Excelsior!

New York State Spending Growth Continues

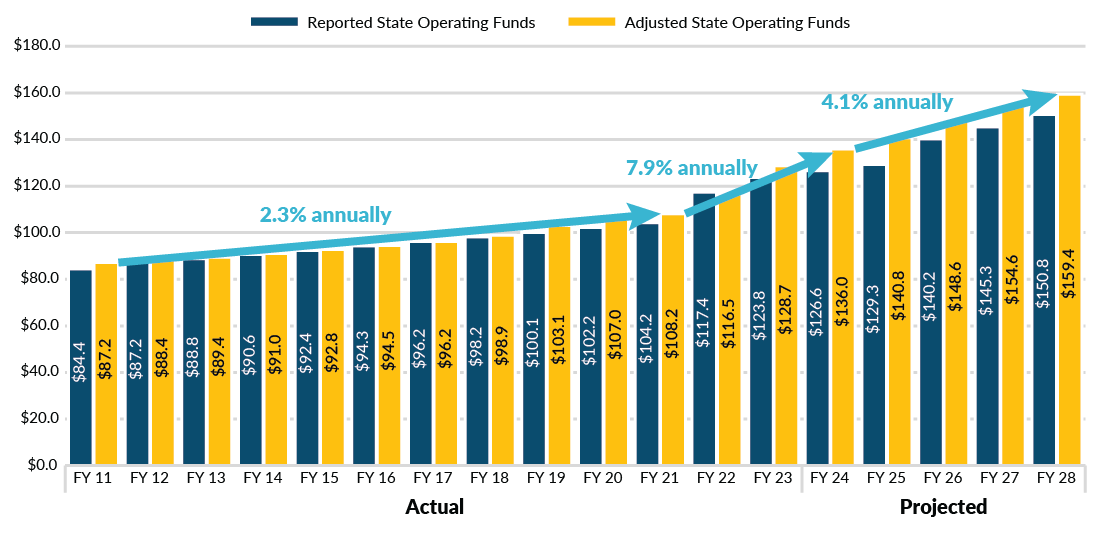

Buoyed by an extraordinary increase in tax receipts at the onset of the COVID-19 pandemic, exceptional federal aid, and temporary tax increases, State spending has vastly increased since fiscal year 2021. While slowing the trend a bit, Governor Kathy Hochul's Fiscal Year 2025 Executive Budget would continue to increase spending next year and in the future. (See Figure 1.)

With this rapid spending growth supported only temporarily by extraordinary receipts, the State faces a $9.9 billion budget gap in fiscal year 2028, which masks an even larger $16 billion structural imbalance. The State’s fiscal stability rests on restraining spending more, rather than inflaming the problem by additional unsustainable spending. Furthermore, additional tax increases would weaken the State’s competitiveness.

The key measure of State spending is State Operating Funds (SOF), which excludes capital spending and federal aid, except for certain COVID federal aid that offset State costs. (See Figure 1 Notes.) The Citizens Budget Commission’s (CBC’s) analysis found that:

- From fiscal year 2021 to fiscal year 2024, SOF spending grows $26 billion, or an average of 7.9 percent annual growth;

- Fiscal year 2025 SOF spending is projected to increase 3.5 percent, after accounting for the Executive Budget’s significant savings initiatives;

- Without the Governor’s proposed savings in Medicaid and school aid, spending would grow 4.9 percent in fiscal year 2025;

- Going forward, between fiscal years 2024 and 2028 the average annual SOF spending growth rate is 4.1 percent, increasing spending over the period another $23 billion;

- Without the Medicaid and school aid savings, spending growth would be 4.7 percent annually over the life of the financial plan; and

- SOF spending is projected to grow $51 billion over the 8 years between fiscal years 2021 and 2028, more than 2.5 times the $19 billion total growth of the prior 8 years;

- This is before the possible addition of spending in the enacted budget;

- To close the State’s structural imbalance, SOF spending growth would need to be kept to 1.5 percent annually over the life of the financial plan.

- The State currently projects a $9.9 billion budget gap in fiscal year 2028. The budget for fiscal year 2028 relies on $6.4 billion in nonrecurring resources from pre-payments, rolled resources, and temporary tax increases. Accounting for these non-recurring resources reveals a structural imbalance of $16.4 billion.

Unless this year radically departs from previous patterns, the forthcoming Legislative one-house budgets will look to add billions of dollars in spending above the Governor’s proposal.

The enacted budget, however, should restrain spending to put the State on a path to budget balance. Forward-looking budget choices this year—namely not layering on further tax and spending increases—would relieve the building budget pressure and stave off a potentially harsh fiscal reckoning.

Figure 1: NYS State Operating Funds Spending, Reported and Adjusted (dollars in billions)

“Reported State Operating Funds” represents actual and projected SOF spending—which does not include COVID-related or any other federal funds—on a cash basis without any adjustments. “Adjusted State Operating Funds,” calculated by CBC staff, serves as the basis for this brief’s narrative. The adjustments to Reported SOF Spending include accounting for off-budget shifts, reclassifications, payment delays, pre-payments, certain federal aid that temporarily offsets State costs, and other maneuvers which shift spending across funds or across years. This provides a more consistent and complete analysis of State spending trends dating back to fiscal year 2011.

CBC staff analysis of New York State Division of the Budget, FY 2025 NYS Executive Budget Financial Plan (January 2024), and prior editions.