's November 2022 Budget Update

The Metropolitan Transportation Authority (MTA) will soon release its proposed 2023 budget as it faces a troubling fiscal future: a structural operating deficit likely exceeding $2.5 billion annually; federal COVID aid rapidly running out; and fiscal risks that could approach $2.0 billion annually from a recession, collective bargaining costs and other factors. Ridership is around 63 percent of pre-pandemic levels and the MTA does not expect it to fully recover. The MTA’s July 2022 plan projects that non-recurring federal aid will cover the gap only through 2024.

The proposed 2023 budget will lay out the MTA’s blueprint for improving its fiscal and operational stability. The MTA should seize the opportunity and runway created by federal aid to implement efficiency-focused operating reforms and—to the extent possible—restructure its long-term debt, which would reduce its structural deficit before the region’s critical transit system risks falling off the fiscal cliff.

The July 2022 Financial Plan Revealed a Recurring $2.5 Billion Annual Structural Deficit, Covered by Federal Aid Through 2024

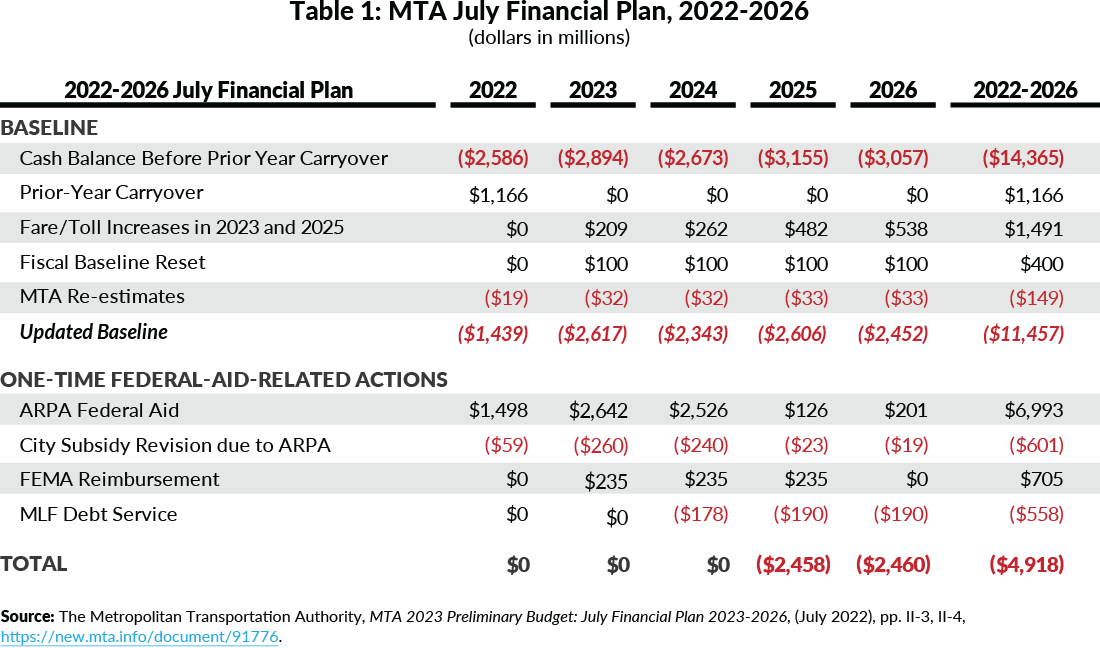

In the July 2022 Financial Plan, the MTA projected annual recurring deficits of approximately $2.5 billion. The MTA proposed using $7.0 billion of American Rescue Plan Act (ARPA) federal stimulus funds and approximately $700 million of Federal Emergency Management Agency (FEMA) reimbursement funds to cover these deficits through 2024. (See Table 1.)

The MTA Proposed to Repay $2.9 Billion Operating Loan, Rather than Converting it to Long-Term Debt as Previously Planned

During the pandemic, the MTA borrowed $2.9 billion from the Federal Reserve Board’s Municipal Liquidity Facility (MLF) to fund operations when revenues declined. The MTA never needed to use the proceeds and the debt comes due in 2023. In the July Financial Plan, the MTA assumed that they would issue long-term debt to pay off the MLF debt, effectively spreading repayment out over 30 years. Recently, the MTA proposed repaying the bonds in 2023 rather than borrowing and incurring long-term debt service costs.1

The MTA Proposed to Use Federal Aid to Restructure Debt and Reduce Costs, but This Would Accelerate Budget Gaps to 2023

The MTA proposed an alternative plan that would use $3.5 billion of federal COVID aid to retire long-term debt, generating recurring savings. (See Figure 1.) Debt service savings from restructuring and defeasing long-term debt would reduce structural deficits and save $3.9 billion from 2024 through 2028.2 However, this would open a more imminent budget gap in 2023.

The MTA also proposed that New York State identify a new revenue source to cover the remaining structural deficit. This revenue source would need to provide $800 million in 2023 and $1.6 billion in 2024 and beyond to close the remaining budget gaps.3

The MTA Faces Significant Additional Budget Risks That Could Reach $2 Billion Annually

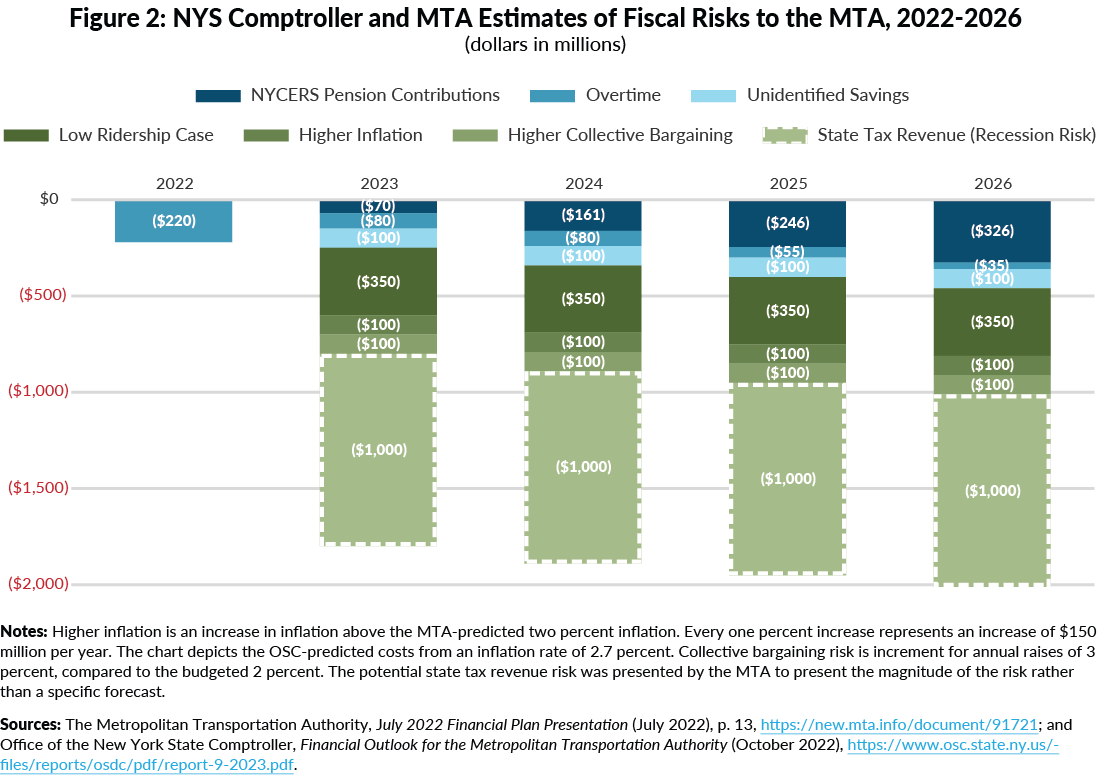

The current deficits are hardly the worst-case scenario. The MTA and Office of the New York State Comptroller (OSC) both identify risks that could increase annual deficits.4 (See Figure 2.) These risks—including higher-than-expected collective bargaining agreement costs, higher overtime spending, and lower ridership—could increase the deficit by $220 million this year, $800 million in 2023, and $1 billion by 2026. A recession could have an even more severe impact, potentially reducing tax revenues by another $1 billion annually.

Seven Things to Look for in the November 2022 MTA Financial Plan

1. How does the structural gap change in comparison to the July Financial Plan and why?

The MTA will update revenue and expenditure projections, which will change the size of the structural deficit in future years. Look for the direction, magnitude, and causes of the change.

2. How does the MTA balance the 2023 budget and what are the implications of these choices for 2024, 2025, and 2026?

If the MTA’s 2023 deficit increases, the financial plan will indicate how the MTA plans to balance the budget. For example, if deficits increase and the MTA uses federal aid more quickly than expected, budget gaps in future years could widen.

3. How much new aid does the MTA want the State to provide?

The MTA has proposed that the State provide additional aid of at least $800 million in 2023 and $1.6 billion annually, beginning in 2024 to balance the budget. This revenue would allow the MTA to use its one-time federal aid to restructure debt and reduce ongoing debt service costs. Look for how much aid the MTA requests and if it identifies potential sources.

4. What are the details and the total value of the MTA’s plan to increase efficiency and productivity?

The MTA expects its “Fiscal Baseline Reset” to generate savings of $100 million per year, which is about four percent of the structural deficit. The Citizens Budget Commission (CBC) previously identified up to $2.9 billion of recurring annual savings that could cover much of the deficit. However, many of the reforms require changes to collective bargaining agreements to adopt standard industry operating practices; hence CBC supports a multi-year phase-in plan starting with efficiencies under the purview of management, followed by implementing changes collectively bargained with labor over time.5 Look for how the MTA will increase efficiency and productivity and how much of the deficit those actions will cover next year and in the future.

5. How does the MTA expect ridership and revenues to change?

Subway ridership in the last three months has averaged between 61 percent and 65 percent of equivalent pre-pandemic levels, which is slightly below the mid-point for the July-updated McKinsey forecast. The MTA currently hopes to reach 80 percent ridership by 2026.

Decreases in ridership reduce fare revenue, which in turn reduces the share of operating costs covered by fares. In 2019, the MTA’s farebox revenue covered 51 percent of its operating expenses, compared to just 33 percent in September 2022.6 Look for changes in ridership relative to pre-pandemic levels, updated ridership forecasts, and detailed plans on how the MTA will continue regaining riders.

6. How are tax revenue forecasts updated?

Lower fare revenue has made the MTA more reliant on tax revenues.7 The largest fiscal risk for the MTA’s budget is depressed taxes due to a shrinking economy. If the economy slides into a recession and the Federal Reserve continues to raise interest rates, tax revenues could decrease, and costs could increase. This represents a risk of up to $1 billion per year. Look for how the MTA adjusts its tax revenue forecasts and any justifications regarding economic conditions.

7. Will the MTA proceed with the planned 2023 and 2025 fare increases?

In 2009, the MTA began biennial fare increases yielding four percent revenue growth to keep in step with rising costs. However, during the pandemic, the MTA first deferred, then cancelled the 2021 fare increase (toll increases were still implemented and designed to yield higher-than-planned toll revenues).8 The planned increases in 2023 and 2025 are a critical component of balancing the budget and keeping pace with costs in this high-inflation environment. Look to see whether the 2023 and 2025 fare increases and associated revenue forecasts are modified.

Footnotes

- Office of the New York State Comptroller, Financial Outlook for the Metropolitan Transportation Authority – October 2022 (October 6, 2022), p. 16, https://www.osc.state.ny.us/reports/financial-outlook-metropolitan-transportation-authority-october-2022.

- Office of the New York State Comptroller, Financial Outlook for the Metropolitan Transportation Authority – October 2022 (October 6, 2022), p. 14, https://www.osc.state.ny.us/reports/financial-outlook-metropolitan-transportation-authority-october-2022.

- Office of the New York State Comptroller, Financial Outlook for the Metropolitan Transportation Authority – October 2022 (October 6, 2022), p. 14, https://www.osc.state.ny.us/reports/financial-outlook-metropolitan-transportation-authority-october-2022; and the Metropolitan Transportation Authority, July 2022 Financial Plan Presentation, (July 2022), p. 13, https://new.mta.info/document/91721.

- Office of the New York State Comptroller, Financial Outlook for the Metropolitan Transportation Authority – October 2022 (October 6, 2022), pp. 17-19, https://www.osc.state.ny.us/reports/financial-outlook-metropolitan-transportation-authority-october-2022.

- Citizens Budget Commission, The Track to Fiscal Stability, (May 25, 2021), https://cbcny.org/research/track-fiscal-stability.

- Metropolitan Transportation Authority, February Financial Plan 2020—2023 February 2020 (February 2020), pp. 2-9, https://new.mta.info/document/15221, and Farebox Recovery and Operating Ratios, 2022 Mid-Year Forecast and Actuals (October 2022), https://new.mta.info/document/98016.

- Office of the New York State Comptroller, Financial Outlook for the Metropolitan Transportation Authority – October 2022 (October 6, 2022), pp. 17-19, https://www.osc.state.ny.us/reports/financial-outlook-metropolitan-transportation-authority-october-2022.

- Metropolitan Transportation Authority, November Financial Plan 2020—2023: Volume 1 November 2019 (November 2019), p. III-1, https://new.mta.info/sites/default/files/2019-11/MTA%202020%20Final%20Proposed%20Budget%20-%20November%20Financial%20Plan%202020-2023%20Volume%201.pdf.