What to Look for in the MTA’s November 2023 Financial Plan

HIGHLIGHTS

While the budget outlook is positive, caution is warranted. The MTA and stakeholders should closely monitor ongoing results because certain risks threaten its projected revenue and expenses.

INTRODUCTION

At its July Board meeting, the Metropolitan Transportation Authority (MTA) presented its July 2023 Financial Plan and 2024 Preliminary Budget, which showed five years of balanced budgets. These positive bottom-line projections are primarily due to New York State’s stabilization plan that increased dedicated taxes $1.1 billion annually, directed forthcoming license fees and projected taxes from casinos to the MTA, and increased subsidies.

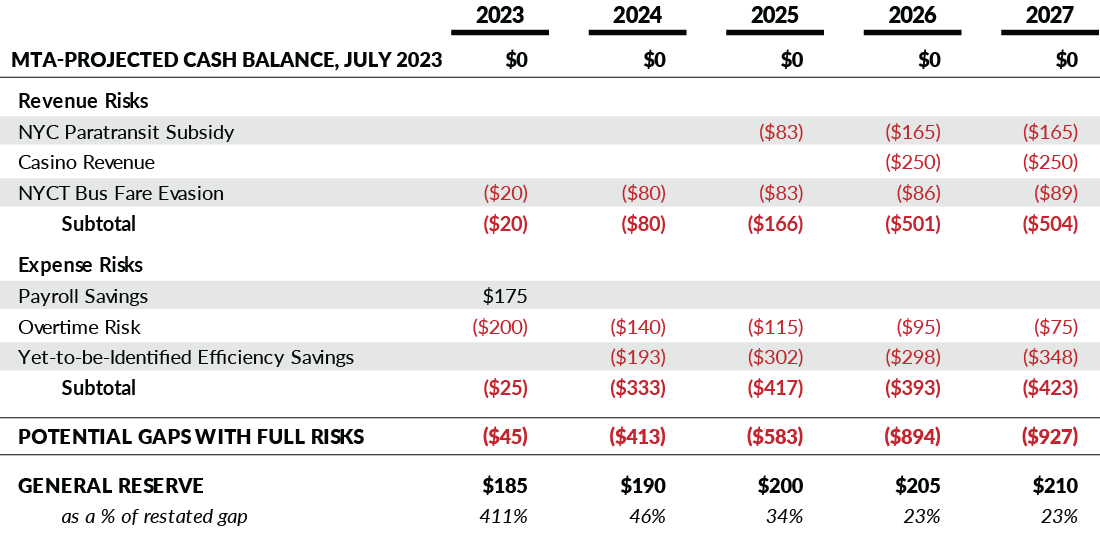

While the budget outlook is positive, caution is warranted. The MTA and stakeholders should closely monitor ongoing results because certain risks threaten its projected revenue and expenses. (See Table 1.) If all of the identified risks were to happen, the MTA would have to take actions to close budget gaps totaling $45 million this year, $413 million in 2024, and growing to $927 million by 2027. Below are key items to look for in the upcoming Final Proposed 2024 Budget and November 2023 Financial Plan, due to be released in early December.

REVENUE RISKS

MTA revenues are at risk mainly due to the uncertainty of subsidies and taxes, though continued fare evasion, especially on buses, also poses a revenue risk.

Increased Paratransit Subsidy. Part of the NYS stabilization plan required New York City to increase its subsidy for the paratransit program to $165 million per year for two years. While the law requires this increase from July 1, 2023, to June 30, 2025, the MTA’s July Financial Plan assumed this higher level of NYC support would continue beyond the date required by law. If the funding increase does not continue beyond the statutory June 2025 date, it would open gaps of $83 million in 2025 and $165 million annually in 2026 and 2027.

Casino Revenue. Casino revenues—from both licenses and taxes—are a gamble. The three downstate licenses could be awarded as early as 2026, but the timing and outcome of the complicated selection and implementation process are far from certain. The MTA’s July 2023 Financial Plan assumes one license will be awarded annually in 2026 and 2027, generating $500 million in revenue per license, the statutory minimum license fee. While the amount may be certain, and perhaps could even be higher, licenses may be awarded more slowly, delaying the revenue. CBC reflects this risk as an average of $250 million annually in 2026 and 2027, due to the possibility that one of the two licenses is awarded after 2027. Furthermore, the State’s rescue plan directs a portion of the expected ongoing gaming tax revenue to stabilize the MTA’s finances after 2027. That amount also is uncertain and will be a future risk.

Economically Volatile Taxes. Roughly 44 percent of the MTA’s 2024 revenues will come from taxes, including the economically volatile mortgage recording and real estate transaction taxes, among others; the MTA’s fiscal health is heavily dependent on the region’s economic health and growth. In July 2023, the MTA updated its tax revenue forecast to reflect weaker collections from transaction taxes and stronger collections from sales taxes.

The State’s stabilization plan increased the payroll mobility tax (PMT) on certain NYC businesses, which is expected to add $1.1 billion annually to the MTA’s projected revenue.1 PMT collections through September 2023 were $62 million lower than forecasted, possibly due to the implementation of the higher rate. PMT revenues warrant close attention to ensure collections meet forecasts going forward.

Table 1: MTA Budget Gaps and Risks

Metropolitan Transportation Authority, MTA 2024 Preliminary Budget: July Financial Plan 2024-2027 (Volume 1, July 2023), Finance Committee Book (February 2023), and other 2023 monthly editions; and Office of the New York State Comptroller, Financial Outlook for the Metropolitan Transportation Authority (Report 9-2024, October 2023).

Ridership and Fare Potential Upside. On the positive side, ridership numbers have hovered close to the McKinsey midpoint forecast; currently the MTA projects reaching 80 percent of pre-COVID ridership by the end of 2026.2 Furthermore, changes in how riders are using the transit system—greater-than-expected OMNY uptake and lower-than-expected use of reduced fare options—have increased the average fare and driven up total fare revenue. The MTA recognized these trends and updated its models in the July 2023 Financial Plan.

Fare Evasion Risk on Buses. Fare evasion continues to drain the MTA’s resources, reducing fare and toll revenue by more than $700 million annually. While the McKinsey ridership forecast reflects trends in fare evasion, it also assumes a gradual decrease in fare evasion to pre-pandemic levels. The MTA is actively targeting fare evasion, and success in those ongoing efforts is critical. Fare evasion has been most problematic on NYC Transit buses, where actual revenue has been continuously below forecast this year. In the first half of the year, strength on the other modes offset the bus revenue shortfall. With the July 2023 forecast increase in fare revenue, stronger performance in other modes is less likely to fully cover bus fare shortfalls. Based on recent trends in bus fare revenue, CBC estimates a risk of $20 million this year, increasing to $80 million in 2024, $83 million in 2025, $86 million in 2026, and $89 million in 2027. Additional revenue shortfalls, not quantified here, could be realized if subway fare evasion is not reduced as expected.

Fare Increases. The MTA’s balanced budget assumes the continuation of the smart policy of biennial 4 percent fare and toll increase in 2025 and 2027. Fares and tolls should keep pace with operating budget growth.3 These increases are not currently a risk to the budget, although their delay, reduction, or elimination would significantly damage the MTA’s fiscal health and operational future. These increases are projected to provide $285 million in 2025, $293 million in 2026, and $568 million in 2027.

EXPENSE RISKS

Higher-than-projected spending also can open and widen budget gaps. Risks include those related to labor costs for MTA personnel and achievement of operational efficiency savings.

Labor-Related Risks. Two near-term, labor-related expense risks may affect the MTA’s fiscal stability. Due to lower-than-budgeted headcount, payroll savings could reach $175 million, according to the Office of the State Comptroller (OSC).4 However, this would be offset by $200 million in higher-than-budgeted overtime, opening a $25 million gap in 2023. As hiring ramps up, the MTA will gradually be able to reduce overtime; the OSC estimates overtime will exceed budgeted levels by $140 million, $115 million, $95 million, $75 million from 2024 to 2027, respectively.

The MTA funded the Transport Workers Union 100 three-year collective bargaining pattern for the entire workforce, which addressed the short-term collective bargaining risk that had been looming.5 The MTA financial plan sets aside funds for 2 percent annual raises for the next round, which starts in 2026. If raises exceed 2 percent, as they do in the current contract, spending for 2026 and 2027 will exceed what is budgeted.

Operational Efficiency Risks. The MTA committed to improve organizational efficiency, targeting $100 million in efficiency savings in 2023, $400 million in 2024, $508 million in 2025, $518 million in 2026, and $528 million in 2027. MTA agencies have been charged with identifying and implementing the actual savings; to date, agencies have identified efficiency savings of $107 million in 2023, $207 million in 2024, $206 million in 2025, $220 million in 2026, and $181 million in 2027. MTA leadership is strongly committed to meeting these operational efficiency savings. However, the MTA has yet to identify operationally how it will achieve the remaining budgeted savings, creating a risk of $193 million in 2024 and growing to $348 million by 2027. As the MTA continues to identify specific plans, these risks will decrease.

However, the MTA still faces the risk of not executing effectively and falling short of planned savings. For example, prior planned savings, such as the Transformation Plan, have not always materialized.6 The MTA and stakeholders should closely monitor implementation and fiscal impact.

POTENTIAL GAPS

The cumulative revenue and expense risks could open operating budget gaps of up to $45 million in 2023, $413 million in 2024, $583 million in 2025, $894 million in 2026, and $927 million in 2027. (See Table 1.) These gaps are much more manageable compared to those before the rescue plan, returning to the size the MTA faced pre-pandemic.7 Still, like then, these should not be ignored. Furthermore, the gaps in the years beyond the financial plan may be larger, due to uncertainty of gaming tax revenue and future collective bargaining costs.

If actual revenues vary significantly from expectations because of economic forces or changes in ridership, the gaps could be larger or smaller. It is critical that the MTA continues biennial fare and toll increases, implements efficiencies to meet its savings targets, and continues to identify ways to increase productivity and reduce costs. CBC’s research identified up to $2.9 billion in operational savings from benchmarking productivity to other transit systems, some of which require working with labor partners to implement work rule changes.8

Importantly, the MTA also sets aside approximately 1 percent of its operating expenses from the Mortgage Recording Tax in annual contributions in the General Reserve, about $185 million in 2023, increasing to $210 million in 2027.9 This fund is a small buffer against the risks the agency faces in the coming years; it could cover the potential 2023 gap completely and between one-quarter and one-half of the 2024 to 2027 gaps. While helpful, this budgetary cushion is insufficient given the risks identified, and the MTA should consider whether the reserve should be gradually increased.

Download Report

What to Look for in the MTA’s November 2023 Financial PlanFootnotes

- The Payroll Mobility Tax rate was increased from 0.34 percent to 0.60 percent on businesses with NYC-based payroll costs at or above $437,500 in any calendar quarter, effective July 1, 2023. For self-employed individuals with net earnings of $50,000 in New York City, the rate was increased from 0.34 percent to 0.47 percent for the tax year ending no later than December 31, 2023, and to 0.60 percent for subsequent tax years. See: Metropolitan Transportation Authority, MTA 2024 Preliminary Budget: July Financial Plan 2024-2027 (Volume 1, July 2023), https://new.mta.info/document/115321.

- Metropolitan Transportation Authority, July 2023 Financial Plan Presentation (July 17, 2023), https://new.mta.info/document/115366, and BudgetWatch: October 2023, (October 2023), p. 2, https://new.mta.info/document/124481.

- Public Comment of Andrew Rein, President, Citizens Budget Commission on the Proposed Changes to the Metropolitan Transportation Authority’s Fares and Tolls, Submitted to the Metropolitan Transportation Authority (June 22, 2023), https://cbcny.org/advocacy/public-comment-proposed-changes-metropolitan-transportation-authoritys-fares-and-tolls.

- Office of the New York State Comptroller, Financial Outlook for the Metropolitan Transportation Authority (Report 9-2024, October 2023), https://www.osc.ny.gov/files/reports/pdf/report-9-2024.pdf.

- Metropolitan Transportation Authority, MTA 2024 Preliminary Budget: July Financial Plan 2024-2027 (Volume 1, July 2023), https://new.mta.info/document/115321.

- Alex Armlovich, “Light, at the Beginning of the Tunnel: What to Look for in the MTA 2021 July Financial Plan” Citizens Budget Commission Blog (July 20, 2021), https://cbcny.org/research/light-beginning-tunnel.

- Nora Nussbaum, “Watch the (MTA Budget) Gap! Operating Budget Is Worse Than It Appears” Citizens Budget Commission Blog (August 7, 2019), https://cbcny.org/research/watch-mta-budget-gap.

- Alex Armlovich, The Track to Fiscal Stability: Operations Reforms for the MTA (Citizens Budget Commission, May 25, 2021), https://cbcny.org/research/track-fiscal-stability.

- Metropolitan Transportation Authority, MTA 2023 Final Proposed Budget - November Financial Plan 2023-2026 Volume 2 (November 2023), https://new.mta.info/document/101136, and MTA 2024 Preliminary Budget: July Financial Plan 2024-2027 (Volume 1, July 2023), https://new.mta.info/document/115321.