What to Look for in the New York City November 2023 Financial Plan

Highlights

When New York City adopted its fiscal year 2024 budget in June 2023 without addressing underlying structural imbalances, it virtually guaranteed that major fiscal challenges remained on the horizon. Revisiting the budget now reveals the City’s budget gaps remain substantial—reaching over 12.5 percent of City-funded spending.1 Absent significant actions to bring recurring expenses in line with recurring revenues, New Yorkers will likely face potentially devastating service cuts in the future.

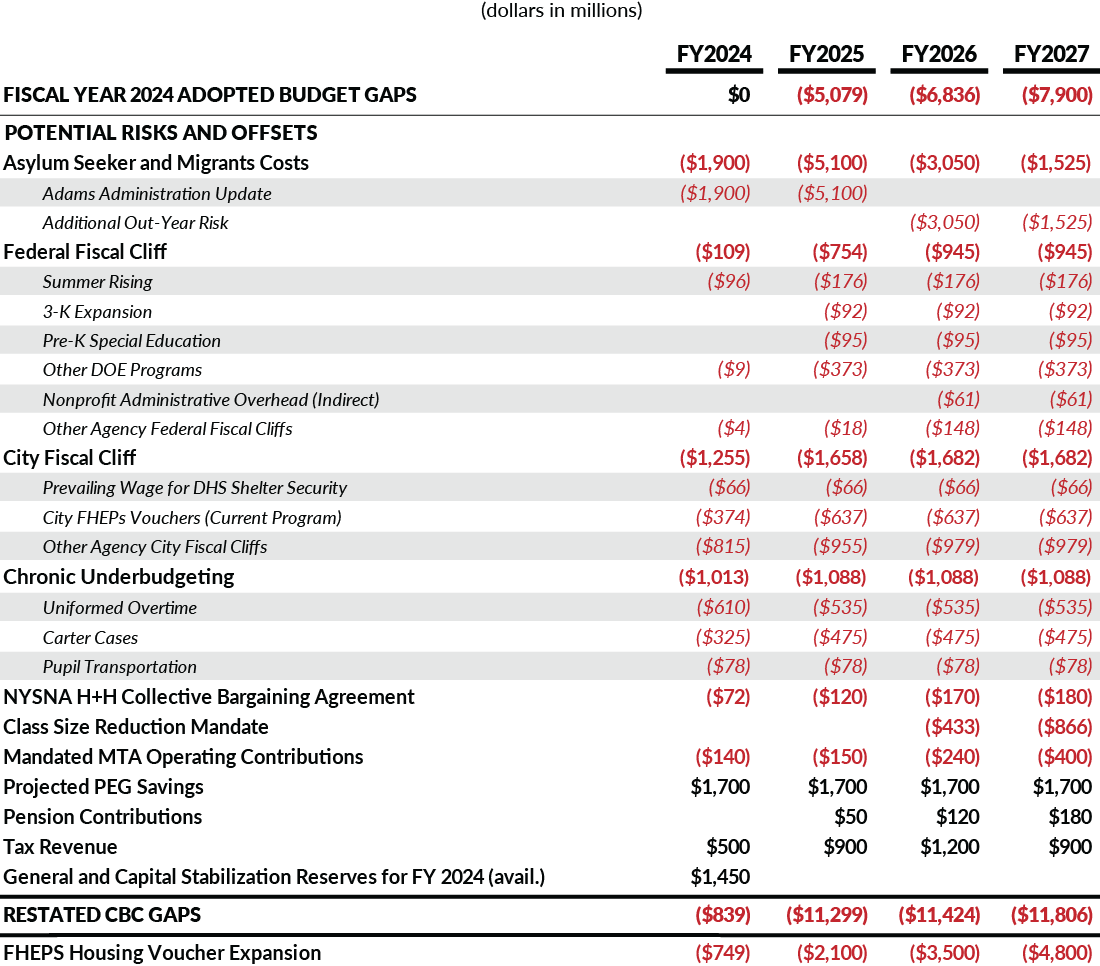

Even after accounting for $1.7 billion in planned savings due to the 5 percent Program to Eliminate the Gap (PEG) announced for the November 2023 financial plan, the City will have to close a fiscal year 2025 budget gap of $11.3 billion. (See Table 1.) Fully funding current programs and meeting existing legal mandates would increase the gap to $11.4 billion in fiscal year 2026 and $11.8 billion in fiscal year 2027.

If the City were to fund the recently enacted expansion of housing voucher eligibility, future gaps would increase to $14.9 billion and $16.6 billion in fiscal years 2026 and 2027, respectively. In addition, due to underbudgeting, unfunded fiscal cliff programs (like the City’s summer school and 3-K programs), and the cost of asylum seeker and migrant services, fiscal year 2024 may now be short $839 million to fund planned services.

Table 1: NYC Budget Gaps and Risks and Offsets

City of New York, Office of the Mayor, “As City Nears Arrival of 100,000 Asylum Seekers Since Last Spring, Mayor Adams Lays out Updated Costs if State and Federal Governments do not Take Swift Action” (press release, August 9, 2023), https://www.nyc.gov/office-of-the-mayor/news/583-23/as-city-nears-arrival-100-000-asylum-seekers-since-last-spring-mayor-adams-lays-out-updated#/0; Office of the New York State Comptroller, “Identifying Fiscal Cliffs in New York City’s Financial Plan” (updated August 9, 2023, accessed November 6, 2023), https://www.osc.ny.gov/reports/osdc/identifying-fiscal-cliffs-new-york-citys-financial-plan; City of New York, General Obligation Bonds: Fiscal 2024 Series B: Official Offering Statement (October 5, 2023), https://www.nyc.gov/assets/investorrelations/downloads/pdf/go-bonds-statements/2024/nycgo-2024b.pdf; City of New York, Department of Education, Division of Operations and Finance & Division of Family and Community Engagement and External Affairs, Class Size Working Group – Meeting #2 (May 3, 2023), https://drive.google.com/file/d/1I8nrtc5wa23T-QOBz3Tsb7_6dsujO1hw/view?usp=sharing; and Office of the New York City Comptroller, Comments on New York City’s Fiscal Year 2024 Adopted Budget (August 11, 2023), https://comptroller.nyc.gov/reports/comments-on-new-york-citys-fiscal-year-2024-adopted-budget/.

Questions loom on how the City balances the fiscal year 2024 budget and plans to balance fiscal year 2025 by January 2024. The November 2023 financial plan will provide part of the answer. But achieving structural stability will require prioritization—hard choices about which services to continue and which to end or scale back; it will also require an increase in government efficiency and a focus on getting the basics right.

Key items to look for and questions to ask about New York City’s November 2023 Financial Plan include:

Asylum Seeker and Migrant Costs

In August 2023, the City updated its asylum seeker and migrant spending projection and put fiscal year 2024 and fiscal year 2025 costs at $4.7 billion and $6.1 billion, respectively.2 These represent significant increases from what was included in the June 2023 financial plan: a $1.8 billion jump for fiscal year 2024 and $5.1 billion for fiscal year 2025. Per diem rates for services continue to climb, increasing to $394 per day per household in August 2023, up from $363 in January 2023.3

The City is likely to reflect increased costs in the November 2023 financial plan. Furthermore, spending is likely to continue into fiscal years 2026 and 2027, which currently include no spending for asylum seekers and migrants.

- Will the City again update its spending projections and include longer-term costs for asylum seeker and migrant services? How does the City plan to control these costs over the long-term?

Federal Fiscal Cliff

The City has been using temporary federal COVID-related funds to support ongoing programs. In fiscal year 2024, there already is a $96 million shortfall for the City’s summer-school program: Summer Rising. This cliff at the Department of Education (DOE) increases to more than $700 million next year and rises Citywide to $945 million starting in fiscal year 2026.4

With federal COVID funds running out in fiscal years 2025 and 2026, the City needs to make hard choices about these soon-to-be-unfunded programs. It should prioritize effective programs and shift other funds to support them, while eliminating or scaling back those that are less impactful.

- Will the City continue some programs funded with federal COVID-related aid, such as 3-K expansion, Summer Rising, and social service nonprofit administrative costs, and where will the funds to support them come from?

City-Funded Fiscal Cliff

The City has been increasingly funding recurring programs—such as CityFHEPs housing vouchers, prevailing wage for security staff at Department of Homeless Services shelters, and additional street basket collection—one year at a time. As a result, programs costing nearly $1.3 billion are not funded in the fiscal year 2024 budget, and $1.7 billion annually is excluded beginning in fiscal year 2025.5

- How will the City preserve, shrink, or eliminate the City-funded fiscal cliff programs and with what funds?

Chronic Underbudgeting

The City typically underbudgets overtime costs for uniformed City personnel, Carter Cases (private school tuition reimbursement for special education students), and student transportation, as well as other smaller programs. These three are likely to cost at least $1 billion more annually than is currently budgeted.

- Will the November 2023 financial plan increase the budget for uniformed overtime, Carter Cases, and student transportation to the actual levels they’ve historically reached? If not, does the City have a plan to drastically reduce spending to the level budgeted?

Collective Bargaining

The City has reflected the full Citywide cost of the civilian and uniformed collective bargaining patterns in the budget, with funds kept in the central labor reserve until individual collective bargaining units settle and ratify their deals.6

The November 2023 financial plan will shift funding for ratified collective bargaining agreements, such as the United Federation of Teachers and Teamsters Local 237 at the NYC Housing Authority, from the central labor reserve to agency budgets.7 The resulting agency budget increases reflect that shift and are not a net increase in City spending.

Furthermore, two recently ratified deals—with the New York State Nurses Association (NYSNA) for New York City Health + Hospitals and with the and the Marine Engineers’ Beneficial Association (MEBA) at the Staten Island Ferry—exceeded the pattern. The cost of the NYSNA contract is roughly $540 million more than the pattern, while the Staten Island Ferry operator agreement is an additional $54 million over the financial plan.8

- Are the above-the-pattern costs of the NYSNA and MEBA contracts reflected in the November 2023 financial plan and how much do they increase each year’s budget gap?

Class Size Reduction

The State’s Class Size Reduction mandate could impose significant costs on the City that are not yet reflected in the financial plan. The NYC DOE estimated that compliance would cost $433 million in fiscal year 2026 and increase to $1.3 billion annually when fully phased in.9

Are the costs of complying with class size reduction reflected in the financial plan and how do they increase each year’s budget gap?

Program to Eliminate the Gap (PEG)

In September 2023, the Mayor instructed agencies to identify savings equal to 5 percent of their City-funded spending to include in the November 2023 financial plan. The City further revealed the November 2023 PEG was expected to save roughly $1.7 billion annually. Agencies submitted their proposals to the Mayor’s Office of Management and Budget in October. The November financial plan will detail what savings initiatives are being pursued. Prior PEGs have relied on re-estimates and savings from vacant positions, rather than finding programmatic efficiencies.

- What PEG savings are included in the November 2023 financial plan and what is their source? Did City agencies improve efficiency, re-estimate current program spending, eliminate vacancies, or increase revenues?

FHEPS Expansion

On July 13, 2023, the City Council overrode Mayor Eric Adams’ veto and significantly expanded the CityFHEPS program, which provides City-funded housing vouchers to eligible families. The budget already did not include full funding for the pre-expansion program—part of the City fiscal cliff already discussed. The City’s budget also has not yet included its cost estimate of the expanded CityFHEPS program.

Based on the recent Offering Statement for the City’s General Obligation bonds, the cost of the program expansion could reach $749 million this fiscal year, $2.1 billion in fiscal year 2025, $3.5 billion in fiscal year 2026, and $4.8 billion in fiscal year 2027.10 Some have challenged the City’s estimate of costs; the City Council’s fiscal impact statement, included with its proposal, estimated the costs would be $396 million in fiscal year 2025 and $3.1 billion in fiscal year 2028.11

- What is the projected cost of the CityFHEPS program and how is the expansion reflected in the financial plan?

Budget Balance for FY 2024 and Outyear Gaps

The City is required to keep fiscal year 2024 in balance. Including the items above would open an $839 million budget gap this year, after using the general and capital stabilization reserves. All the adjustments made to revenues and expenses will affect the future budget gaps.

The City could choose to let “fiscal cliff” programs end due to lack of funding. Additional State or federal funding for migrants and asylum seekers would also reduce the City’s budget gaps. The City could also continue to underfund certain line items or not fully reflect the cost of legal mandates, which would reduce out-year gaps on paper.

- How does the City maintain balance in fiscal year 2024? How do out-year budget gaps change?

Tax Revenue

Year-to-date tax revenue collections are close to budgeted projections in the aggregate, and the City may choose to leave the revenue forecast untouched. Typically, November is a “technical” modification to the financial plan, without a new economic forecast. However, there is potential for modest upside on revenue, especially as the likelihood of a recession declines. Based on revenue forecasts from other monitors, it is reasonable to expect an upward revision to tax revenues of $500 million this fiscal year and approximately $1 billion annually in fiscal years 2025 to 2027.

- Does the City adjust the tax revenue forecast

,and, if so, by how much?

Statutorily Required MTA Contributions

The State’s requirement that the City support the MTA operating budget for paratransit, MTA Bus Company, and SI Railway exceeds what is currently budgeted by approximately $150 million this year and next, increasing to $400 million by fiscal year 2027.12

- Are the legally required contributions to the MTA operating budget reflected in the City’s financial plan?

Pension Contributions

In fiscal year 2023, pension returns averaged 8 percent, 1 percentage point above the 7 percent actuarially assumed rate of return. When pension returns exceed or fall below the actuarial rate, the City’s annual actuarially required contributions (ARCs) are adjusted up or down. The benefit or cost of exceeding or missing the rate of return is spread over five years.

- Are savings of roughly $50 million in fiscal year 2025, $120 million in fiscal year 2026, and $180 million in fiscal year 2027 reflected in the November 2023 financial plan?

Footnotes

- This is based on the Fiscal Year 2024 Adopted Budget’s City Funds as adjusted by CBC for transfers and reserves, added spending from the potential risks identified and PEG and pension savings identified in Table 1, and the Restated CBC Gaps identified in Table 1.

- City of New York, Office of the Mayor, “As City Nears Arrival of 100,000 Asylum Seekers Since Last Spring, Mayor Adams Lays out Updated Costs if State and Federal Governments do not Take Swift Action” (press release, August 9, 2023), https://www.nyc.gov/office-of-the-mayor/news/583-23/as-city-nears-arrival-100-000-asylum-seekers-since-last-spring-mayor-adams-lays-out-updated#/0.

- The Council of the City of New York, Committee Report and Briefing Paper of the Finance, Legislative, and Oversight & Investigations Divisions: Oversight: Asylum Seeker Response Efforts – Costs and Projections (October 23, 2023), https://legistar.council.nyc.gov/View.ashx?M=F&ID=12388914&GUID=2FDF37AC-4191-4467-930C-3AAC5789EB38.

- Office of the New York State Comptroller, “Identifying Fiscal Cliffs in New York City’s Financial Plan” (updated August 9, 2023, accessed November 6, 2023), https://www.osc.ny.gov/reports/osdc/identifying-fiscal-cliffs-new-york-citys-financial-plan.

- Office of the New York State Comptroller, “Identifying Fiscal Cliffs in New York City’s Financial Plan” (updated August 9, 2023, accessed November 6, 2023), https://www.osc.ny.gov/reports/osdc/identifying-fiscal-cliffs-new-york-citys-financial-plan.

- City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2024 Executive Budget: Message of the Mayor (April 26, 2023), https://www.nyc.gov/assets/omb/downloads/pdf/mm4-23.pdf.

- United Federation of Teachers, “UFT members overwhelmingly approve new contract” (press release, July 10, 2023), https://www.uft.org/news/press-releases/uft-members-overwhelmingly-approve-new-contract; and Teamsters Local 237, “2023 Contract Updates: Housing Contract Ratified by Wide Margin” (October 25, 2023), https://local237.org/all-categories/181-contracts/1986-tentative-citywide-contract.

- City of New York, General Obligation Bonds: Fiscal 2024 Series B: Official Offering Statement (October 5, 2023), https://www.nyc.gov/assets/investorrelations/downloads/pdf/go-bonds-statements/2024/nycgo-2024b.pdf.

- City of New York, Department of Education, Division of Operations and Finance & Division of Family and Community Engagement and External Affairs, Class Size Working Group – Meeting #2 (May 3, 2023), https://drive.google.com/file/d/1I8nrtc5wa23T-QOBz3Tsb7_6dsujO1hw/view?usp=sharing; and Office of the New York City Comptroller, Comments on New York City’s Fiscal Year 2024 Adopted Budget (August 11, 2023), https://comptroller.nyc.gov/reports/comments-on-new-york-citys-fiscal-year-2024-adopted-budget/.

- City of New York, General Obligation Bonds: Fiscal 2024 Series B: Official Offering Statement (October 5, 2023), https://www.nyc.gov/assets/investorrelations/downloads/pdf/go-bonds-statements/2024/nycgo-2024b.pdf.

- The Council of the City of New York, Fiscal Impact Statement: Proposed Intro 893-A (May 24, 2023), https://legistar.council.nyc.gov/View.ashx?M=F&ID=12022611&GUID=25600F6F-1811-49D7-A91D-347BDCAFF5B2.

- Office of the New York City Comptroller, Comments on New York City’s Fiscal Year 2024 Adopted Budget (August 11, 2023), https://comptroller.nyc.gov/reports/comments-on-new-york-citys-fiscal-year-2024-adopted-budget/.