Target and Tighten

The Sustainable Path for School Aid Growth in New York

Contents

Introduction

New York State’s budget growth has accelerated in recent years: State Operating Funds (SOF) spending grew 7.9 percent annually from fiscal year 2021 to fiscal year 2024.1 State school aid is one of the main contributors to this growth, increasing 6.7 percent per year, or $6.6 billion in total, during this period.2 In addition, school districts simultaneously received a massive infusion of $11.4 billion in temporary federal COVID aid.3

The State’s burgeoning SOF spending has widened budget gaps. Spending restraint is needed to close those gaps, and that will only be accomplished by limiting growth in school aid, which is nearly 30 percent of SOF spending. Slowing school aid growth should be done while better targeting aid to districts with high and growing needs; this will focus resources where they are most needed, while also strengthening the State’s bottom line.

The New York State Fiscal Year 2025 Executive Budget proposed three changes to the formula that allocates Foundation Aid, the largest category of State school aid. The two changes that drive savings are the phaseout of the hold harmless provision, which ensures no funding reductions for school districts with declining enrollment or increasing local revenue, and the change to the inflation adjustment factor. These changes would save $413 million in school year 2024-25, reducing Foundation Aid growth to a more sustainable 2.1 percent for next year.

CBC’s analysis of school aid data from the Fiscal Year 2025 Executive Budget finds that:

- Total State school aid would increase 1.9 percent, and 3.2 percent per student, in school year 2024-25, reaching $38.1 billion and $15,761 per student;

- This slower growth follows three years of rapid growth, during which total State school aid increased 6.7 percent annually ($6.6 billion in total);

- Proposed changes to Foundation Aid, which makes up 60 percent of State school aid, would result in a 2.1 percent (or $507 million) increase in Foundation Aid in school year 2024-25;

- Higher wealth districts are more likely to receive year-over-year reductions in Foundation Aid due to the proposed changes;

- Total school district revenue in school year 2024-25, excluding COVID-related federal aid, would reach $35,975 per student, a 5.6 percent increase; and

- Even after the proposed savings, the State would send $2.4 billion to 145 districts that already self-fund a sound basic education (SBE) with local revenue and regular federal aid before receiving any State aid.

The Citizens Budget Commission (CBC) wholeheartedly supports the proposed phaseout of the hold harmless provision, which has prevented any annual decrease in a district’s Foundation Aid, even, for example, when enrollment declined. The proposed inflation-factor change is a blunter instrument, which effectively helps bring Foundation Aid spending growth to a more sustainable level in the next school year but across all districts, without better targeting need. The Senate and Assembly have both since omitted these modifications from their one-house budget proposals. The Legislature should reconsider this and enact a fiscal year 2025 budget that brings State school aid growth to a more sustainable level.

The State should consider other reforms that would provide more targeted savings. For example, the State could shift some of its expense-based aid to Foundation Aid, which would target funding based on need and not a district’s ability to self-fund with local revenue. Also, the State could eliminate School Tax Relief (STAR), a property-tax-relief program that results in increased funding for wealthier districts.

FY2025 Executive Budget Proposed 3 Changes to Foundation Aid

The Governor’s Executive Budget proposed to:

- Phase Out Hold Harmless: The hold harmless provision ensures that if a school district’s Foundation Aid allocation would decrease, either due to enrollment declines or increased local wealth, the prior-year aid level is instead maintained. Ultimately, the hold harmless provision would be eliminated under the Governor’s proposal. But to ease the impact of elimination on affected districts, the Executive Budget proposed a supplemental transition adjustment for school year 2024-25. This transition adjustment would reduce the hold harmless allocation to between 50 percent and 91 percent based on each district’s State Sharing Ratio, which approximates the district’s reliance on State aid. For example, if a district’s hold harmless allocation would have been $10.0 million, it would instead be between $5.0 million and $9.1 million. Districts that are more reliant on State aid would see a smaller reduction in their hold harmless allocation.

- Change the Annual Inflation Factor: Currently, the one-year change in the Consumer Price Index (CPI) is used annually to adjust Foundation Aid. The Executive Budget proposed changing this to the average of annual CPI change over the previous 10 years, with the highest and lowest change years removed. This modification would reduce the inflation factor for the upcoming school year from 4.1 percent to 2.4 percent. This change reduces the growth in Foundation Aid across-the-board for school year 2024-25 but does not decrease aid from one year to the next.

- Modify the State Sharing Ratio: The State Sharing Ratio approximates a district’s reliance on State school aid. Wealthier districts tend to have a lower ratio, and districts with fewer local resources tend to have a higher ratio. Under current law, the State Sharing Ratio is capped at 0.90. The Executive Budget raises this cap to 0.91 in the 2024-25 school year. This results in 63 higher-need districts receiving slightly more aid than they otherwise would have, from both Foundation Aid and the hold harmless transition adjustment.4

The Senate and Assembly's one-house budget proposals rejected the proposed changes to hold harmless and the inflation factor.

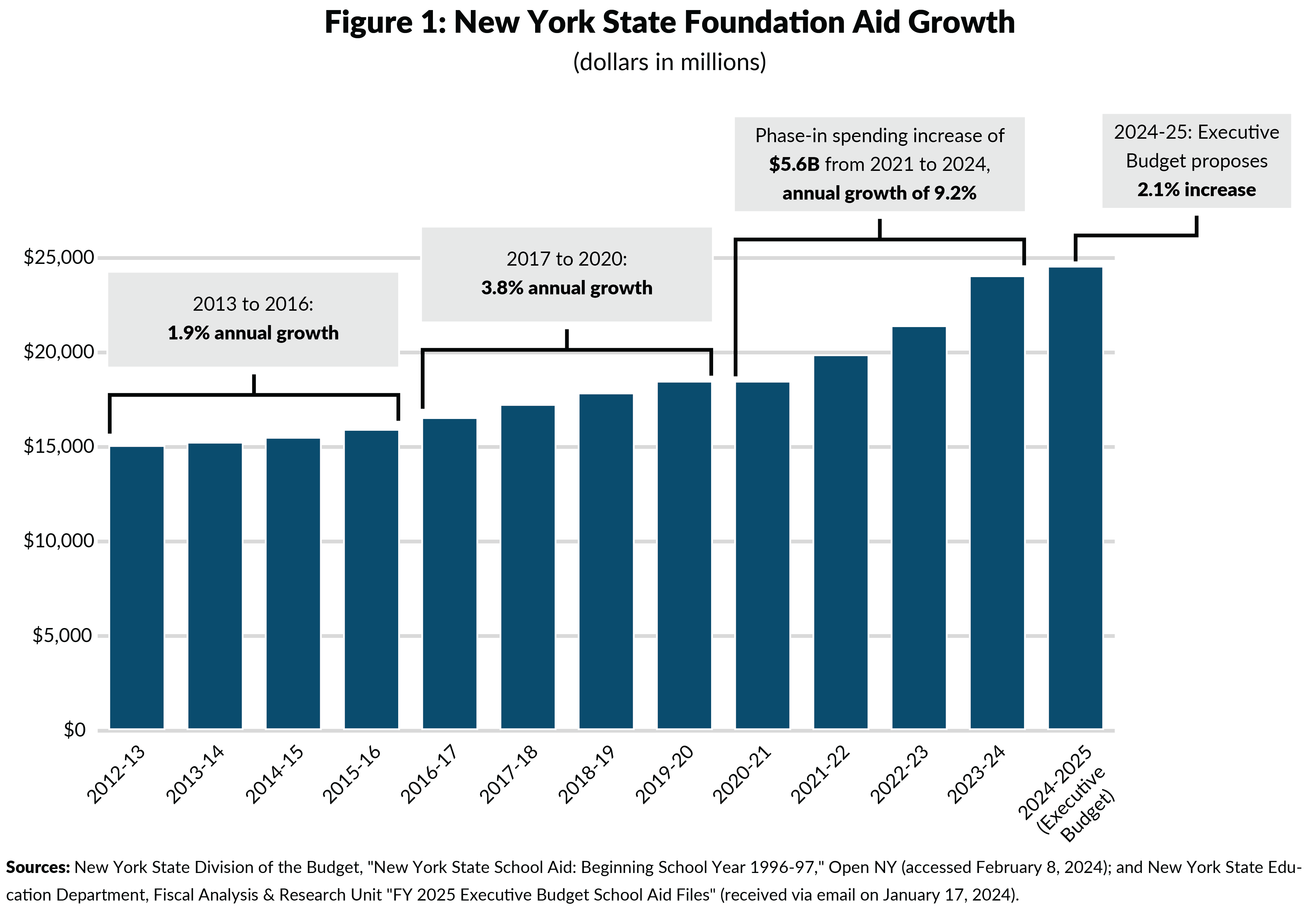

Foundation Aid Year-Over-Year Growth Would Moderate to 2.1 percent after 3 Years of Rapid Growth

The formula changes would result in Foundation Aid—over 60 percent of the State’s total school aid—increasing by 2.1 percent, or $507 million, next year. (See Figure 1.) This moderate growth follows the major increase of $5.6 billion, or 9.2 percent annually, over the past three years, which also far outpaced growth in previous years.

Phaseout of Hold Harmless Affects Wealthier Districts More, But All Districts Are Affected by the Inflation Adjustment

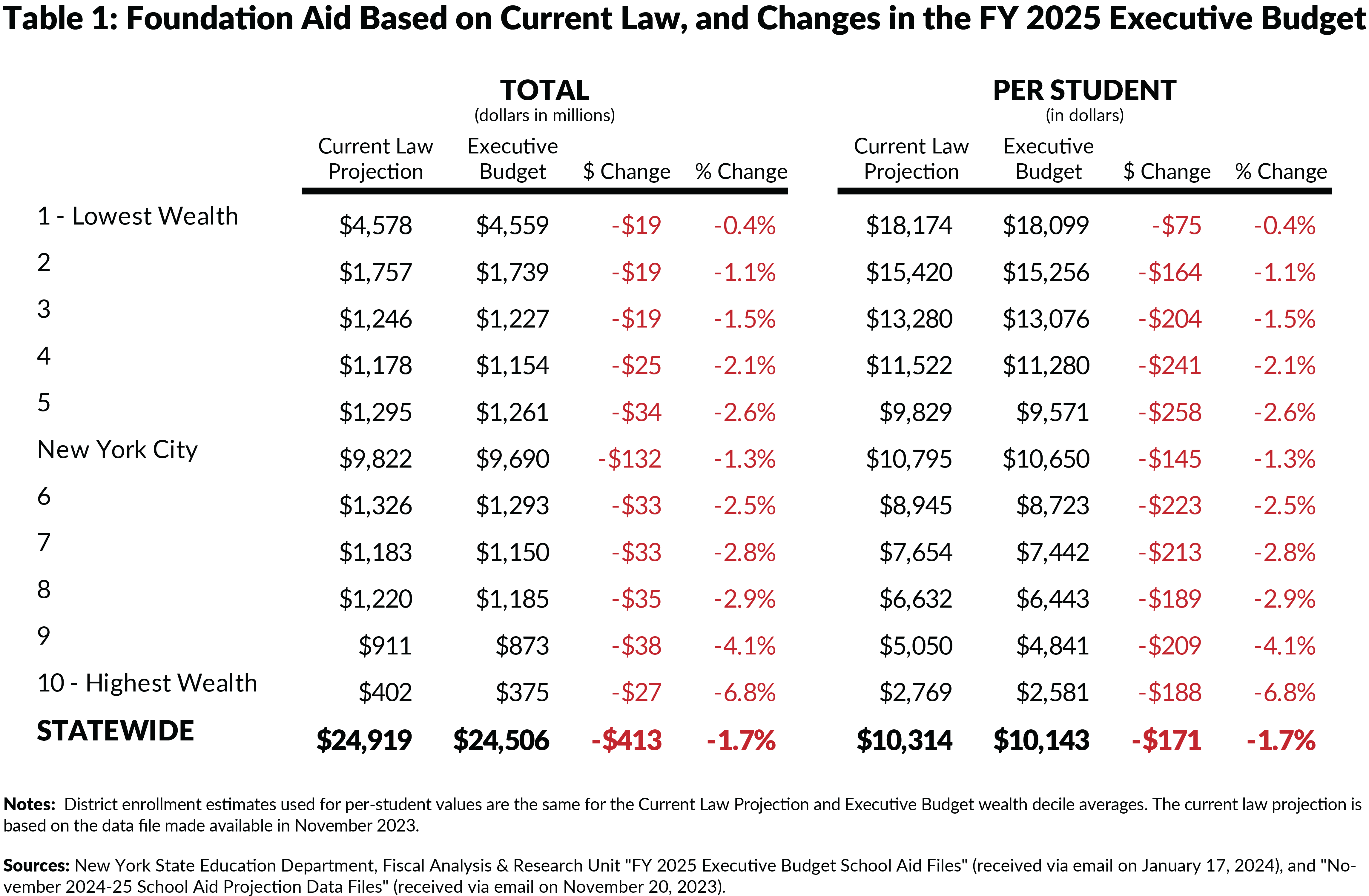

The Fiscal Year 2025 Executive Budget proposed changes would mean Foundation Aid would grow by $413 million less next year, compared to the current formula.5 In percentage terms, the changes from current law would affect wealthier school districts the most. Foundation Aid to districts in the highest wealth decile would be reduced by an average of 6.8 percent from the current law projection, compared to just 0.4 percent in the lowest-wealth-decile districts. (See Table 1.)

Foundation Aid to 337 districts would decline year-over-year, a total reduction of $168 million. Of the 337 districts that face reductions, 101 are “self-funding” districts—those that can fully fund an SBE through local revenue and federal aid, without any State funding. For some districts, the year-over-year proposed Foundation Aid reductions are quite large in percentage terms but represent a relatively small loss of total funds available; most of these districts are relatively wealthy and local resources provide most of their funds. For example, 45 of the 51 districts with a reduction greater than 25 percent are self-funding districts, and Foundation Aid only represents 4.9 percent of total revenue. The average per-student local revenue in these 51 districts is estimated to exceed $42,000 in the coming school year.

Even with Proposed Modifications, Total State School Aid Would Still Increase by 1.9 Percent, and 3.2 Percent Per Student

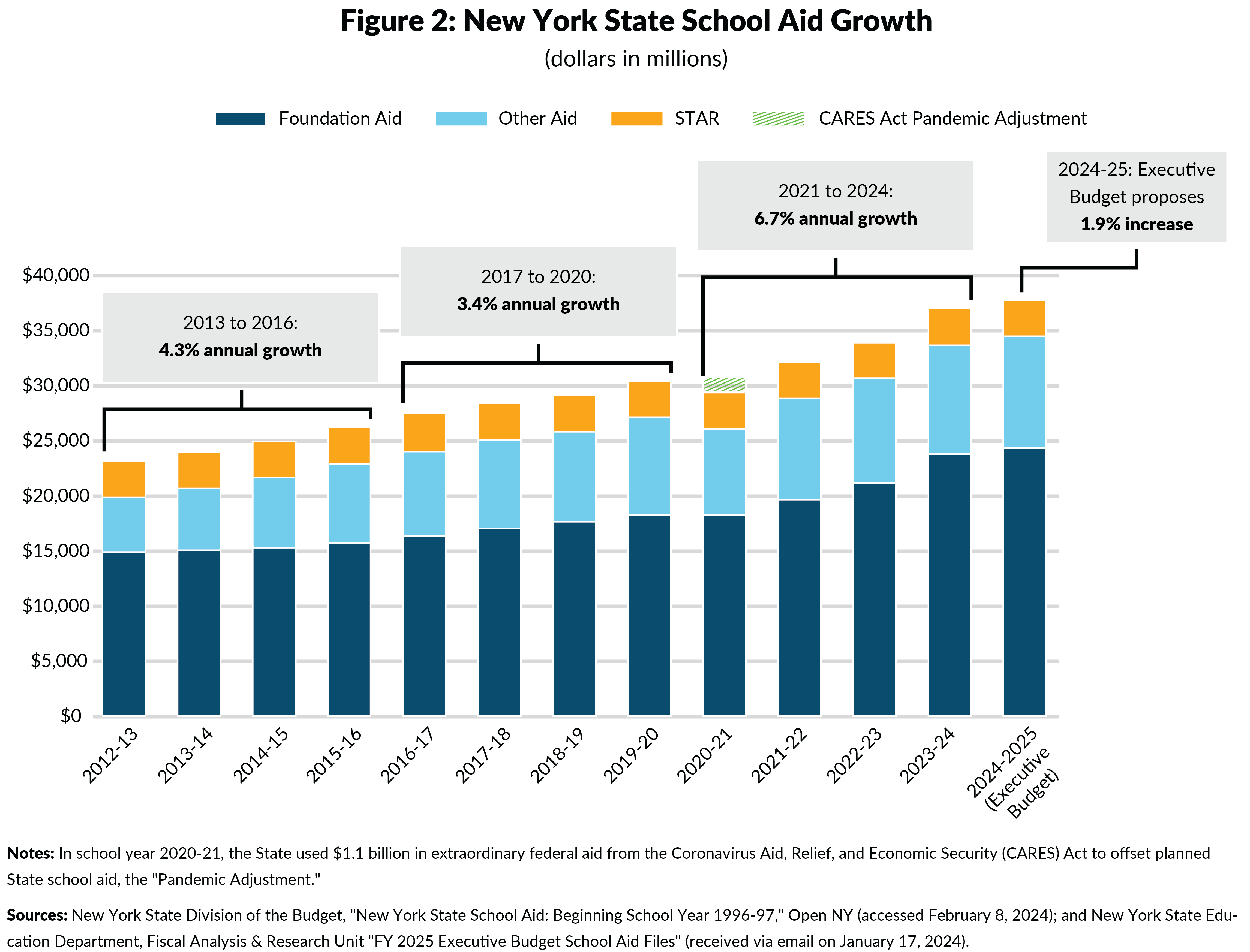

Total State school aid, including Foundation Aid, expense-based aids, and STAR, would be $38.1 billion in the coming school year under the Governor’s proposal, an increase of 1.9 percent over the current school year. (See Figure 2.) This follows a period of strong growth from the 2020-21 to 2023-24 school years, during which State school aid increased by $6.6 billion dollars, or 6.7 percent annually. Furthermore, even with the Governor’s savings proposals, State aid would still grow consistently in out-years, with average annual growth of 2.6 percent through school year 2027-28.6

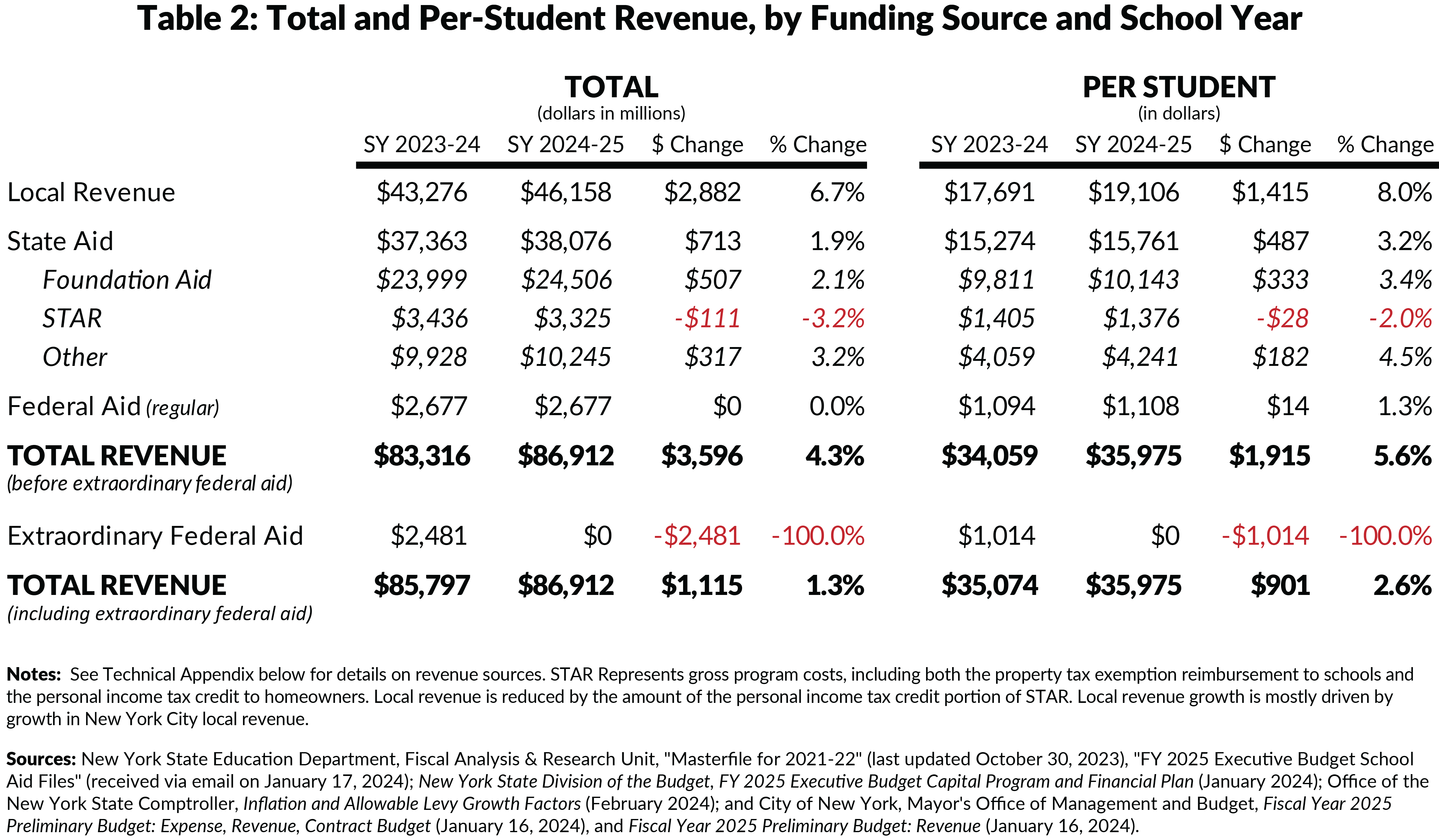

With enrollment continuing to decline in many districts, per-student State aid would grow more robustly, by 3.2 percent to $15,761. (See Table 2.)

Total school district revenue would reach nearly $87 billion, assuming federal aid remains constant and local revenues grow by 2 percent, excluding New York City, where local revenues are projected to increase 11.9 percent in the NYC Fiscal Year 2025 Preliminary Budget.7 On a per-student basis, total revenue would reach $35,975, a 5.6 percent increase.

The State Would Still Allocate $2.4 Billion in Aid to 145 Districts That Self-Fund a Sound Basic Education

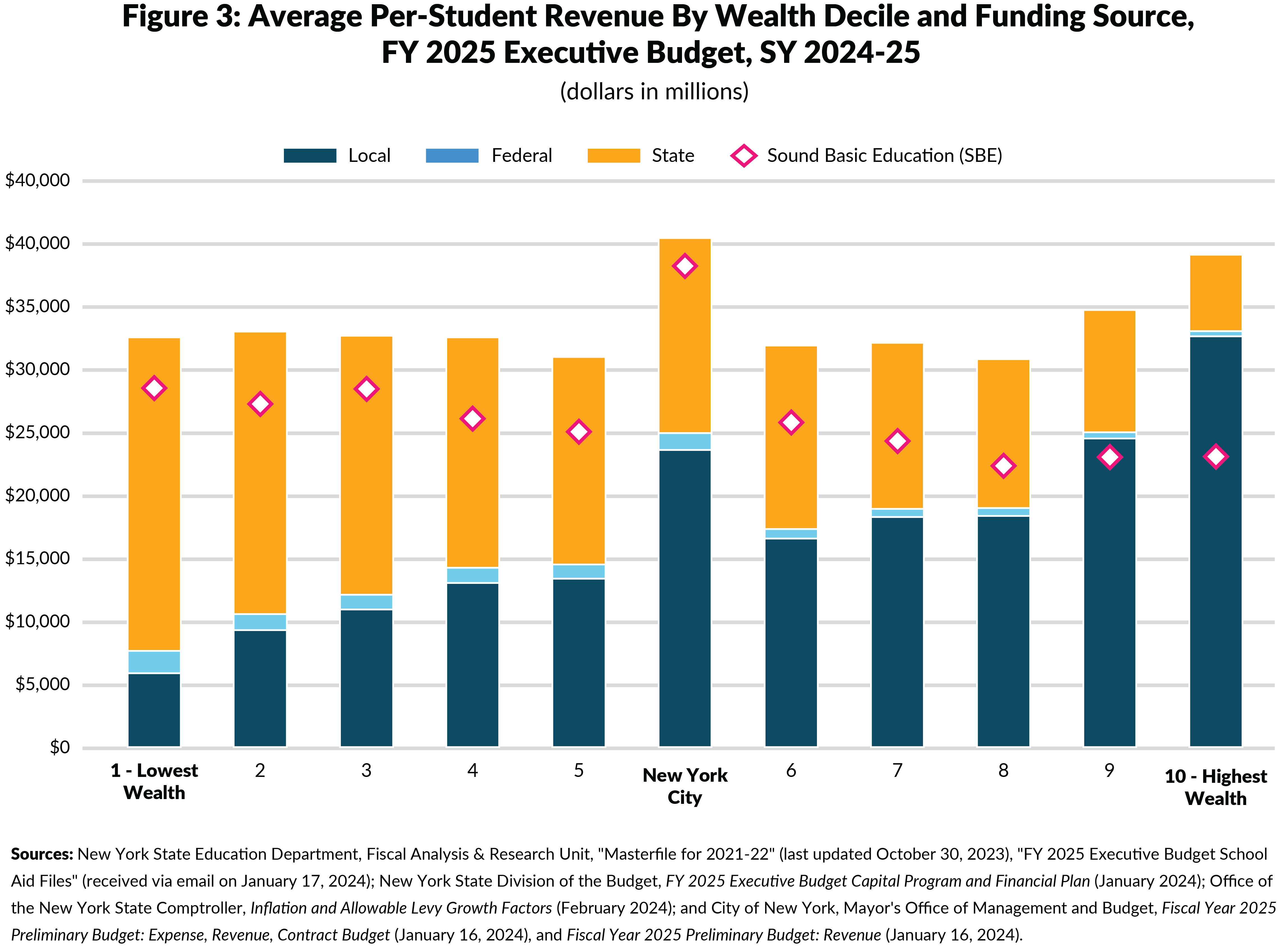

Even with the proposed changes, New York State would allocate $2.4 billion to 145 districts that can fully fund an SBE with local and regular federal resources. This amount is lower than in past years but still represents significant resources that could be either better targeted by need or provide State fiscal relief. Most of these districts—117 out of 145—are within the top two wealth deciles. These districts spend far more per student than others, and significant State aid directed to self-funding districts drives up spending disparities between the highest wealth deciles and all others (see Figure 3).

The State Needs to Moderate Spending Growth, Including School Aid

Billions of dollars are allocated every year to New York school districts that have tremendous local resources. The changes proposed in the Fiscal Year 2025 Executive Budget would yield needed savings and meaningfully improve the current allocation of school aid resources. There are other changes the State should consider to better target school aid based on need.

In the Fiscal Year 2025 Enacted Budget, the Governor and the Legislature should:

- Enact the Phaseout of Hold Harmless: Demographics across school districts have changed significantly since the introduction of the Foundation Aid formula in 2007. Districts that have lost significant enrollment over the past 17 years have maintained their Foundation Aid. Eliminating the hold harmless provision will allow Foundation Aid to be more reflective of these changing demographics. Because this change can lead to dramatic changes in some districts, it is reasonable for it to be made gradually, as proposed; and

- Seek Additional Savings from Other Sources: The change to the CPI factor in the Foundation Aid formula is a very blunt instrument that affects all school districts the same way. However, spending moderation is necessary. The State should consider changes to expense-based aid categories—some of which do not incorporate district need in their allocation—and the elimination of STAR. The STAR program allocates nearly 40 percent more funding per student to high-wealth districts ($1,885) than to low-wealth districts ($1,355).

Technical Appendix

Spending Calculations and Estimates: Spending figures contain estimated funding for school year 2024-25 by district calculated as follows:

Federal: Regular federal aid is equal to actual federal aid from the 2021-22 Masterfiles.

State: Includes all aid included in the 2024-25 school aid runs plus estimated School Tax Relief (STAR) gross program costs within the district (based on total planned STAR costs for school year 2024-25 proportional to actual STAR costs in school year 2021-22).

Local: Local funding is estimated based on actual local revenue from the 2021-22 Masterfiles increased by the allowable tax levy growth factor in each subsequent year and reduced by the personal income tax credit portion of STAR.

Sound Basic Education (SBE): Each district’s SBE amount is calculated by CBC by adding the “foundation amount” reported in school aid runs plus other expense-based aid for transportation, construction, and other costs for school year 2021-22 from Masterfiles inflated by CPI factors reported by the Office of the New York State Comptroller.

Wealth Decile Calculations: Wealth deciles are based on the average of a district’s free and reduced-price lunch share and census poverty share, divided by the district’s combined wealth ratio as determined by New York State Education Department (NYSED). The resulting figure is then indexed to the state average to determine a needs index.

Footnotes

- Patrick Orecki, Excelsior! State Spending Growth Continues (Citizens Budget Commission, February 2024),https://cbcny.org/research/excelsior.

- New York State Division of the Budget, “New York State School Aid: Beginning School Year 1996-97,” Open NY (last updated February 12, 2024),https://data.ny.gov/Government-Finance/New-York-State-School-Aid-Beginning-School-Year-19/9pb8-dg53/about_data; New York State Education Department, Fiscal Analysis & Research Unit “FY 2025 Executive Budget School Aid Files” (received via email on January 17, 2024); and CBC staff analysis of New York State Division of the Budget, Fiscal Year 2025 New York State Executive Budget Financial Plan (January 2024),www.budget.ny.gov/pubs/archive/fy25/ex/fp/fy25fp-ex.pdf, and prior editions.

- CBC staff analysis of New York State Education Department, “ARP LEA State Budget Reports,” (accessed August 25, 2022),www.nysed.gov/federal-education-covid-response-funding/arp-lea-state-budget-reports.

- Part A of New York Senate Bill 8306, www.nysenate.gov/legislation/bills/2023/S8306.

- The $413 million figure is based on the current law projection file made available in November, 2023. The CPI factor used in this file, 3.8 percent, is lower than what would be used if the current law foundation aid formula were carried into the enacted budget, because the full calendar year of CPI data for 2023 were not yet available. Elsewhere, the reduction has been reported as $420 million. The difference is due to districts with data missing in the November current law projection files. New York State Education Department, Fiscal Analysis & Research Unit “FY 2025 Executive Budget School Aid Files” (received via email on January 17, 2024), and "November 2024-25 School Aid Projection Data Files” (received via email on November 20, 2023).

- New York State Division of the Budget, Fiscal Year 2025 New York State Executive Budget Financial Plan (January 2024), www.budget.ny.gov/pubs/archive/fy25/ex/fp/fy25fp-ex.pdf.

- Local revenues are based the most recent year of available (school year 2021-22) and further inflated by the allowable tax levy growth factor (up to 2% annually), for all districts outside of New York City. New York City figures are based on the Fiscal Year 2025 Preliminary Budget. Local revenues are further adjusted to account for the personal income tax credit portion of the STAR program.