When the Smoke Clears

Despite Continued Economic Strength, NYC Spent More Than It Received in 2019

In announcing the terms of the New York City Adopted Budget for Fiscal Year 2020, Mayor Bill de Blasio and City Council Speaker Corey Johnson noted that strong revenue growth has supported increased annual spending. What they did not point out was that the City’s spending obligations in fiscal year 2019 were $255 million greater than the revenues collected.[1]

How is this possible when State law and the City Charter require balanced budgets?

Related Content: What is a Balanced Budget?

Each year, the City prepays some of the following fiscal year’s expenses—what budget wonks call the “surplus roll.” Unused resources that accumulate during a fiscal year—the result of higher than anticipated revenues or lower than anticipated spending—are used to “prepay” bills that otherwise would be due in the following year, essentially “rolling” resources across fiscal years. Accounting rules allow this and it makes balancing the latter year’s City budget easier by reducing spending needs.2 Think about how paying January’s mortgage a month early in December because you have the extra cash makes next year easier on the pocketbook, even though it really does not change your obligations.

Adjusting for the impact of the annual surplus roll is necessary to understand the true spending obligation in any given fiscal year. At the end of fiscal year 2018, the City prepaid $4.576 billion in fiscal year 2019 expenses. This amount—the “roll in” to fiscal year 2019—exceeded the $4.221 billion “rolled out” in fiscal year 2019, with available money being used to prepay fiscal year 2020 expenses. Any time more money is rolled in than out means the City spent more than it collected in that year. In fiscal year 2019, the net difference was $255 million. (See Table 1.) Think about how ending the year with $1,000 in your bank account feels good, until you remember that you started the year with $2,000.

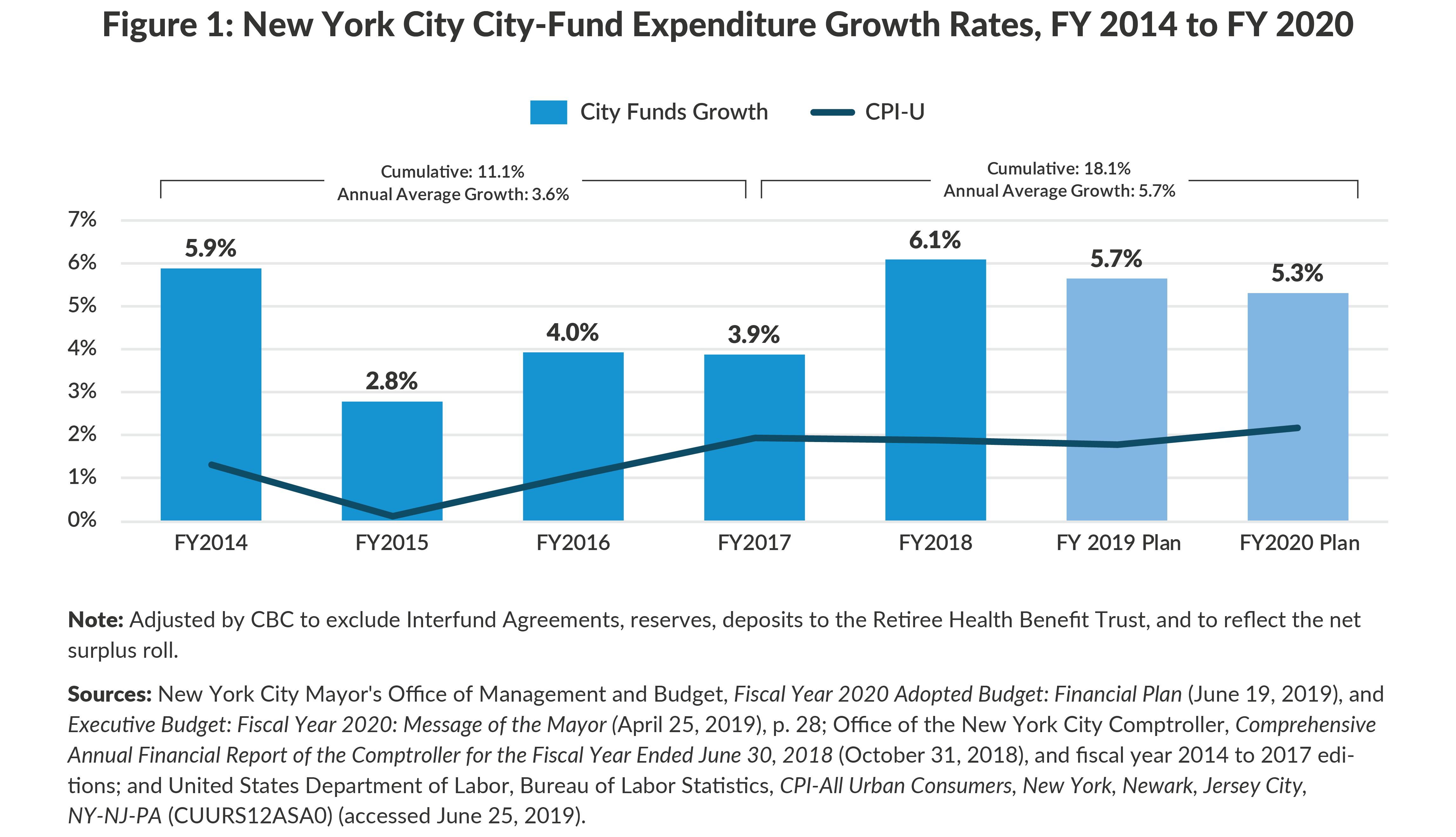

This shortfall is concerning since it suggests that the City’s level of spending is unsustainable even in a strong economy. Furthermore, spending growth is generally accelerating. City-funded expenditures grew 5.7 percent in fiscal year 2019 and are projected to increase 5.3 percent in fiscal year 2020, faster than the 3.6 percent annual average between fiscal years 2014 and 2017. (See Figure 1.) The city workforce also is projected to grow to a record level in fiscal year 2020—333,433 authorized positions, roughly 1,100 more positions than authorized for fiscal year 2019 despite the expansion of the partial hiring freeze.

The City has made efforts to restrain spending, but they are insufficient. The Mayor and Council Speaker should continue to identify opportunities to restrain spending much more, particularly in ways that improve productivity so that priority services are preserved.

Footnotes

- In addition to the $255 million in spending obligations, the City made an optional deposit of $100 million into the Retiree Health Benefits Trust.

- These prepayments are allowed under generally accepted accounting principles (GAAP) and do not trigger any violation of the New York State Financial Emergency Act for the City of New York.