Target School Aid to Avoid the Most Painful Cuts

New York State is facing profound impacts on public health, health care, economic activity, and public finances from COVID-19. The New York State Division of the Budget (DOB) reports that the State will reduce fiscal year 2021 local assistance spending by $8 billion from $69.7 billion to $61.7 billion in order to balance its budget. If that reduction is implemented, school aid, which represents $26.8 billion or 38 percent of state local assistance spending, will not be exempt from State spending cuts.

Prior to the pandemic and fiscal crisis, the Governor’s Executive Budget called for increasing school aid by $826 million in school year 2020-2021. As the April 1 deadline approached, the pandemic’s effects started to become clearer and the State Enacted Budget decreased State-funded school aid by $1.2 billion, using $1.2 billion in increased federal aid to hold total school aid flat. Compared to the $826 million increase included in the Executive Budget, State-funded school aid was $2 billion lower than the Executive Budget.

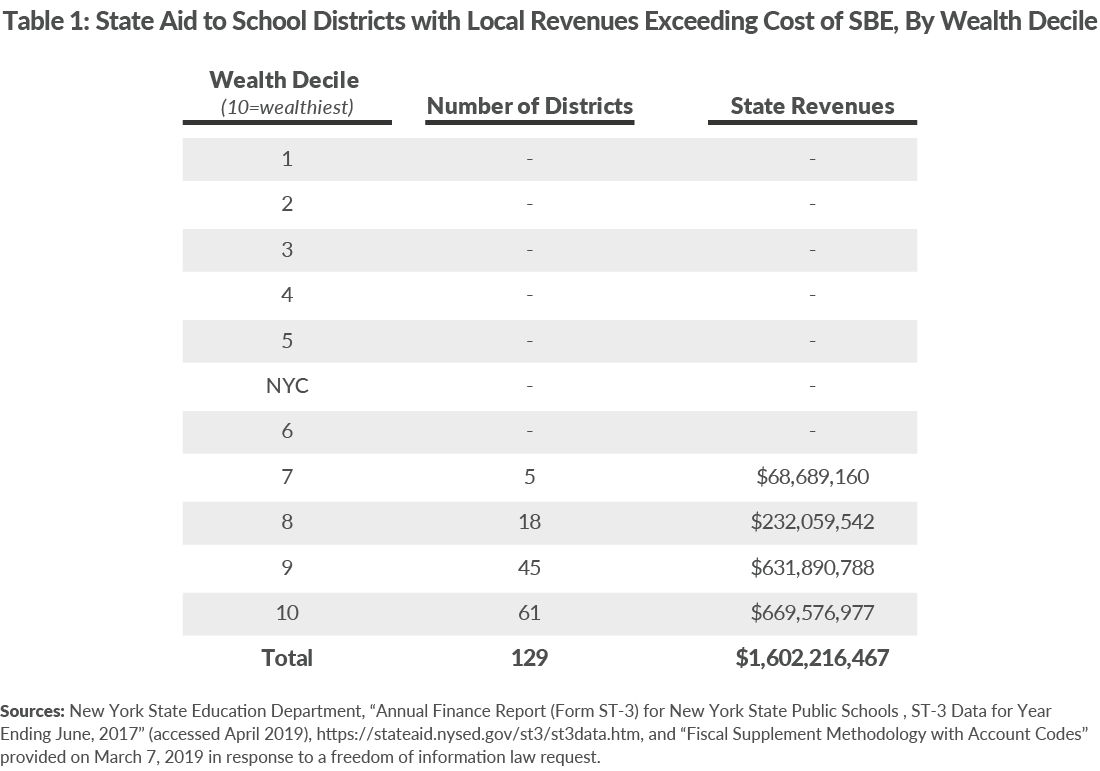

When the State crafts its gap-closing plan, it should focus on first ensuring that all districts have sufficient funds to provide a sound basic education (SBE), and reduce funds to districts that already have sufficient local resources to meet this requirement. In school year 2017-2018, the most recent year for which data exists, there were 129 school districts that received $1.6 billion in State aid despite raising enough local revenue to fund an SBE. More than 80 percent of the excess State aid went to the wealthiest 20 percent of school districts; there were no school districts in the 60 percent of least wealthy districts that raised enough local revenue to fund an SBE.1

As the State evaluates measures to close the budget gap, it should first ensure that districts that lack sufficient local resources to meet SBE standards receive the necessary funding. Decreases in funding should first target districts that do not need State aid to fund an SBE. Although cuts in State aid to these districts may require program adjustments, these districts will still have sufficient revenues to provide a constitutionally guaranteed SBE. (See table 1.)

In addition, the Executive Budget proposed to fold $1.8 billion in ten different types of education aid into Foundation Aid, which was a step in the right direction of consolidation of most types of school aid into one revenue stream.2 However, the Executive Budget fell short by preserving the ten aids’ allocation methods rather than making them need-based. For example, library, textbook, and software aids total $237 million and provide the same amount per pupil regardless of student need or district wealth. High tax aid totals $223 million and actually provides more aid to wealthier districts.3 By incorporating funding from these aids into a revised Foundation Aid formula, the State can reduce costs and ensure all districts have the necessary revenues to provide an SBE.

With the State budget being realigned, now is the time to revisit how New York distributes its school aid dollars by accounting for student need, district wealth, and total district revenues. Across-the-board cuts may be more politically palatable but will have a disproportionate impact on the less wealthy school districts that receive a greater portion of their revenues from the State.

Download Blog

Target School Aid to Avoid the Most Painful CutsFootnotes

- Testimony of David Friedfel, Director of State Studies, Citizens Budget Commission, before the New York State Senate Joint Standing Committees on Education and on Budget and Revenues, Testimony on the Distribution of the Foundation Aid Formula as it Relates to Pupil and District Needs (December 3, 2019), https://cbcny.org/advocacy/testimony-distribution-foundation-aid-formula-it-relates-pupil-and-district-needs.

- The ten aid types include BOCES Aid; Computer Software Aid; Special Services Aid; Computer Hardware Aid; High Tax Aid; Library Materials Aid; Charter School Transitional Aid; Academic Enhancement Aid; Textbooks Aid; and Supplemental Public Excess Cost Aid. See: Testimony of David Friedfel, Director of State Studies, Citizens Budget Commission, before the New York State Joint Legislative Budget Hearing on Elementary and Secondary Education, Testimony on Education Proposals in Executive Budget for Fiscal Year 2021 (February 10, 2020), https://cbcny.org/advocacy/testimony-education-proposals-executive-budget-fiscal-year-2021.

- David Friedfel, “Ripe for Reform,” (Citizens Budget Commission Blog, January 2, 2018), https://cbcny.org/research/ripe-reform.