A Premium Option

School Districts Can Save $850 Million By Following the State’s Lead on Health Insurance

Introduction

In response to New York State’s fiscal year 2022 budget gap, the Executive Budget calls for a change to the composition of school funding. The fiscal year 2022 Executive Budget proposes reducing districts’ state aid by $1.35 billion and aid for school expenses by $485 million.1 While this decrease is offset by an increase in federal aid delivered to schools as part of the Coronavirus Response and Relief Supplemental Appropriations Act, the stimulus package passed in December 2020, federal funding will expire after 2022. State aid reductions, meanwhile, are recurring and leave total school aid in outyears essentially flat from fiscal year 2021 levels.2

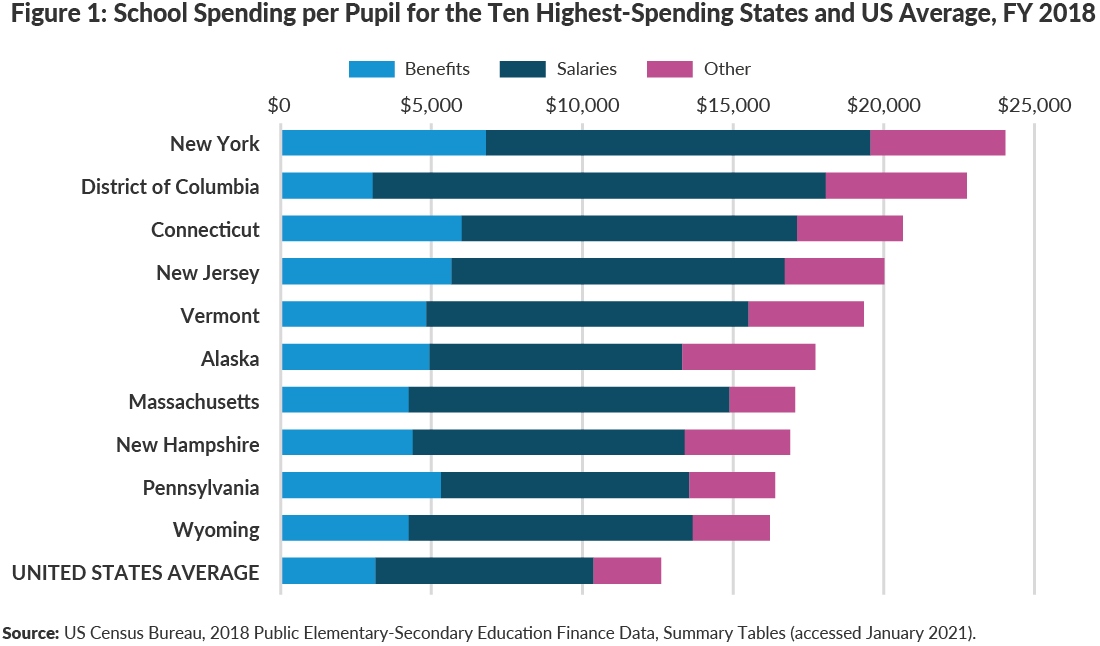

While the Executive Budget and federal aid affect upcoming changes in school funding, spending in New York State on education generally is far more than in other states. In fiscal year 2018, New York’s State and local governments spent $24,040 per public elementary and secondary school pupil, the highest level in the country and nearly twice the national average of $12,612. Employee benefits, which include health insurance coverage, are a major driver of this spending difference; New York spent $6,813 per pupil on benefits, 116 percent higher than the national average.3 (See Figure 1.)

To address their own fiscal stress, New York’s 673 school districts should examine all areas of spending, including the high rate of spending on public school health benefits, to find efficiencies and contain costs in the face of stagnant or decreasing State aid and localities’ looming budget gaps. In total, New York’s school districts spend $7 billion annually on health insurance for employees, their families, and retirees.4

Each school district independently determines health insurance premium shares, plans, and costs, leading to wide variation across the state. In New York City nearly all Department of Education employees, like other City employees, choose a health plan that does not require a contribution toward the premium cost. Outside of New York City, the average employee premium contribution rate for school districts is 14 percent for single coverage and 16 percent for family coverage. These contribution rates are lower than those required by many of New York’s private sector employers; in 2019 employee contributions averaged 21.3 percent for single coverage and 22.5 percent for family coverage.5

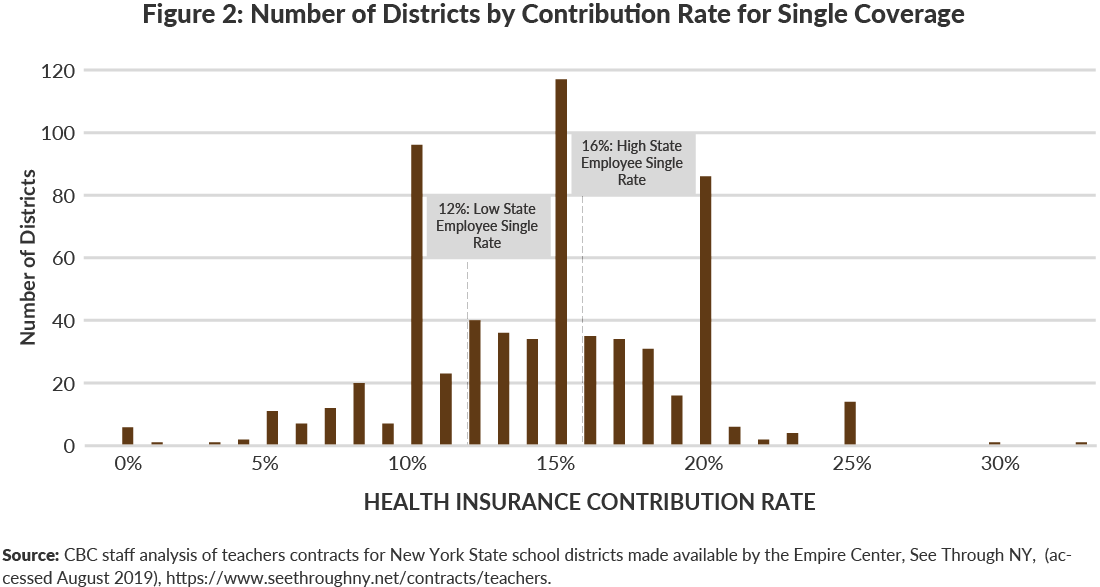

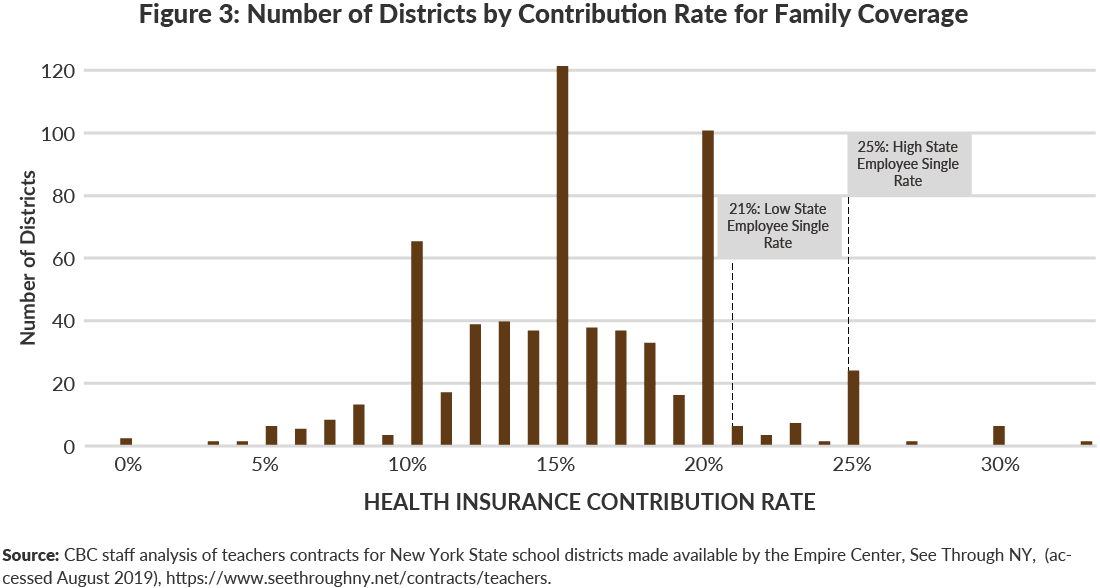

Premium-sharing rates for school district employees also generally are lower than those for New York State employees, which are 12 or 16 percent for single coverage and 21 or 25 percent for family coverage, depending on salary.6 If all New York school district employees contributed the same share of premiums as State employees, districts could save $846 million annually. New York City accounts for about half of total savings—$426 million in 2019—because it is the State’s largest school district and currently does not require an employee premium share.7 The rest of the State’s school districts could save a combined $419 million.8

School District Employees’ Premium Sharing Since 2010

The Citizens Budget Commission (CBC) first reported on school district premium-sharing arrangements in 2011.9 Examining teacher contracts for the 2009-2010 academic year, CBC calculated employees in 52 percent of school districts paid at least 10 percent of premiums for single coverage—the State employee standard at the time. However, just 20 percent of districts shared premium costs at or above the State employee rate for family coverage of 18.6 percent.10

Since 2010, many school districts have increased employee premium shares. However, these increases have not kept pace with the rising premium shares paid by State employees overall. As a result, fewer districts now have premium sharing rates at or above State employee levels, increasing the savings possible by matching the State’s rate.

School districts have increased the employee share for single coverage more than for family coverage. Between 2010 and 2019, 80 percent of districts increased the employee contribution for single coverage, while just 16 percent of districts increased the share for family coverage. Average single coverage premium-sharing rates rose from 7.8 to 14.4 percent; family coverage rates rose from 14.2 to 15.7 percent between 2010 and 2019.11

At the same time, the State employee premium sharing rate for single coverage rose by 6 percentage points from 10 percent to 16 percent for employees earning more than $47,000, a salary level exceeded by most school district employees. For employees earning less, the single coverage contribution rate rose 2 percentage points to 12 percent. Premium-sharing rates for family coverage rose from 18.6 percent in 2010 to 21 percent for those earning less than $47,000 and to 25 percent for those above $47,000.12

In 2019, two-thirds of districts—employing 75 percent of the State’s total school district employees—had premium-sharing rates below the 16 percent contributed by higher-earning State employees for single-person coverage. (See Figure 2.) For family coverage nearly all school districts fell below the State employees’ contribution rate; premium-sharing met or exceeded the State level in just 5 percent of districts. (See Figure 3.) The vast majority of districts, 569 in 2019, have the same contribution rates for single and family coverage.13

Conclusion

School districts in New York spend more on both employees’ salaries and benefits than other districts in the country. As New York State takes steps to close its budget gap for the upcoming fiscal year, school districts may need to identify savings to offset the impact of State aid actions. Savings achieved by increasing employees’ health insurance premiums to the State employee level would not reduce spending directly on classroom instruction. While many districts have increased their employees’ share of health insurance premium costs over the past decade, the potential savings by matching school health insurance to State employee benchmarks has increased compared to 10 years ago, from $500 million in 2011 to $846 million in 2019. This is the result of higher premium-sharing rates for New York State employees and rising healthcare costs, as well as the New York City’s continued policy that does not require employees to contribute to premium costs.14

Appendix

Estimating Savings from Increasing School District Employee Premium Shares

This analysis estimates potential savings from increasing school district employee contribution rates to State employee benchmarks. First, CBC staff compiled the most recent teacher contracts for every district in New York State made available through the Empire Center’s SeeThroughNY. Using these district-level premium-sharing rates and school health expenditure data for the New York State Education Department, CBC staff estimated employees’ current premium contributions at each district. Because the State has an income-based premium-sharing arrangement, CBC staff use data on school district personnel from the New York State Education Department to estimate the share of employees in each district earning less than $47,000 to then calculate expected average premium contributions rates for the entire district. Estimates also assume that increasing employee premium shares will not change the number of employees enrolling in plans and that 40 percent of employees are enrolled in single plans and 60 percent are enrolled in family plans. CBC staff assumed premium-sharing arrangements specified in teacher contracts were generally uniform for all school district personnel.

For districts with contribution rates below State benchmarks, CBC staff estimated premium contributions if school employees contributed at the same levels as State employees. The total gap between current and State premium-sharing levels for all districts provides the estimated potential savings from the raising school health insurance contribution rates to State benchmarks.

Footnotes

- The FY 2022 Executive Budget proposes reducing expense-based school aid by $693 million for the full school year; the value of this change in the fiscal year, relative to prior projections is $485 million. See: Patrick Orecki, Balancing Act: Alternatives that Balance the NYS Budget without Raising Income Taxes (Citizens Budget Commissions, February 10, 2021), https://cbcny.org/research/balancing-act.

- Patrick Orecki, Balancing Act: Alternatives that Balance the NYS Budget without Raising Income Taxes (Citizens Budget Commissions, February 10, 2021), https://cbcny.org/research/balancing-act.

- US Census Bureau, 2018 Public Elementary-Secondary Education Finance Data, Summary Tables (accessed January 2021), https://www.census.gov/data/tables/2018/econ/school-finances/secondary-education-finance.html.

- New York State Education Department Fiscal Analysis and Reporting Unit, Fiscal Profiles, 2017-2018 (accessed January 2020), http://www.oms.nysed.gov/faru/Profiles/profiles_cover.html.

- If school districts matched these large private employer rates, the health expenditure savings rates would be about the same as if they matched State employee levels, with higher contributions for single coverage and slightly lower contributions for family coverage. Source: Agency for Healthcare Research and Quality, Medical Expenditure Panel Survey, 2019, Table II.C.3 and Table II.D.3, (accessed February 10, 2020), https://www.meps.ahrq.gov/mepsweb/data_stats/quick_tables_search.jsp?component=2&subcomponent=2.

- State employee premium shares depend on employees’ salaries. Employees below grade 10 (about $47,000 in 2019) contribute 12 percent for single coverage and 27 percent of the additional cost of dependent coverage for family plans. Above that threshold, contribution rates rise to 16 and 31 percent, respectively. Because family premium shares are marginal to the cost of single coverage—not shares of total premium costs—State employees contribute 21 and 25 percent (for employees earning above and below $47,000, respectively) of the total cost of family premium sharing.

- These estimates reflect the gap between school health expenditures under employees’ current premium cost-sharing arrangement and hypothetical expenditures if employees contributed at the same levels as State employees. A recent CBC report proposed two alternative models for the New York City municipal workforce. One would implement contribution rates for New York City school and other employees earning less than $65,000 to 6 percent for single coverage and 8 percent for family coverage. Employees earning more than $65,000 would pay 14 percent for single coverage and 16 percent for family coverage. These proposals would save the City $675 million annually. The second used contribution rates of 10 percent for single coverage and 25 percent for family coverage, which would save around $1.1 billion annually. For more see: Ana Champeny and Maria Doulis, How to Make $1 Billion in Labor Savings Real & Recurring (Citizens Budget Commission, September 2, 2020), https://cbcny.org/research/how-make-1-billion-labor-savings-real-recurring.

- New York City Department of Education payroll data differs from that provided by the State, as State data may not include some clerical and auxiliary positions. For statewide comparability, this report uses data available from New York State. See: New York State Education Department Information and Reporting Service, Personnel Master File, 2017-2018 (accessed January 2020), http://www.p12.nysed.gov/irs/pmf/; Empire Center, See Through NY, (accessed August 2019), https://www.seethroughny.net/contracts/teachers; and New York State Education Department Fiscal Analysis and Reporting Unit, Fiscal Profiles, 2017-2018 (accessed January 2020), http://www.oms.nysed.gov/faru/Profiles/profiles_cover.html.

- Elizabeth Lynam and Selma Mustovic, “School Districts Savings by Following State Practices for Employee Health Insurance,” Citizens Budget Commission Blog (February 1, 2011), https://cbcny.org/research/school-districts-savings-following-state-practices-employee-health-insurance.

- This sum represents New York City’s potential school district savings at the contribution rates currently used by New York State. Additional savings could be achieved if similar contribution rates are extended to by labor negotiations to other parts of New York City government, as is true in New York State’s other dependent school districts. Two such proposals were presented in a recent CBC report. See: Ana Champeny and Maria Doulis, How to Make $1 Billion in Labor Savings Real & Recurring (Citizens Budget Commission, September 2, 2020), https://cbcny.org/research/how-make-1-billion-labor-savings-real-recurring.

- In 2011 State employees contributed 25 percent of the additional cost of dependent coverage. Single coverage was 10 percent, and family contributions were 18.6 percent of the total premium cost. Numbers differ from the 2011 analysis, which did not account for the fact that the cost of dependent coverage is marginal to the cost of single coverage. See: Elizabeth Lynam and Selma Mustovic, “School Districts Savings by Following State Practices for Employee Health Insurance,” Citizens Budget Commission Blog (February 1, 2011), https://cbcny.org/research/school-districts-savings-following-state-practices-employee-health-insurance.

- Empire Center, See Through NY, (accessed August 2019), https://www.seethroughny.net/contracts/teachers and Elizabeth Lynam and Selma Mustovic, “School Districts Savings by Following State Practices for Employee Health Insurance,” Citizens Budget Commission Blog (February 1, 2011), https://cbcny.org/research/school-districts-savings-following-state-practices-employee-health-insurance.

- State employee premium shares depend on employees’ salaries. Employees below grade 10 (about $47,000 in 2019) contribute 12 percent for single coverage and 27 percent of the additional cost of dependent coverage for family plans. Above that threshold, contribution rates rise to 16 and 31 percent, respectively.

- For 2019 premium-sharing rates are available for 641 of the state’s 674 districts, with the remaining districts either lacking data or using a non-standard arrangement, such as fixed-dollar contribution amounts. Data For both 2011 and 2019 is available for 608 districts.