No Extension without Evaluation

Reject Proposed Extension of Certain NYC Economic Development Tax Breaks Absent Appropriate Analysis

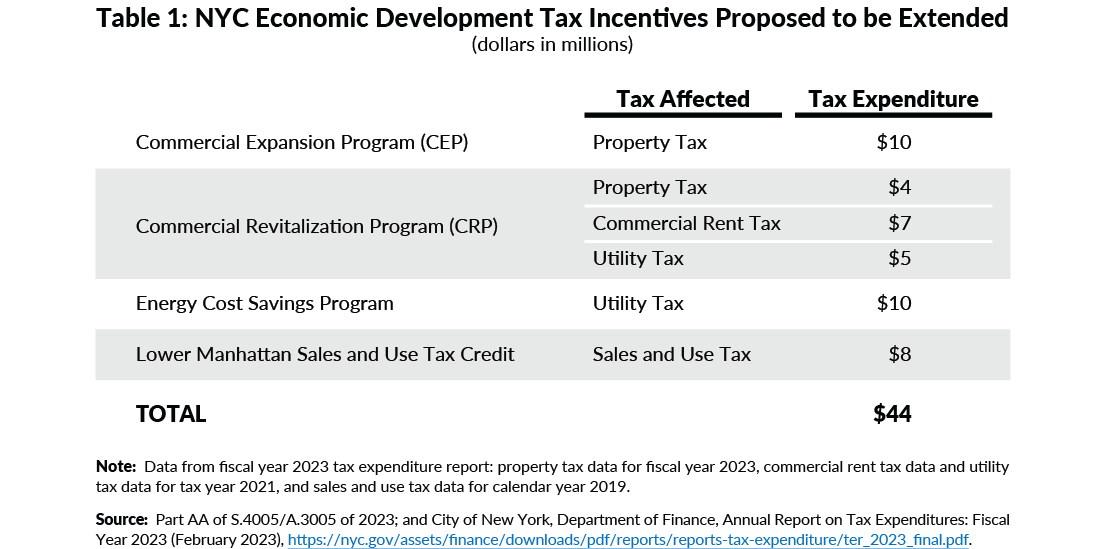

Governor Kathy Hochul's Fiscal Year 2024 Executive Budget proposes a five-year extension for a package of New York City tax incentives that costs the City an annual $44 million in foregone revenue. An incentive should not be extended absent a rigorous evaluation of its effectiveness and efficiency and an analysis demonstrating it is needed to meet current and future goals. In fact, prior evaluations found two of these programs to be ineffective; the bar to justify their extension should be appropriately higher.

The programs were intended to increase the development and occupancy rate of commercial real estate by attracting and retaining office and retail tenants in specific areas, particularly Lower Manhattan and the Garment District. Enacted by New York State in 1995 and 2000, the programs have been renewed repeatedly by the State Legislature even as the City’s economy overall and in these areas evolved.1 The programs include:

- The Commercial Revitalization Program (CRP) and Commercial Expansion Program (CEP), which provide property tax reductions for owners of buildings with qualifying office and retail leases, and commercial rent tax reductions for qualifying leaseholders;

- A sales tax exemption for certain purchases to furnish and equip eligible commercial office space in Lower Manhattan; and

- A reduction in energy costs in eligible industrial and commercial space, which is facilitated by the utility provider who recoups the reduction through its tax liability to the City.

Together, these programs cost New York City $44 million annually in foregone revenue from property taxes ($14 million), utility taxes ($15 million), commercial rent taxes ($7 million), and sales taxes ($8 million). (See Table 1.)

The Executive Budget proposes to extend the Commercial Revitalization Program, the Energy Cost Savings Program, and the Lower Manhattan Sales and Use Tax Credit by five years, and the Commercial Expansion Program by six years. The new expiration dates would be during 2028 and 2029. Existing beneficiaries would continue to receive benefits for the current terms of the incentive, regardless of whether the programs are extended on not.

Analysis is necessary to demonstrate the efficacy and cost-effectiveness of economic development incentive programs and should inform decisions to extend and or modify programs.2 The New York City Council passed Local Law 18 of 2017 that directs the New York City Independent Budget Office (IBO) to perform an independent evaluation of City economic development tax breaks on a schedule agreed to by the IBO and the City Council.3 The IBO has completed two evaluations to date. New York State also enacted a law requiring the Department of Tax and Finance to contract out for a comprehensive evaluation of economic development incentives, including determining the return on investment; this study is currently underway.4

In 2018, the IBO evaluated CRP and CEP and found that neither program significantly improved office vacancy rates or employment in Lower Manhattan compared to non-participating areas, such as Midtown.5 As the report found the programs ineffective, City Council leadership at the time called for the CEP and CRP incentives to be phased out.6 Nonetheless, the State Legislature renewed the programs in 2020 for three years.

Conclusion

Any extension or expansion of an existing tax expenditure should be supported by a prospective model of its impacts and justified by an evaluation that determines whether the tax expenditure achieved its purpose, was needed to induce behavior that would not have occurred otherwise (such as increased investments in targeted areas), or subsidized activity that would normally occur. For programs like CEP and CRP, existing evaluations should inform the Legislature’s decision of whether to extend, amend, or sunset these programs.

Download Blog

No Extension without EvaluationFootnotes

- Most NYC tax law, including exemption programs, is set by the State. The City is not able to create or modify these programs directly.

- Riley Edwards, Managing Economic Development Programs in New York City: An Assessment of Progress (Citizens Budget Commission, January 2, 2018), https://cbcny.org/research/managing-economic-development-programs-new-york-city; Tammy Gamerman, “Economic Development Bigger in State Budget, But Benefits Unclear,” Citizens Budget Commission Blog (April 15, 2015), https://cbcny.org/research/economic-development-bigger-state-budget-benefits-unclear; and Testimony of Patrick Orecki, Director of State Studies, Citizens Budget Commission, Testimony on the Effectiveness of NYS Economic Development Programs, submitted to the NYS Senate Standing Committee on Finance, the NYS Senate Standing Committee on Commerce, Economic Development and Small Business, and the NYS Senate Standing Committee on Investigations and Government Operations (January 14, 2022), https://cbcny.org/advocacy/testimony-effectiveness-nys-economic-development-programs.

- City of New York, Local Law 18 of 2017, http://nyc.legistar1.com/nyc/attachments/5ef6c419-d8fe-4755-8d9c-143c79ed5b1d.pdf.

- New York State Tax Law, Chapter 60, Article 8, Section 180, https://www.nysenate.gov/legislation/laws/TAX/180.

- Arash Farahani, Worth the Cost?: An Examination of the Commercial Revitalization & Commercial Expansion Programs (New York City Independent Budget Office, November 2018), https://ibo.nyc.ny.us/iboreports/worth-the-cost-an-examination-of-the-commercial-revitalization-commercial-expansion-programs-november-2018.pdf.

- New York City Council, “Speaker Corey Johnson and Finance Committee Chair Daniel Dromm Welcome IBO’s Worth The Cost? Analysis and Call for the Phase-Out of the Commercial Revitalization and the Commercial Expansion Programs” (press release, November 14, 2018), https://council.nyc.gov/press/2018/11/14/1664/.