Don’t Step Off the Cliff

Fiscal Cliffs and Budget Gaps in New York City’s Fiscal Year 2025 Preliminary Budget

Contents

Overview

Mayor Eric Adams’ Preliminary Fiscal Year 2025 Budget uses higher than previously projected revenue, in-year reserves and resources, and reductions in agency and asylum seeker spending not only to balance the proposed fiscal year 2025 budget and restore some previously announced Program to Eliminate the Gap (PEG) savings, but also to fund $2.5 billion of fiscal year 2024 programs that had been underbudgeted.1

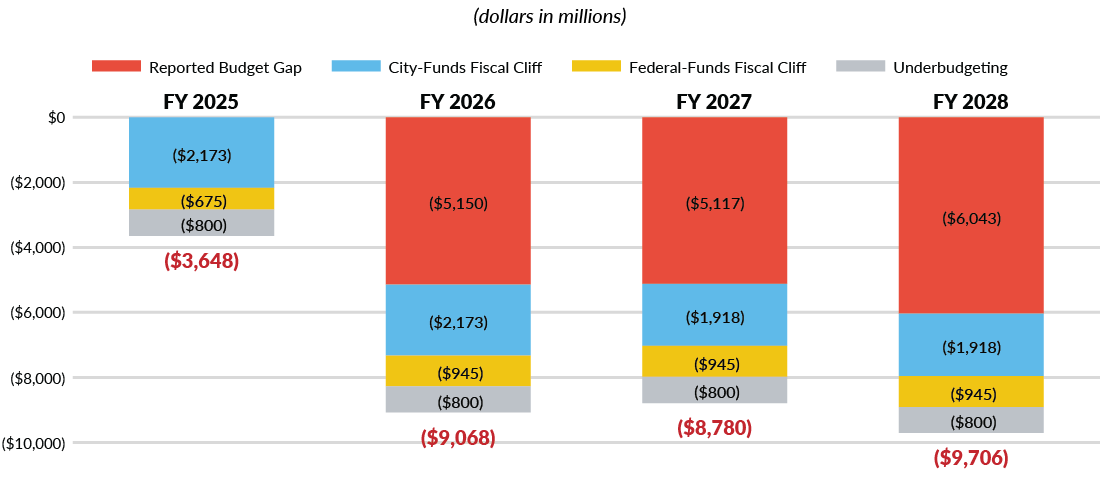

In fact, while the Mayor took important steps to improve budget transparency, the Citizens Budget Commission’s (CBC’s) analysis shows the Preliminary Budget’s planned spending in fiscal year 2025 is $3.6 billion short of what would be needed to fund programs and expenses at the current service level. (See Appendix Table.) Furthermore, the budget gaps in fiscal years 2026 through 2028—assuming ongoing programs will be fully funded—are understated by an estimated $3.7 billion to $3.9 billion, bringing them to $8.8 billion to $9.7 billion. (See Figure 1.)

To balance the fiscal year 2025 budget while also ensuring projected spending fully supports all planned programs, the City should implement an additional PEG in the Executive Budget and shrink or eliminate programs that the available resources cannot fully support.

Some have erroneously suggested that the Administration’s previously lower revenue estimates, higher projected cost of serving asylum seekers, and PEG restorations demonstrate that plenty of money is available—that the need for PEGs was significantly overstated and the City can afford to increase spending more. This is false. Even if revenue estimates had been increased and migrant costs decreased in November 2023 instead of January 2024, the magnitude of the savings plans to date would have been needed to fund current-year obligations and present a balanced Fiscal Year 2025 Preliminary Budget.

The current level of underfunding ongoing programs, which started in the years right before the pandemic and was increased by using federal COVID aid for recurring programs, has reached critical levels. This should stop. Substantially more transparency is needed to show which programs are not fully funded and whether the City plans to shrink or end those programs.

The Mayor made important and welcome progress improving budget transparency and accuracy by adding funds for Carter Cases, student transportation, and charter schools—areas of chronic underbudgeting—to fiscal years 2025 to 2028.2 He rightly presented these actions as needed improvements in transparency; spending to continue current service levels should be included for the budget to accurately reflect the City’s plans. Now, the City should build on that progress and finish the job. To be fully transparent, the budget should include funding for all planned programs and acknowledge that under- and un-funded programs will shrink or end.

Only when the budget is transparent—and completely and accurately funds the City’s planned programs—will the clear prospect of a fiscal reckoning encourage City leaders, both the Executive and the City Council, to make the hard and wise choices needed to prioritize key, impactful programs and increase government efficiency. This will create the fiscal stability needed for the City to ensure New York and New Yorkers thrive.

Examining the Fiscal Year 2025 Preliminary Budget and prior spending, CBC finds:

- The Preliminary Budget added $2.5 billion to fiscal year 2024 to fund fiscal cliff programs and underbudgeted expenses, including the CityFHEPs rental assistance program at the Department of Social Services (DSS), foster care services at the Administration for Children’s Services (ACS), and overtime at the uniformed agencies;

- The PEG restorations for fiscal years 2024 and 2025 total $194.9 million, or 5.2 percent of the November 2023 Plan PEG over the two years;

- Fiscal year 2025 projected spending does not include $3.6 billion needed to fully fund current and planned service levels, including:

- $2.2 billion for City-funds fiscal cliffs, including:

- $704 million for CityFHEPs;

- $200 million for homeless shelters; and

- $65 million for Early Intervention;

- $675 million for programs, almost entirely at the Department of Education (DOE), currently funded with federal COVID funds, such as:

- $60 million for Community Schools;

- $95 million for Pre-K Special Education;

- $13 million for bilingual education expansion; and

- $800 million from chronic underbudgeting of uniformed overtime ($655 million) and required MTA subsidies ($145 million);

- $2.2 billion for City-funds fiscal cliffs, including:

- Fiscal years 2026 through 2028 do not include sufficient funds for many of the same un- or under- budgeted fiscal year 2025 programs; it’s also missing $61 million in funding for administrative costs at the City’s nonprofit contractors, funded currently with federal COVID funds;

- Fully funding current services in fiscal years 2026 to 2028 would increase budget gaps for those years to between $8.8 billion and $9.7 billion; and

- Future revenues may be higher if the economic expansion continues to exceed forecasts; however, spending may also be higher if the City is required to fund the expansion of CityFHEPS, the State’s class size reduction mandate, and services for migrants in fiscal years 2027 and 2028 above projected levels.

To be fully transparent and stabilize the budget, the Administration should:

- Further reduce planned spending through a PEG for the Executive Budget;

- Fully fund underbudgeted and fiscal cliff programs to the extend resources are available, or explicitly identify which ones will be shrunk or eliminated; and

- Maintain balance in the fiscal year 2025 budget, as required, and present budget gaps that account for all planned services for fiscal years 2026 through 2028.

The City Council is critical to shaping the City budget and plays a large part in determining the City’s future fiscal stability. It should ensure that its proposals for added or modified spending are affordable based on fully funding or reducing the current set of planned programs.

The January Preliminary Budget Added $2.5 Billion in New Spending in Fiscal Year 2024, Primarily to Support Current Programs

The January Fiscal Year 2025 Preliminary Budget added $2.5 billion in fiscal year 2024 for what the City called “new needs.”3 Fully $1.4 billion was to mitigate the City-funds fiscal cliff, including $442 million for the CityFHEPS Rental Assistance program, $458 million for cash assistance at DSS, $81 million for childcare at ACS, and $16 million for the Subway Safety Plan at the Department of Homeless Services (DHS). Another nearly $560 million of City-fund fiscal cliff programs identified by the office of the State Comptroller (OSC) remain unfunded in fiscal year 2024.4

The budget also added $666 million to rectify underbudgeting of overtime at uniformed agencies and the City’s subsidy to the Metropolitan Transportation Authority (MTA). Overtime spending by uniformed agencies has historically been underbudgeted, with year-end costs exceeding adopted budgets by up to 50 percent.5 As of this January, the fiscal year 2024 overtime budget of $1.1 billion for the uniformed agencies had been fully spent, while five months remain in the fiscal year.6 Despite the $506 million increase in the Preliminary Budget, the overtime budget of the four uniformed agencies is still likely $324 million below what will be needed.7

The Preliminary Budget also added $390 million of new spending for fiscal year 2024 only. While some of this may support one-time expenditures, CBC found that $170 million, including $87 million for school nurses, $22 million for school cleaning, and $20 million for supportive housing at the Department of Health and Mental Hygiene (DOHMH) were likely to recur, creating new City-funds fiscal cliffs. Finally, $42 million of recurring spending was added to the budget for all years, such as a new inspector class at the Taxi and Limousine Commission.

Fiscal Year 2025 Planned Spending Is $3.6 Billion Below What it Would Cost to Maintain Current Program Levels

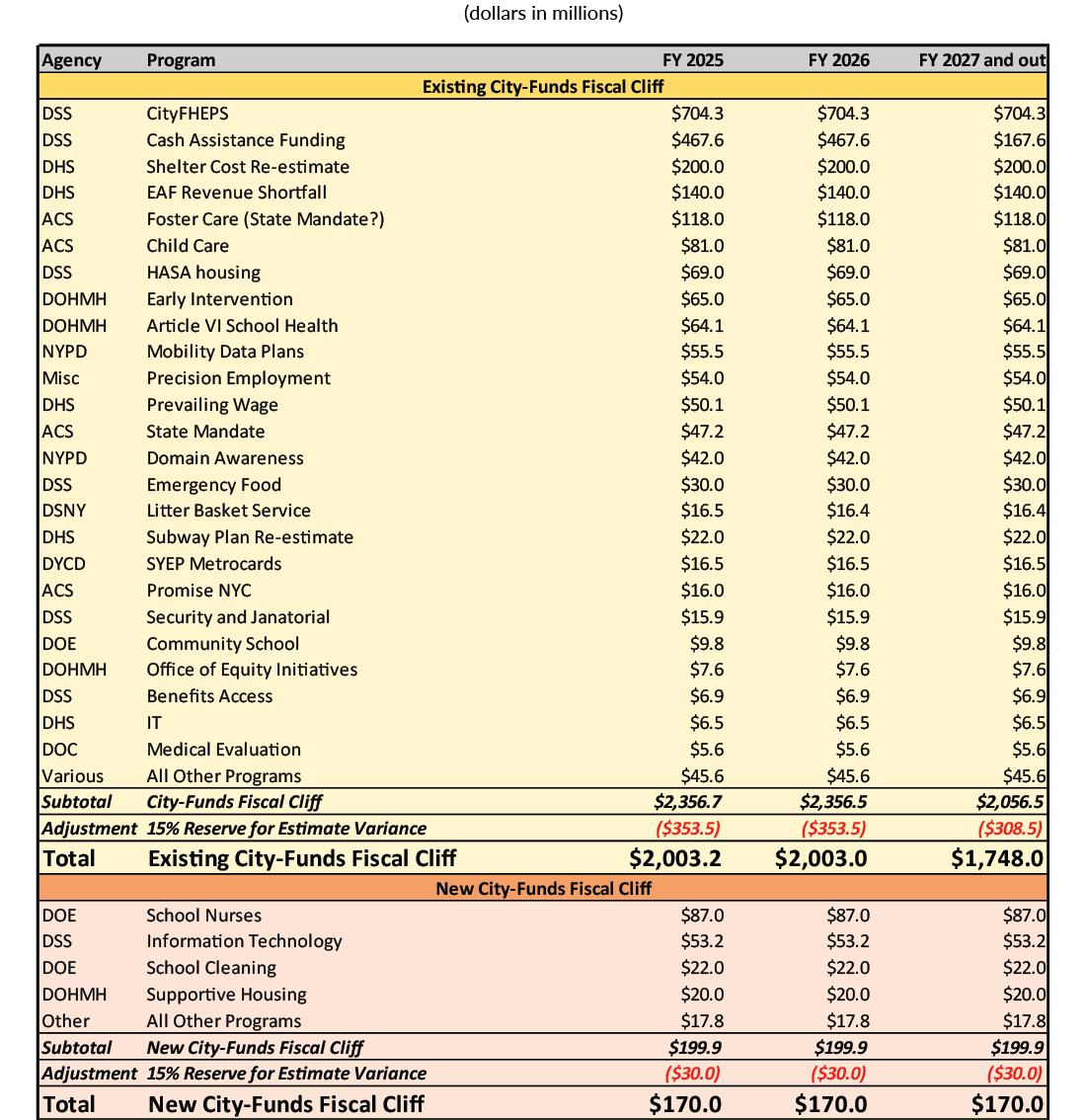

Examination of the City and federal COVID fiscal cliffs and chronic underbudgeting reveals that fiscal year 2025 has a $3.6 billion funding shortfall; in other words, the City would need to increase spending $3.6 billion to maintain current program levels. (See Appendix Table.) Alternatively, if the City were to explicitly shrink or eliminate programs and/or identify and increase efficiency to reduce costs, the planned spending could support the new level of planned programs.

This shortfall is comprised of City-funds fiscal cliffs, federal-funds fiscal cliffs, and chronic underbudgeting. Specifically:

- City-funds fiscal cliff of $2.2 billion includes:

- $704 million for the FHEPs housing voucher program (existing, not expanded program;

- $81 million for childcare;

- $69 million for housing for individuals with HIV/AIDs;

- $65 million for Early Intervention; and

- $17 million for litter basket service;

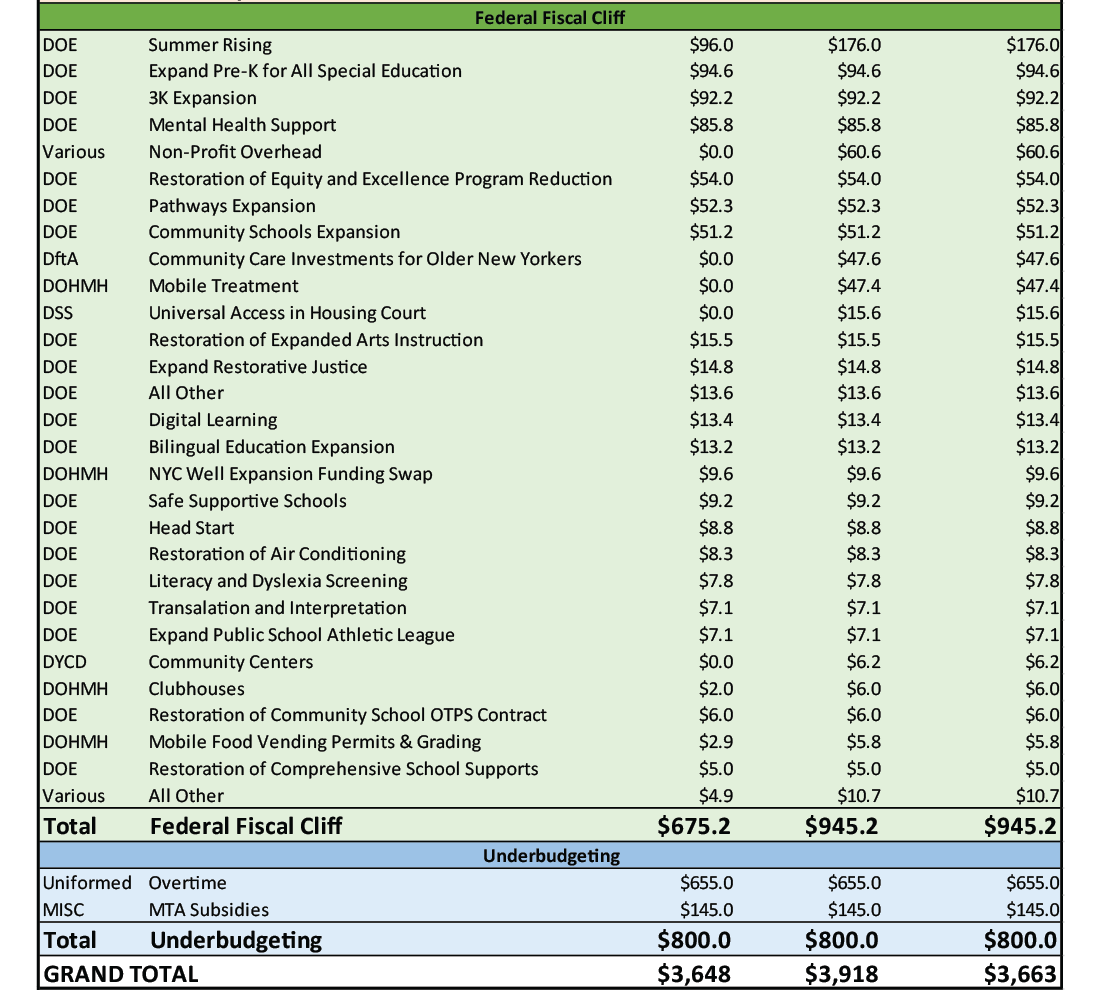

- The federal-funds fiscal cliff of $675 million, which is primarily for DOE programs, includes:

- $95 million to expand Pre-K for All Special Education programs;

- $86 million for mental health support;

- $60 million for Community Schools;

- $13 million for bilingual education; and

- Chronic underbudgeting of $800 million includes $655 million for uniformed overtime and $145 million for mandated MTA subsidies.

This level of underfunding has reached critical levels; the funds needed to sustain current programs far exceeds the $1.45 billion in the General and Capital Stabilization Reserves. Substantially more transparency is needed to show which programs are not fully funded and whether the City plans to shrink or end those programs.

To increase transparency, deliver critical services, and stabilize the budget, the City should prioritize and fund effective and impactful programs, shrink or eliminate less critical and effective programs, and increase efficiency. This will require hard choices, diligent management, and close collaboration with labor.

The Budget Gaps in Fiscal Years 2026 to 2028 Would Be $8.8 Billion to $9.7 Billion if Current Service Levels and Plans Are Fully Funded

The reported out-year budget gaps are $5.2 billion, $5.1 billion, and $6.0 billion in fiscal years 2026 to 2028, respectively.8 However, like fiscal year 2025, the financial plan does not include the funds needed to maintain current services. If funds were added to mitigate the City-fund fiscal cliff, federal-funds fiscal cliffs, and chronic underbudgeting, CBC estimates that budget gaps could be $9.1 billion in fiscal year 2026 and $9.7 billion in fiscal year 2028. (See Figure 1.)

Figure 1: CBC Projection of NYC Budget Gaps and Shortfalls to Maintain Current Services

CBC analysis of City of New York, Mayor's Office of Management and Budget, Fiscal Year 2025 Preliminary Budget: Reconciliation (January 16, 2024), Fiscal Year 2025 Preliminary Budget: Financial Plan Detail (January 16, 2024), and Fiscal Year 2025 Preliminary Budget: Departmental Estimates (January 16, 2024); Office of the New York State Comptroller, "Identifying Fiscal Cliffs in New York City's Financial Plan" (updated December 22, 2023, accessed February 6, 2024), and Review of the Financial Plan of the City of New York (Report 16-2024, December 2023); and Office of the New York City Comptroller, "Checkbook NYC: Data Feeds" (accessed January 22, 2024), and The State of the City's Economy and Finances (December 15, 2023).

Additional budget risks are significant and not reflected here. First, the expansion of eligibility for the CityFHEPs voucher program, enacted by the City Council’s override of the Mayor’s veto, could increase the program’s cost by $17.0 billion over 5 years, according to the Administration’s estimates.9 The City Council estimate is lower but still reaches $10.6 billion over 5 years.10 Second, full implementation of the State’s class size mandate will have significant costs to both the DOE’s operating and capital budgets.11 Third, the budget assumes asylum seeker costs decrease to $2.5 billion in fiscal year 2027 and $1.0 billion in fiscal year 2028; if the decrease is not as steep, the budget would be insufficient.12

Conversely, if the economy is stronger than expected, revenues may be higher than projected.

Executive Budget Should Be Fully Transparent and Include a PEG

To facilitate the necessary discussion and hard choices about which programs to prioritize, which to scale back, and which to end, the Fiscal Year 2025 Executive Budget should reflect the full spending needed to maintain all planned programs at planned levels. That level of directness and transparency is needed to foster a clear-eyed, fact-based conversation among elected officials, policy makers, advocates, and the public.

Absent changes, fiscal year 2025 would have a funding shortfall of $3.6 billion and fully funding the needs for all programs will increase the projected outyear budget gaps to $8.8 billion to $9.7 billion, according to CBC estimates. Given the City’s fiscal condition, the Administration should continue with its original plan to implement a PEG in the Fiscal Year 2025 Executive Budget.

Conclusion

Funding shortfalls and future gaps this large during an economic recovery are evidence that City’s fiscal position is extremely precarious. Artificially smaller budget gaps may be easier to abide by, but they dangerously mask the true challenge and minimize the need for swift and decisive action to reduce City spending.

Increasing transparency and making the hard choices is not only the responsibility of the Executive. The City Council has a very important role to play. While they invariably will have programs for which they want to increase funding, they first should do their part to ensure the budget fully funds planned programs or transparently shrinks or eliminates ones for which there are not resources. Only then, and with additional resources identified, should expansions be considered.

Appendix

City-Funds, Federal-Funds Fiscal Cliff, and Underbudgeting in the NYC Fiscal Year 2025 Preliminary Budget

Fiscal cliff estimate is based on a CBC analysis of "Identifying Fiscal Cliffs in NYC's Financial Plan," updated in December 2023, produced by the Office of the State Comptroller. CBC reconciled the reported cliffs as of November 2023 Financial Plan with the City's Fiscal Year 2025 Preliminary Budget and updated the cliff estimate for fiscal year 2025 and out as appropriate. If funding in FY 2024 was at least 90 percent of the cliff estimate, the lower amount was the new cliff going forward. Similarly, if a program was funded at 110 percent or more of the cliff amount, the higher level is the cliff going forward. For cash assistance, the cliff is increased by $300 million in fiscal year 2025 and 2026 to reflect higher spending in fiscal year 2024 and lower budgeted levels in those years. New funding added to just fiscal year 2024 was considered a new fiscal cliff if it was likely to recur based on the limited description available. The federal fiscal cliff for Summer Rising was reduced by $80 million in fiscal year 2025 only, to reflect increased City funding. The overtime estimate is based on fiscal year 2024 overtime spending at the four uniformed agencies as of January 2024, projected through the end of the fiscal year, compared to budgeted funding in fiscal year 2025 and beyond. MTA subsidy was based on reports by the Office of the New York City Comptroller and the Office of the New York State Comptroller. For the City-funds cliff, to account for limited details and year-to-year variation in spending, the projected cliff was reduced by 15 percent.

CBC analysis of City of New York, Mayor's Office of Management and Budget, Fiscal Year 2025 Preliminary Budget: Reconciliation (January 16, 2024), Fiscal Year 2025 Preliminary Budget: Financial Plan Detail (January 16, 2024), and Fiscal Year 2025 Preliminary Budget: Departmental Estimates (January 16, 2024); Office of the New York State Comptroller, "Identifying Fiscal Cliffs in New York City's Financial Plan" (updated December 22, 2023, accessed February 6, 2024), and Review of the Financial Plan of the City of New York (Report 16-2024, December 2023); and Office of the New York City Comptroller, "Checkbook NYC: Data Feeds" (accessed January 22, 2024), and The State of the City's Economy and Finances (December 15, 2023).

Footnotes

- City of New York, Mayor’s Office of Management and Budget, January 2024 Financial Plan Detail: Fiscal Years 2024 – 2028 (January 16, 2024), https://www.nyc.gov/assets/omb/downloads/pdf/tech1-24.pdf.

- Carter Cases are reimbursement of private school tuition for students with disabilities. See: Yolanda Smith, “Carter Case” Spending for Students with Special Needs Continues to Grow Rapidly (Independent Budget Office, March 2021), https://ibo.nyc.ny.us/iboreports/carter-case-spending-for-students-with-special-needs-continues-to-grow-rapidly-march-2021.pdf.

- City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2025 Preliminary Budget: Reconciliation (January 16, 2024), https://www.nyc.gov/assets/omb/downloads/pdf/jan24-fprecon.pdf.

- Office of New York State Comptroller, “Identifying Fiscal Cliffs in New York City’s Financial Plan,” (December 22, 2023, accessed February 6, 2024), https://www.osc.ny.gov/reports/osdc/identifying-fiscal-cliffs-new-york-citys-financial-plan.

- Ana Champeny, Overboard on OT (Citizens Budget Commission, August 17, 2017), https://cbcny.org/research/overboard-ot.

- This refers to the cumulative civilian and uniformed overtime at the four agencies, not each individual agency. Some agencies have exceeded the budgeted levels, while others have not. CBC analysis of City of New York, Mayor's Office of Management and Budget, Fiscal Year 2025 Preliminary Budget: Reconciliation (January 16, 2024), https://www.nyc.gov/assets/omb/downloads/pdf/jan24-fprecon.pdf and Fiscal Year 2025 Preliminary Budget: Departmental Estimates (January 16, 2024), https://www.nyc.gov/assets/omb/downloads/pdf/de1-24.pdf; and Office of the New York City Comptroller, "Checkbook NYC: Data Feeds" (accessed January 22, 2024), https://www.checkbooknyc.com/data-feeds.

- CBC analysis of City of New York, Mayor's Office of Management and Budget, Fiscal Year 2025 Preliminary Budget: Reconciliation (January 16, 2024), https://www.nyc.gov/assets/omb/downloads/pdf/jan24-fprecon.pdf and Fiscal Year 2025 Preliminary Budget: Departmental Estimates (January 16, 2024), https://www.nyc.gov/assets/omb/downloads/pdf/de1-24.pdf; and Office of the New York City Comptroller, "Checkbook NYC: Data Feeds" (accessed January 22, 2024), https://www.checkbooknyc.com/data-feeds.

- City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2025 Preliminary Budget: Financial Plan Detail (January 16, 2024), https://www.nyc.gov/assets/omb/downloads/pdf/tech1-24.pdf.

- City of New York, Office of the Mayor, Statement Following CityFHEPS Council Vote (press release, May 25, 2023), https://www.nyc.gov/office-of-the-mayor/news/363-23/statement-following-cityfheps-council-vote.

- Council of the City of New York, Finance Division, Fiscal Impact Statement: Proposed Intro. No: 229-A (May 24, 2023), https://legistar.council.nyc.gov/View.ashx?M=F&ID=12022609&GUID=A5CBA85B-8652-4584-85E7-A8F62BCA8AC5

- NYC Public Schools, Class Size Working Group – Meeting #2 (May 3, 2023), https://drive.google.com/file/d/1I8nrtc5wa23T-QOBz3Tsb7_6dsujO1hw/view.

- City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2025 Preliminary Budget: Financial Plan Detail (January 16, 2024), https://www.nyc.gov/assets/omb/downloads/pdf/tech1-24.pdf.